Question: Questions 1 through 9. #2 is c #3 is b Show work for all For questions 1 through 9, suppose the structure of an economy

Questions 1 through 9.

#2 is c

#3 is b

Show work for all

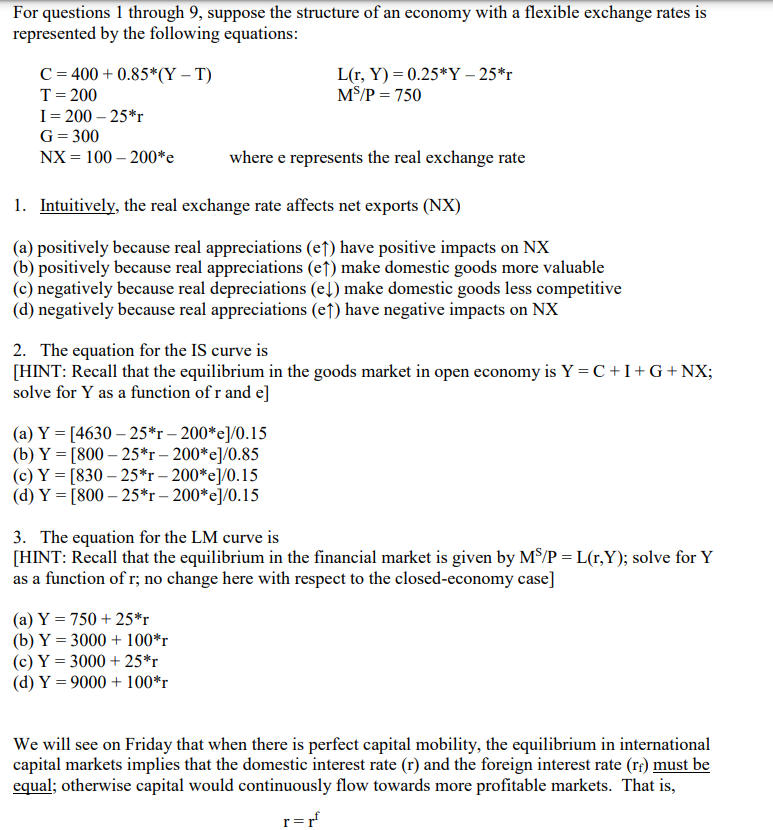

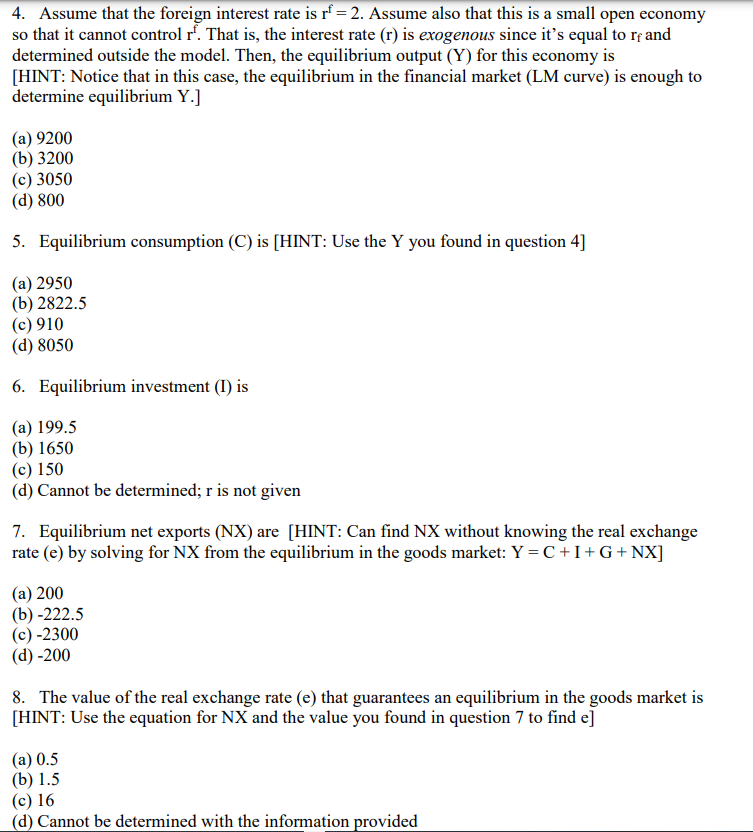

For questions 1 through 9, suppose the structure of an economy with a flexible exchange rates is represented by the following equations: C = 400+ 0.85*(Y-T) T = 200 L(r, Y) = 0.25*Y - 25*r MS/P = 750 I=200-25*r G = 300 NX = 100-200*e where e represents the real exchange rate 1. Intuitively, the real exchange rate affects net exports (NX) (a) positively because real appreciations (et) have positive impacts on NX (b) positively because real appreciations (et) make domestic goods more valuable (c) negatively because real depreciations (el) make domestic goods less competitive (d) negatively because real appreciations (et) have negative impacts on NX 2. The equation for the IS curve is [HINT: Recall that the equilibrium in the goods market in open economy is Y=C+I+G+NX; solve for Y as a function of r and e] (a) Y = [4630-25*r-200*e]/0.15 (b) Y = [800-25*r - 200*e]/0.85 (c) Y = [830-25*r-200*e]/0.15 (d) Y = [800-25*r-200*e]/0.15 3. The equation for the LM curve is [HINT: Recall that the equilibrium in the financial market is given by MS/P = L(r,Y); solve for Y as a function of r; no change here with respect to the closed-economy case] (a) Y = 750+25*r (b) Y = 3000 + 100*r (c) Y = 3000 + 25*r (d) Y = 9000 + 100*r We will see on Friday that when there is perfect capital mobility, the equilibrium in international capital markets implies that the domestic interest rate (r) and the foreign interest rate (rf) must be equal; otherwise capital would continuously flow towards more profitable markets. That is, r=rf 4. Assume that the foreign interest rate is rf = 2. Assume also that this is a small open economy so that it cannot control rf. That is, the interest rate (r) is exogenous since it's equal to rf and determined outside the model. Then, the equilibrium output (Y) for this economy is [HINT: Notice that in this case, the equilibrium in the financial market (LM curve) is enough to determine equilibrium Y.] (a) 9200 (b) 3200 (c) 3050 (d) 800 5. Equilibrium consumption (C) is [HINT: Use the Y you found in question 4] (a) 2950 (b) 2822.5 (c) 910 (d) 8050 6. Equilibrium investment (I) is (a) 199.5 (b) 1650 (c) 150 (d) Cannot be determined; r is not given 7. Equilibrium net exports (NX) are [HINT: Can find NX without knowing the real exchange rate (e) by solving for NX from the equilibrium in the goods market: Y=C+I+G+NX] (a) 200 (b)-222.5 (c)-2300 (d) -200 8. The value of the real exchange rate (e) that guarantees an equilibrium in the goods market is [HINT: Use the equation for NX and the value you found in question 7 to find e] (a) 0.5 (b) 1.5 (c) 16 (d) Cannot be determined with the information provided 9. Suppose the government increases its spending (G) from 300 to 350. The equilibrium output (Y) for this economy if rf is still 2 is [HINT: Re-do question 4] (a) 9250 (b) 3250 (c) 3200 (d) 850 For questions 1 through 9, suppose the structure of an economy with a flexible exchange rates is represented by the following equations: C = 400+ 0.85*(Y-T) T = 200 L(r, Y) = 0.25*Y - 25*r MS/P = 750 I=200-25*r G = 300 NX = 100-200*e where e represents the real exchange rate 1. Intuitively, the real exchange rate affects net exports (NX) (a) positively because real appreciations (et) have positive impacts on NX (b) positively because real appreciations (et) make domestic goods more valuable (c) negatively because real depreciations (el) make domestic goods less competitive (d) negatively because real appreciations (et) have negative impacts on NX 2. The equation for the IS curve is [HINT: Recall that the equilibrium in the goods market in open economy is Y=C+I+G+NX; solve for Y as a function of r and e] (a) Y = [4630-25*r-200*e]/0.15 (b) Y = [800-25*r - 200*e]/0.85 (c) Y = [830-25*r-200*e]/0.15 (d) Y = [800-25*r-200*e]/0.15 3. The equation for the LM curve is [HINT: Recall that the equilibrium in the financial market is given by MS/P = L(r,Y); solve for Y as a function of r; no change here with respect to the closed-economy case] (a) Y = 750+25*r (b) Y = 3000 + 100*r (c) Y = 3000 + 25*r (d) Y = 9000 + 100*r We will see on Friday that when there is perfect capital mobility, the equilibrium in international capital markets implies that the domestic interest rate (r) and the foreign interest rate (rf) must be equal; otherwise capital would continuously flow towards more profitable markets. That is, r=rf 4. Assume that the foreign interest rate is rf = 2. Assume also that this is a small open economy so that it cannot control rf. That is, the interest rate (r) is exogenous since it's equal to rf and determined outside the model. Then, the equilibrium output (Y) for this economy is [HINT: Notice that in this case, the equilibrium in the financial market (LM curve) is enough to determine equilibrium Y.] (a) 9200 (b) 3200 (c) 3050 (d) 800 5. Equilibrium consumption (C) is [HINT: Use the Y you found in question 4] (a) 2950 (b) 2822.5 (c) 910 (d) 8050 6. Equilibrium investment (I) is (a) 199.5 (b) 1650 (c) 150 (d) Cannot be determined; r is not given 7. Equilibrium net exports (NX) are [HINT: Can find NX without knowing the real exchange rate (e) by solving for NX from the equilibrium in the goods market: Y=C+I+G+NX] (a) 200 (b)-222.5 (c)-2300 (d) -200 8. The value of the real exchange rate (e) that guarantees an equilibrium in the goods market is [HINT: Use the equation for NX and the value you found in question 7 to find e] (a) 0.5 (b) 1.5 (c) 16 (d) Cannot be determined with the information provided 9. Suppose the government increases its spending (G) from 300 to 350. The equilibrium output (Y) for this economy if rf is still 2 is [HINT: Re-do question 4] (a) 9250 (b) 3250 (c) 3200 (d) 850

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts