Question: Questions 1 The MAZO division uses a cost plus pricing strategy, adding a 30% premium to the cost of the product (which includes not only

| Questions | |

| 1 | The MAZO division uses a cost plus pricing strategy, adding a 30% premium to the cost of the product (which includes not only variable manufacturing but fixed manufacturing costs related to the product). What is the sales price per item and the total sales? What is the gross commission that needs to be included |

| 2 | Assume that the MAZO division has the capacity to produce 8500 units. They are being asked by Tartan Teas to private label 1500 units @$270. Should the accept or reject the offer? Why or why not? |

| 3 | MAZO has also been approached by Damocles - a diverse manufacturing conglomerate that makes everything from world class knives to food and drink products and its highly automated facilities - to manufacture all teas for MAZO. MAZO will still have to market its product. In order to make this decision, you should assume that the facts in (1) still exist. You should also assume that the order in (2) did not occur. Please Indicate the price at which you will outsource rather than manufacturing in-house. |

| 4 | There has been a global increase in material and labor costs. The cost of material has increased to $128 per unit and the cost of labor has increased to $104 per unit. MAZO is not able to increase prices. MAZO also has been approached by Damocles as to whether they want to sell the entire product line to Damocles. Prepare a contribution margin income statement analysis using these new numbers and leverage off this to evaluate a sell vs. continue to manufacture decision. |

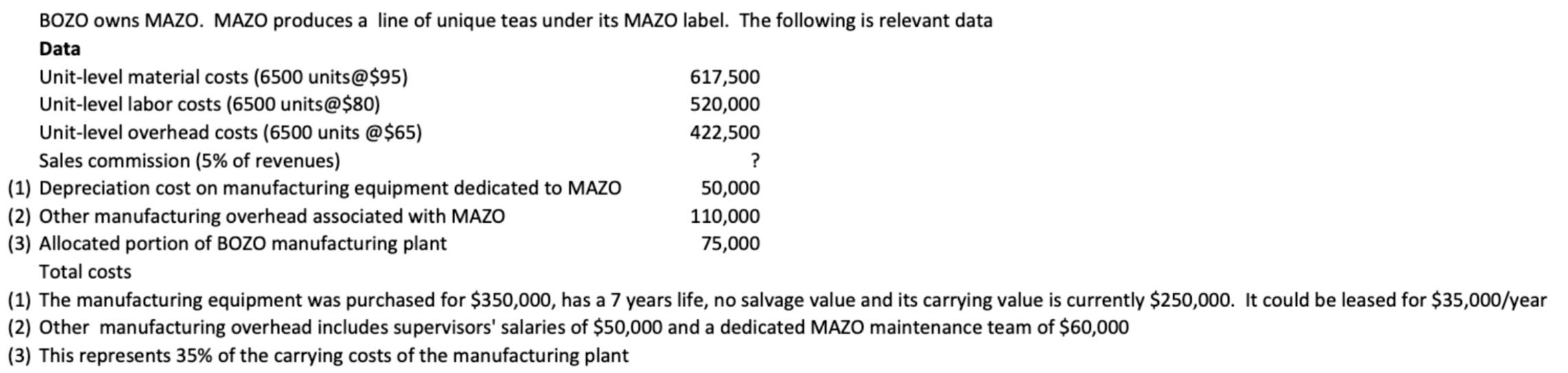

BOZO owns MAZO. MAZO produces a line of unique teas under its MAZO label. The following is relevant data Data Unit-level material costs (6500 units@ $95) 617,500 Unit-level labor costs (6500 units @ $80) 520,000 Unit-level overhead costs (6500 units @ $65) 422,500 Sales commission (5% of revenues) ? (1) Depreciation cost on manufacturing equipment dedicated to MAZO 50,000 (2) Other manufacturing overhead associated with MAZO 110,000 (3) Allocated portion of BOZO manufacturing plant 75,000 Total costs (1) The manufacturing equipment was purchased for $350,000, has a 7 years life, no salvage value and its carrying value is currently $250,000. It could be leased for $35,000/year (2) Other manufacturing overhead includes supervisors' salaries of $50,000 and a dedicated MAZO maintenance team of $60,000 (3) This represents 35% of the carrying costs of the manufacturing plant

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts