Question: Questions 1 through 4 please Chapter 15: Study Questions 1. Frank and Addie have 3 children who have investment income for tax year 2019. All

Questions 1 through 4 please

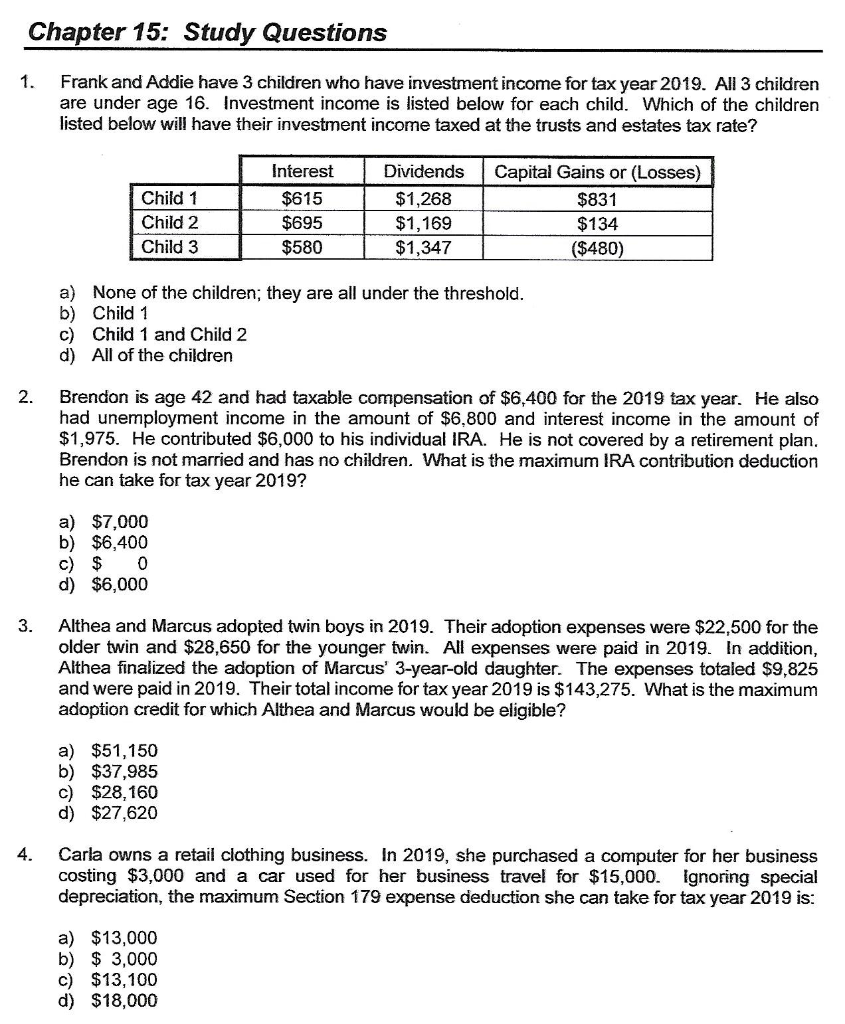

Chapter 15: Study Questions 1. Frank and Addie have 3 children who have investment income for tax year 2019. All 3 children are under age 16. Investment income is listed below for each child. Which of the children listed below will have their investment income taxed at the trusts and estates tax rate? Interest Child 1 Child 2 Child 3 $615 $695 $580 Dividends $1,268 $1,169 $1,347 Capital Gains or (Losses) $831 $134 ($480) a) None of the children; they are all under the threshold. b) Child 1 c) Child 1 and Child 2 d) All of the children 2. Brendon is age 42 and had taxable compensation of $6,400 for the 2019 tax year. He also had unemployment income in the amount of $6,800 and interest income in the amount of $1,975. He contributed $6,000 to his individual IRA. He is not covered by a retirement plan. Brendon is not married and has no children. What is the maximum IRA contribution deduction he can take for tax year 2019? a) $7,000 b) $6,400 c) $ 0 d) $6,000 3. Althea and Marcus adopted twin boys in 2019. Their adoption expenses were $22,500 for the older twin and $28,650 for the younger twin. All expenses were paid in 2019. In addition, Althea finalized the adoption of Marcus' 3-year-old daughter. The expenses totaled $9,825 and were paid in 2019. Their total income for tax year 2019 is $143,275. What is the maximum adoption credit for which Althea and Marcus would be eligible? a) $51,150 b) $37,985 c) $28,160 d) $27,620 4. Carla owns a retail clothing business. In 2019, she purchased a computer for her business costing $3,000 and a car used for her business travel for $15,000. Ignoring special depreciation, the maximum Section 179 expense deduction she can take for tax year 2019 is: a) $13,000 b) $ 3,000 c) $13,100 d) $18,000

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts