Question: Questions 1 through 8 help if you can BRIEF EXERCISES 1. Product Costing Systems LOL Product costing systems are quite varied. The three fundamental costing

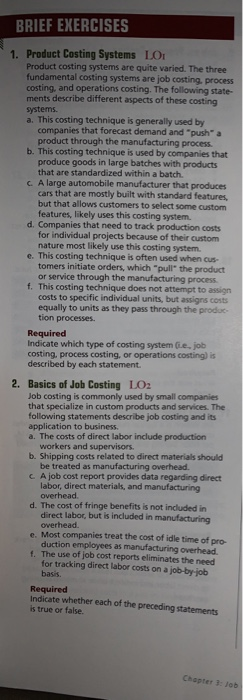

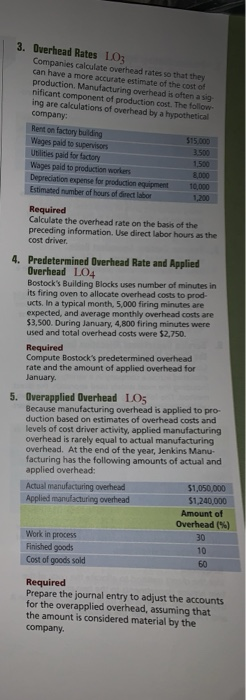

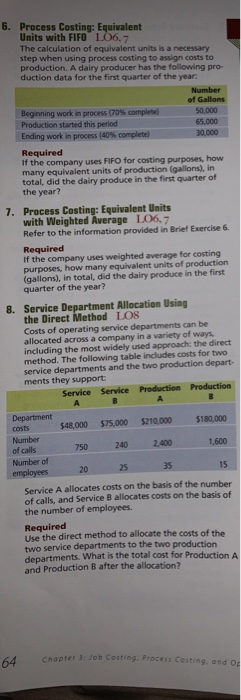

BRIEF EXERCISES 1. Product Costing Systems LOL Product costing systems are quite varied. The three fundamental costing systems are job costing process costing, and operations costing. The following state- ments describe different aspects of these costing systems. a. This costing technique is generally used by companies that forecast demand and "pusha product through the manufacturing process. b. This costing technique is used by companies that produce goods in large batches with products that are standardized within a batch c. A large automobile manufacturer that produces cars that are mostly built with standard features, but that allows customers to select some custom features, likely uses this costing system d. Companies that need to track production costs for individual projects because of their custom nature most likely use this casting system e. This costing technique is often used when cus tomers initiate orders, which "pull" the product or service through the manufacturing process f. This costing technique does not attempt to assion costs to specific individual units, but assigns costs equally to units as they pass through the produc tion processes. Required Indicate which type of costing system (.e.job costing process costing, or operations costing) is described by each statement. 2. Basics of Job Costing LO2 Job costing is commonly used by small companies that specialize in custom products and services. The following statements describe job costing and its application to business. a. The costs of direct labor include production workers and supervisors. b. Shipping costs related to direct materials should be treated as manufacturing overhead. CA job cost report provides data regarding direct labor, direct materials, and manufacturing Overhead d. The cost of fringe benefits is not included in direct labor, but is included in manufacturing overhead e. Most companies treat the cost of idle time of pro duction employees as manufacturing overhead The use of job cost reports eliminates the need for tracking direct labor costs on a job by job basis. Required Indicate whether each of the preceding statements is true or false. Chapter 3: Job 3. Overhead Rates LO: Companies calculate overhead rates so that they can have a more accurate estimate of the cost of production Manufacturing overhead is often a sig nificant component of production cost. The follow- Ing are calculations of overhead by a hypothetical company Rent on factory building $15.000 Wages paid to supervisors Utilities paid for factory Wages paid to production workers Depreciation expense for production equipment 10.000 1,200 Estimated number of hours of direct labor 3.500 1,500 8.000 Required Calculate the overhead rate on the basis of the preceding information. Use direct labor hours as the cost driver. 4. Predetermined Overhead Rate and Applied Overhead LO4 Bostock's Building Blocks uses number of minutes in its firing oven to allocate overhead costs to prod- ucts. In a typical month, 5,000 firing minutes are expected, and average monthly overhead costs are $3.500. During January 4,800 firing minutes were used and total overhead costs were $2,750 Required Compute Bostock's predetermined overhead rate and the amount of applied overhead for January 5. Overapplied Overhead LOS Because manufacturing overhead is applied to pro- duction based on estimates of overhead costs and levels of cost driver activity, applied manufacturing overhead is rarely equal to actual manufacturing Overhead. At the end of the year, Jenkins Manu- facturing has the following amounts of actual and applied overhead: Actual manufacturing overhead $1,050,000 Applied manufacturing overhead $1,240,000 Amount of Overhead (4) Work in process Finished goods 10 Cost of goods sold Required Prepare the journal entry to adjust the accounts for the overapplied overhead, assuming that the amount is considered material by the company. 6. Process Costing: Equivalent Units with FIFO LO6.7 The calculation of equivalent units is a necessary step when using process costing to assign costs to production. A dairy producer has the following pro- duction data for the first quarter of the year: Number of Gallons Beginning work in process (70% complete) 50,000 Production started this period 65.000 Ending work in process (40% complete 30.000 Required If the company uses FIFO for costing purposes, how many equivalent units of production (gallons), in total, did the dairy produce in the first quarter of the year? 7. Process Costing: Equivalent Units with Weighted Average L06.7 Refer to the information provided in Brief Exercise 6. Required If the company uses weighted average for costing purposes, how many equivalent units of production (gallons), in total, did the dairy produce in the first quarter of the year? 8. Service Department Allocation Using the Direct Method LOS Costs of operating service departments can be allocated across a company in a variety of ways, including the most widely used approach: the direct method. The following table includes costs for two service departments and the two production depart- ments they support: Service Service Production Production $75.000 $210,000 $180,000 Department costs Number of calls Number of employees $48.000 750 240 2.400 1.600 20 25 35 Service A allocates costs on the basis of the number of calls, and Service B allocates costs on the basis of the number of employees. Required Use the direct method to allocate the costs of the two service departments to the two production departments. What is the total cost for Production A and Production B after the allocation? 4 Chapter Job Costing Process Costing good

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts