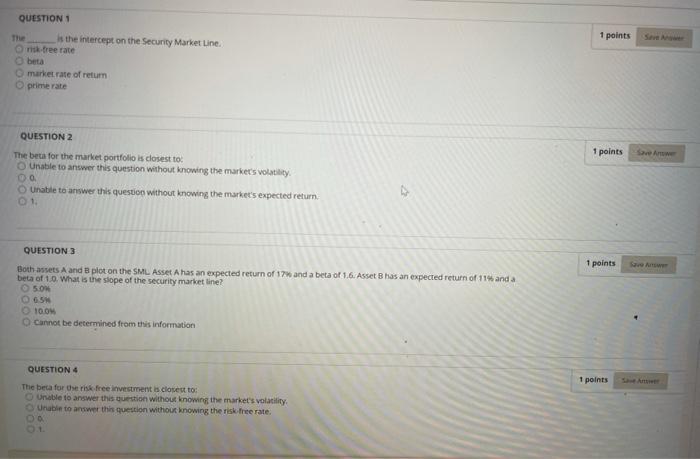

Question: QUESTIONS 1 points The is the intercept on the Security Market Line. Titree rate beta market rate of retum prime rate QUESTION 2 1 points

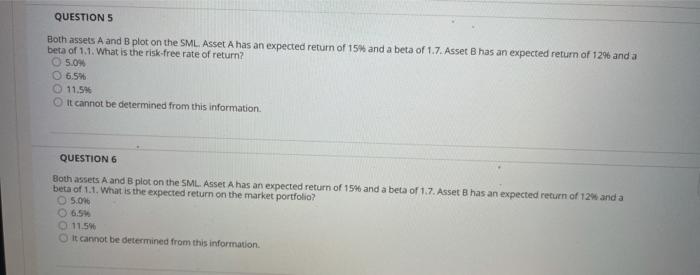

QUESTIONS 1 points The is the intercept on the Security Market Line. Titree rate beta market rate of retum prime rate QUESTION 2 1 points The beta for the market portfolio is closest to Unable to answer this question without knowing the market's volatility 0.0 Unable to answer this question without knowing the market's expected return 1. 1 points QUESTION 3 Both assets A and B plot on the SML Asset A has an expected return of 17 and a beta of 1.6. Asset B has an expected return of 11% and a beta of 1.0. What is the slope of the security market line? 5.00 05 10.04 Cannot be determined from this information 1 points QUESTION 4 The beta for seris.free investment is closest to Unable to answer this question without knowing the market's volatility Unable to answer this question without knowing the risk free rate. 00 01 QUESTIONS Both assets A and B plot on the SML Asset A has an expected return of 15% and a beta of 1.7. Asset Bhas an expected return of 12% and a beta of 1.1. What is the risk-free rate of return? 05.04 6.5% 11.5% It cannot be determined from this information QUESTION 6 Both assets A and B plot on the SML Asset A has an expected return of 15% and a beta of 1.7. Asset B has an expected return of 12% and a beta of 1.1. What is the expected return on the market portfolio? 5.04 0 6.5 11.5 It cannot be determined from this information

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts