Question: Questions: 1. What are the main issues in this case? 2. What recommendations would you make to Delta? 3. What would be the implementation plan

Questions:

1. What are the main issues in this case?

2. What recommendations would you make to Delta?

3. What would be the implementation plan for the suggested recommendations?

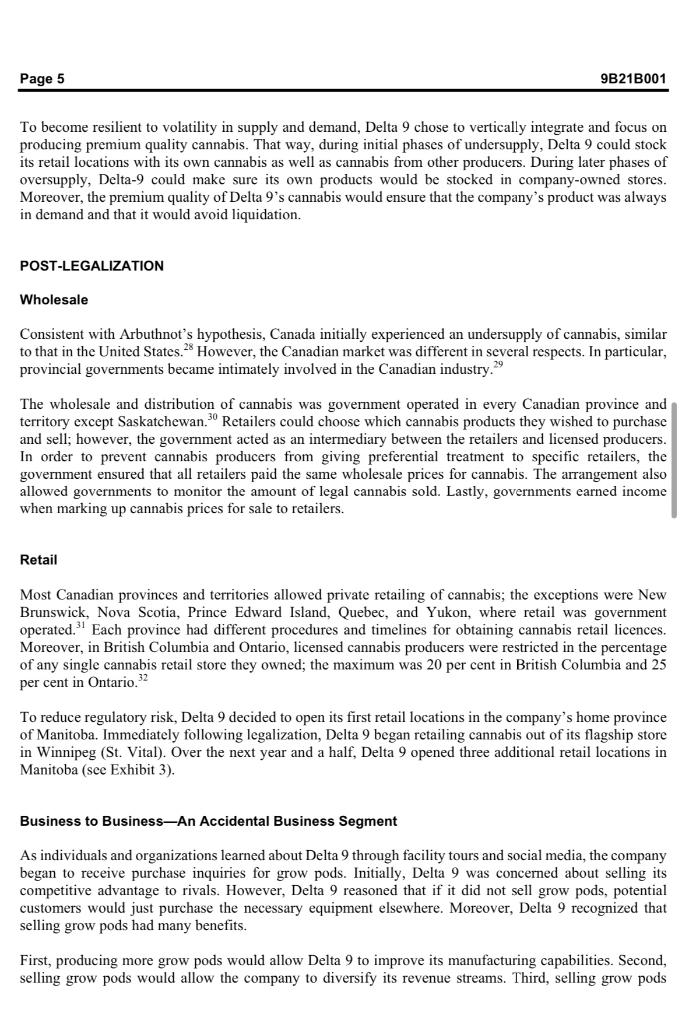

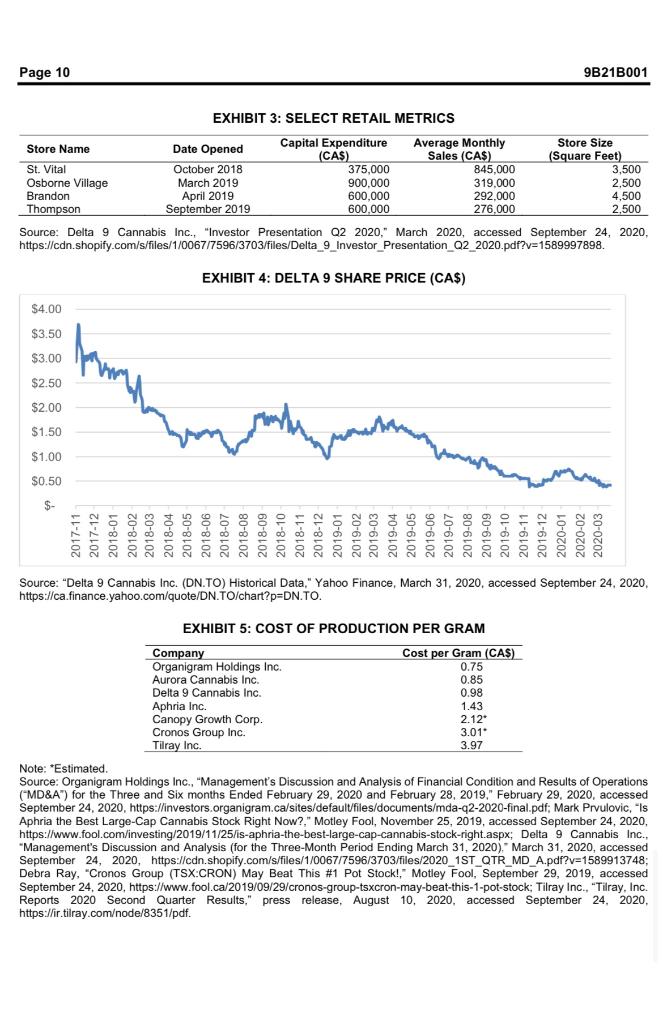

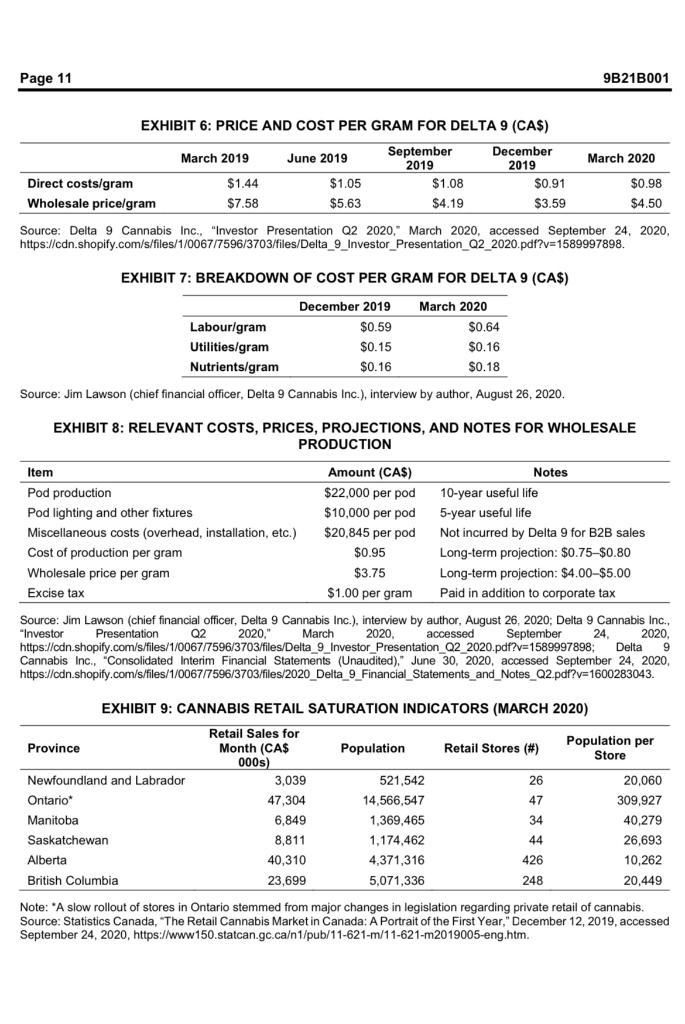

Pavandeep Sehra wrote this case under the supervision of Kun Huo solely to provide material for class discussion. The authors do not intend to illustrate either effective or ineffective handling of a managerial situation. The authors may have disguised certain names and other identifying information to protect confidentiality. This publication may not be transmitted, photocopied, digitized, or otherwise reproduced in any form or by any means without the permission of the copyright holder. Reproduction of this material is not covered under authorization by any reproduction rights organization. To order copies or request permission to reproduce materials, contact Ivey Publishing, Ivey Business School, Western University, London, Ontario, Canada, N6G ON1; (t) 519.661.3208; (e) cases@ivey.ca; www.iveycases.com. Our goal is to publish materials of the highest quality; submit any errata to publishcases@ivey.ca. Copyright 2021, Ivey Business School Foundation Version: 2021-03-03 On Wednesday, April 1, 2020, John Arbuthnot, chief executive officer (CEO) and co-founder of Delta 9 Cannabis Inc. (Delta 9), was in his office earlier than usual. The day before marked the close of Delta 9's best fiscal quarter ever. This was far from a surprise: Delta 9 had grown rapidly since its founding in 2012. An avid sports fan, Arbuthnot likened the past three fiscal quarters of the business to scoring three goals in the first period of a hockey game. Arbuthnot considered the rest of 2020 to be Delta 9's second period. However, despite this growth, Delta 9's share price had deflated over the past year, a problem that was exacerbated by the COVID-19 pandemic. Delta 9's original growth strategy had relied on the capital markets being bullish on the cannabis industry. Now, Arbuthnot was forced to reconsider his game plan. Should the company raise additional capital to fund growth? How should the company allocate its capital internally? Buzz. Arbuthnot looked down at his cell phone. It was a calendar reminder for his presentation to the board of directors in one week's time. Arbuthnot looked forward to delivering the solid financials to the board, but he knew that he would have to answer the difficult question as well. For a growth company, the question was always, "What is next?" CANNABIS INDUSTRY BACKGROUND Terms and Uses Cannabis referred to a genus of flowering plants. 1 For marketing purposes, it was commonly accepted that there were three species within this genus: Cannabis sativa, Cannabis indica, and Cannabis ruderalis. 2 Most strains of cannabis were blends of Cannabis sativa and Cannabis indica. Perhaps the best-known use of cannabis was for its psychoactive effect; the consumption or smoking of cannabis was known to generate a "high" that was largely attributable to the presence of the chemical delta9-tetrahydrocannabinol (THC). THC and another constituent compound of cannabis, cannabidiol (CBD), were known to provide pain relief. 3 THC and CBD were most concentrated in the plant's flowering buds, which were the most popular and valuable component of the plant for smoking and consuming. Cannabis could also be used to treat nausea, vomiting, low appetite, and muscle spasms, among other medical ailments. 4 Hemp referred to cannabis that was not cultivated for the plant's psychoactive effect. There were many uses for hemp, including consuming its nutritious seeds, using its fibres in textiles, and using the oil from its seeds to produce oil-based paints. 5 Legal History of Cannabis in Canada Canada became one of the first Western nations to criminalize cannabis with the Act to Prohibit the Improper Use of Opium and other Drugs in 1923. In the 1990s, however, landmark court decisions established the constitutional right to use cannabis for medicinal purposes. In 2001 , the Canadian federal government implemented the Marihuana Medical Access Regulations (MMAR), which allowed patients to obtain licences to grow cannabis for themselves and a small number of other patients. 6 Patients could also obtain cannabis directly from Health Canada. By 2012, however, it was widely understood that the MMAR was deeply flawed. Growers felt that the government was putting them at risk of home invasion, and the electrical equipment used for indoor growth could be a fire hazard. 7 Further, only a single strain of cannabis was available from Health Canada. Many patients turned toward the black market instead, simply for convenience. 8 Around this time, the concept of decriminalizing or legalizing the recreational use of cannabis became an increasingly popular political conversation. Politicians understood that the black market was unregulated, yielded no tax revenue, was too often associated with organized crime, and forced patients to pay higher prices. In 2012, close to two-thirds of Canadians favoured legalizing or decriminalizing cannabis. In December 2012, Health Canada announced plans to overhaul the MMAR. In June 2013, the Marihuana for Medical Purposes Regulations (MMPR) took the production of medical cannabis out of the hands of individuals and placed it into the hands of regulated and licensed producers. 10 In October 2015, the Liberal Party of Canada won the federal election. Legalizing the recreational use of cannabis had been an official policy of the Liberal Party since January 2012, and in April 2017, the party introduced the structure for legalization with the Cannabis Act, introduced to the House of Commons. The Act came into effect on October 17, 2018, making Canada just the second country in the world to legalize the recreational use of cannabis. 12 Although the Cannabis Act legalized cannabis federally, provinces and territories were responsible for "developing, implementing, maintaining and enforcing systems to oversee the distribution and sale of cannabis." "13 Legal History of Cannabis in the United States In 1970, the United States classified cannabis as a Schedule I controlled substance, alongside drugs such as heroin and LSD. Nonetheless, many states subsequently legalized or decriminalized both the medicinal and recreational use of cannabis. In 1996, California became the first state to legalize the medicinal use of cannabis. 14 In December 2012 , Washington became the first state to legalize the recreational use of cannabis. As of March 2020, the medicinal use of cannabis was legal in 33 states and the recreational use of cannabis was legal in 11 states. These state regulations were in direct conflict with federal law. 15 State of Cannabis Market and Forecasted Growth The market for legal cannabis in Canada grew at an incredible pace following legalization: by March 2020 , legal cannabis retail sales had grown to CA $181 million from just $42 million in October 2018 (see Exhibit 1). 16 In 2019 , legal cannabis retail sales grew an average of 8.4 per cent each month, with sales for the year totalling $1.2 billion. 17 However, the market size for cannabis was significantly larger; in 2019 , more than 40 per cent of consumers obtained their cannabis from the black market. 18 There were many explanations for why the black market for cannabis continued to thrive post-legalization. Firstly, black market cannabis was easier to obtain; the rollout of legal cannabis retail locations was slow in 2018 and 2019. However, the main issue was that the black market offered cannabis at lower prices by evading taxes. The black market also continued to thrive because many customers believed that the black market offered a greater variety of high-quality cannabis. Even legal cannabis producers widely acknowledged that smaller-scale craft producers grew higher quality cannabis, which was difficult to produce on a mass scale. 19 As legal cannabis companies improved their variety and quality of cannabis, achieved greater economies of scale, and opened additional retail locations, the black market was expected to lose significant market share. In fact, it was expected that legal cannabis sales would reach $2.5 billion in sales in 2020 and just over $6.4 billion in 2024.20 In the United States, legal cannabis sales amounted to US $12.2 billion in 2019, which was expected to grow at a compound annual growth rate (CAGR) of 20.6 per cent over the next five years. 21 Globally, legal cannabis sales in 2019 amounted to US $17.7 billion. With more geographies across the world beginning to open recreational and medical cannabis markets, global cannabis sales were expected to reach US $40 billion by 202422 Major Players (Early 2020) More than 470 companies were licensed to cultivate, process, or wholesale cannabis in Canada. 23 The largest cannabis companies were Canopy Growth Corporation, Aurora Cannabis Inc., Tilray Inc., Aphria Inc., Organigram Holdings Inc., and Cronos Group Inc. In their first fiscal quarters of 2020, these companies achieved combined revenues of approximately $340 million. Of these companies, only Canopy Growth and Aurora Cannabis owned retail locations. 24 The retail landscape for cannabis was fragmented. The market was new and expanding, and stores and brands were frequently opened, bought, and consolidated. Canada's largest cannabis retail chains included Prairie Records (WestLeaf Cannabis Inc.), Fire \& Flower Cannabis Co., Tweed Inc. (Canopy Growth Corporation), Tokyo Smoke (Canopy Growth Corporation), Meta Growth Corporation, YSS Corporation, NOVA Cannabis (Alcanna Inc.), and High Tide Inc. Combined, these brands operated fewer than 220 of the roughly 1,000 legal cannabis retailers throughout the country. 25 DELTA 9 Arbuthnot started Delta 9 in January 2012. At that time, he was still a commerce student at the University of Manitoba's Asper School of Business. While completing a new venture feasibility study, Arbuthnot predicted that the corporate production of medical cannabis would soon become legal. He envisioned a company that commercialized medical cannabis and used first-mover advantage to capture a significant portion of the market. Page 4 9B21B001 Unlike many new venture projects, which only lived on paper, Arbuthnot's idea was turned into reality when he boldly followed his passion and cofounded Delta 9 Biotech Inc. with his father, Bill. Since its founding, Delta 9 had been headquartered in Winnipeg, Manitoba. Raising initial capital to get the company started was extremely difficult because cannabis was highly stigmatized in 2012 . However, through hard work and creativity, Arbuthnot was able to raise the capital required to retrofit a warehouse for cannabis production and to apply for licences to cultivate and sell cannabis. By March 2014, Delta 9 had received sales and cultivation licences from Health Canada, making Delta 9 just the fourth company in Canada to become a fully licensed producer of medical cannabis. Four months later, in July 2014, Delta 9 began making parcel deliveries of medical cannabis to hundreds of customers. In November 2017, with the company renamed Delta 9 Cannabis Inc., its shares began trading on the Toronto Stock Exchange. Grow Pod Production Because of Canada's cold winters, most Canadian cannabis companies grew cannabis in large, undivided greenhouses. The unsegregated, open nature of the greenhouses incentivized companies to maximize production in the space they had because many of the expenses in these facilities were independent of the volume of production. In the early days of legalization, well-funded companies expanded production capacity rapidly in anticipation of higher future demand and to deter new companies from entering the market. The producers ended up overshooting demand and the price for cannabis crashed. Additionally, open growth increased the risk of crop failure; if a pest or disease infected just a single plant, the issue could spread to all other plants in the facility. Recognizing the disadvantages of open and unsegregated growth, Delta 9 planted cannabis in grow pods. Grow pods were shipping containers that Delta 9 proprietarily retrofitted for cannabis cultivation. The pods were stackable, scalable, and modular, which allowed for vertical farming and incremental increases in production capacity. Importantly, because grow pods were independent of each other, crop failures could be isolated. In addition, grow pods could be optimized for different cannabis strains, which ensured consistency and superior quality cannabis while keeping the cost of production low (see Exhibit 2 ). Delta 9 manufactured three types of grow pods: genetics and clone units, flowering units, and support units. Cannabis seeds or cuttings were rooted in genetics and clone units. After a few weeks, these plants were transferred to flowering units, where the plants remained for the rest of their growing lives. Support units were used to process and store cannabis. Shift Toward a Vertical Integration Strategy Following the Canadian federal election in October 2015 , it became clear that the recreational use of cannabis would become legal in Canada within a few years. 26 Therefore, Arbuthnot decided to move Delta 9 from the medical cannabis market to the much larger recreational market. Delta 9 analyzed the experience of the few states in the United States that had already legalized the recreational use of cannabis. Invariably, each state had experienced significant volatility in supply and demand. These markets started with an undersupply of cannabis and elevated wholesale and retail prices that were not competitive with the black market. As cannabis companies increased their output, the situation reversed; markets faced an oversupply of cannabis with significantly reduced wholesale prices. In markets facing oversupply, lower quality cannabis was deeply discounted to processing companies to produce oils and edibles. 27 Page 5 9B21B001 To become resilient to volatility in supply and demand, Delta 9 chose to vertically integrate and focus on producing premium quality cannabis. That way, during initial phases of undersupply, Delta 9 could stock its retail locations with its own cannabis as well as cannabis from other producers. During later phases of oversupply, Delta-9 could make sure its own products would be stocked in company-owned stores. Moreover, the premium quality of Delta 9's cannabis would ensure that the company's product was always in demand and that it would avoid liquidation. POST-LEGALIZATION Wholesale Consistent with Arbuthnot's hypothesis, Canada initially experienced an undersupply of cannabis, similar to that in the United States. 28 However, the Canadian market was different in several respects. In particular, provincial governments became intimately involved in the Canadian industry. 29 The wholesale and distribution of cannabis was government operated in every Canadian province and territory except Saskatchewan. 30 Retailers could choose which cannabis products they wished to purchase and sell; however, the government acted as an intermediary between the retailers and licensed producers. In order to prevent cannabis producers from giving preferential treatment to specific retailers, the government ensured that all retailers paid the same wholesale prices for cannabis. The arrangement also allowed governments to monitor the amount of legal cannabis sold. Lastly, governments earned income when marking up cannabis prices for sale to retailers. Retail Most Canadian provinces and territories allowed private retailing of cannabis; the exceptions were New Brunswick, Nova Scotia, Prince Edward Island, Quebec, and Yukon, where retail was government operated. 31 Each province had different procedures and timelines for obtaining cannabis retail licences. Moreover, in British Columbia and Ontario, licensed cannabis producers were restricted in the percentage of any single cannabis retail store they owned; the maximum was 20 per cent in British Columbia and 25 per cent in Ontario. 32 To reduce regulatory risk, Delta 9 decided to open its first retail locations in the company's home province of Manitoba. Immediately following legalization, Delta 9 began retailing cannabis out of its flagship store in Winnipeg (St. Vital). Over the next year and a half, Delta 9 opened three additional retail locations in Manitoba (see Exhibit 3 ). Business to Business-An Accidental Business Segment As individuals and organizations learned about Delta 9 through facility tours and social media, the company began to receive purchase inquiries for grow pods. Initially, Delta 9 was concerned about selling its competitive advantage to rivals. However, Delta 9 reasoned that if it did not sell grow pods, potential customers would just purchase the necessary equipment elsewhere. Moreover, Delta 9 recognized that selling grow pods had many benefits. First, producing more grow pods would allow Delta 9 to improve its manufacturing capabilities. Second, selling grow pods would allow the company to diversify its revenue streams. Third, selling grow pods Page 6 9B21B001 would also allow Delta 9 to foster valuable partnerships with different cannabis companies. Delta 9 could purchase high-quality cannabis from these partners for resale throughout Delta 9's distribution channels. Further, these partnerships could lead to revenues from sales of additional equipment, consulting services, and cannabis genetics. Delta 9 received its first order for grow pods in 2018. By 2019, business to business (B2B) was Delta 9's highest margin segment, with 90 per cent of the revenue in this segment derived from selling grow pods. So far, Delta 9 had focused primarily on selling grow pods to companies based in Canada. For those who held a micro-cultivation licence, grow pods offered a turnkey solution for growing cannabis on a small-scale basis in accordance with their licence. Twenty-eight companies held this licence in March 2020, up from just two in July 2019. Delta 9 had already received orders from 12 companies who were pursuing or had been granted micro-cultivation licences. At that time, Health Canada was awarding a new micro-cultivation licence every five to seven days, a trend that was expected to continue throughout 2020..33 Despite this Canadian growth opportunity, exporting grow pods could be yet more lucrative. Many countries were beginning to open medical or recreational cannabis distribution programs. Opening these programs would take years of planning. In that time, Delta 9 could sell equipment and consulting services to foreign companies. Various experts considered selling equipment and consulting services to be a preferred growth opportunity over simply exporting cannabis abroad, because protectionist policies and international drug treaties limited the prospect of international trade for non-medical cannabis. 34 In fact, these policies benefited Delta 9 because they insulated the company from international competitors aiming to import cannabis into Canada. In tropical countries, cannabis could grow outdoors, year-round, for as little as $0.11 per gram, albeit at a lower quality. 35 In the near future, Delta 9 believed that its primary markets for grow pods would be in Canada and the United States. Long term, Delta 9 saw grow pods as a solution for indoor farming in industries other than cannabis. In many cases, grow pods offered a solution to growing food locally at lower costs, for example, in remote locations such as Nunavut where shipping costs were very high. Industry Troubles Post-Legalization Canada's cannabis industry initially faced an undersupply of cannabis, prices that were not competitive with the black market, and a slow rollout of retail stores. In addition, the federal government did not legalize cannabis edibles, extracts, or topicals until October 201936 Revenue from and growth of the cannabis industry was thus much lower than initially expected. Moreover, many large companies focused too heavily on expanding production and capturing market share as opposed to competing on quality and distribution. By 2019 , the market was flooded with cannabis. To compound problems, scandals, downsizing announcements, and large write-downs from some of Canada's largest cannabis companies were causing industry-wide concerns. 37 In April 2019, the cannabis stock bubble burst. 38 Although Delta 9 had improved its financial performance almost every quarter since going public, the company's share price also plummeted. To worsen matters, in March 2020, a global pandemic prompted Canadian public health authorities to implement lockdowns to prevent the spread of SARS-CoV-2 (COVID-19). These lockdowns upended the entire Canadian retail industry. With the market facing an oversupply of cannabis and a reduced retail sales outlook, it was expected that wholesale prices would drop. Moreover, it was expected that some producers would struggle to sell their inventory. Although cannabis did not have a defined shelf life, consumer sentiment was that fresher was better; therefore, many retailers tried to sell off inventory that was older than 60 days. 39 Some experts warned that some companies would be forced to destroy cannabis. 40 These issues caused cannabis stocks to fall even further. By March 2020, Delta 9's share price reached an all-time low (see Exhibit 4). DELTA 9 'S BUSINESS SEGMENTS Wholesale While it was expected that some producers would struggle to sell their inventory in 2020, Delta 9's management was confident that the company would face no such issue. Many of Delta 9's largest competitors struggled to grow cannabis of a similar quality, and some had been plagued by widespread crop failure. 41 Moreover, given Delta 9's low cost of production, the company often exercised its ability to undercut market wholesale prices (see Exhibit 5). By undercutting the competition, Delta 9 aimed to increase its market share and brand recognition. In the long term, however, the company intended to raise its wholesale prices. As Delta 9 matured as a company, its cost of production trended downward (see Exhibits 6 and 7). By increasing production levels without increasing labour in the same proportion, Delta 9 's management believed that its cost of production per gram of cannabis could fall even further. Delta 9 had just recently invested in automating the bottling, packaging, capping, and labelling of its consumer-packaged dried cannabis products. As of March 2020, Delta 9 operated 257 flowering units, giving the company an annual production capacity of 8,325 kilograms of cannabis. In the company's current facility, production capacity could reach 11,975 kilograms per year. For every 11 new flowering units, the company would need to install one support unit. (See Exhibit 8 for the costs associated with expanding wholesale production, projections for the price and cost per gram of cannabis.) Delta 9 had a corporate tax rate of 27 per cent and a weighted average cost of capital (WACC) of 12.5 per cent. To grow beyond the production capacity of 11,975 kilograms, Delta 9 would have to expand into a second production facility. The second facility would hold 400 grow pods, bringing Delta 9's total production capacity to 23,495 kilograms per year. The total, all-inclusive cost of this project was estimated at $35 million. Retail As of March 2020, Delta 9 controlled 30 per cent of cannabis revenues in Manitoba, and the company was looking to expand its retail presence in other provinces. The black market was expected to lose significant market share as the number of stores in each province continued to increase, but the number of customers per store would decline. Industry experts estimated the following: a mature market could accommodate one cannabis retail location for every 10,000-20,000 residents (Delta-9's board, however, believed that the Canadian market could support one store for every 10,000 residents); 18 per cent of Canadians used cannabis; and an average cannabis user could be expected to spend $1,200 on cannabis per year. 42 This implied revenues of $2.16 million per store. However, Alberta was the only province approaching this level of saturation (see Exhibit 9). Due to the rapidly evolving and increasingly competitive cannabis retail landscape, revenue projections for cannabis retail stores was uncertain. Delta 9 estimated that new retail locations would achieve an average of \$2.5 million in annual sales. Although all of Delta 9's Manitoba locations were on pace to comfortably exceed this sales figure, analysts for similar cannabis retailers estimated a range of between $2 million and $3 million in annual sales for new retail locations (see Exhibit 10)43 Each new store would require a manager and assistant manager. All equipment and leasehold improvements would need to be replaced after five years. B2B By increasing the company's sales efforts on grow pods, Delta 9 estimated that it could receive between 45 and 90 grow pod orders each quarter over the next year. Delta 9 could produce five grow pods per week, which it sold at an average price of $64,000 per pod 44 Due to the unpredictable nature of sales, Delta 9kept an inventory of 12 grow pods on hand. Customers paid a 75 per cent deposit on order and paid the balance within 30 days of delivery. DECISION Prior to the pandemic, Delta 9 had intended to use its cash flow from operations and cash on hand ($5.32 million) to maximize the production capacity in its current facilities and open new retail locations. Further expanding production capacity would necessitate construction of an additional building, which would require raising tens of millions of dollars in capital. Prior to the pandemic, capital was allocated to business segments roughly in proportion to their contribution to Delta 9's gross margin. This strategy was successful in allowing the company to grow while sustaining its strategy of vertical integration. But with the pandemic and stock price crash of 2020, it appeared that a re-evaluation of Delta 9's capital allocation plan was needed. As Arbuthnot logged on to his computer, he took a moment to reflect on his journey with Delta 9. Just eight years prior, many people thought that he was foolish for entering the cannabis space. Today, he was the CEO of one of Manitoba's most interesting businesses. Arbuthnot was happy to have turned his vision into a reality, but there was still a lot of game left to play. Source: Statistics Canada, "Table 20-10-0008-01: Retail Trade Sales by Province and Territory," September 24, 2020, accessed September 24,2020 , https://www150.statcan.gc.ca. EXHIBIT 2: DELTA 9'S GROW PODS Source: Delta 9 Cannabis Inc., D9_INVEST_large.jpg, March 31, 2020, accessed September 24, 2020, https://cdn.shopify.com/s/files/1/0090/6438/2521/files/D9_INVEST_large.jpg?v=1550789432; Delta 9 Cannabis Inc., DeltagGrow.jpg, March 31, 2020, accessed September 24, 2020, https://s29296.pcdn.co/wp-content/uploads/2017/11/Delta9Grow.jpg; "A Detailed Look into the Delta 9 Biotech Facility," YouTube video, 14:34, posted by "FTMIG," November 13, 2019 , accessed September 4, 2020, https://youtu.be/CAYMx0c.Jj2k. Page 10 9B21B001 EXHIBIT 3: SELECT RETAIL METRICS \begin{tabular}{lcccc} \hline Store Name & Date Opened & CapitalExpenditure(CAS) & AverageMonthlySales(CAS) & StoreSize(SquareFeet) \\ \hline St. Vital & October 2018 & 375,000 & 845,000 & 3,500 \\ Osborne Village & March 2019 & 900,000 & 319,000 & 2,500 \\ Brandon & April 2019 & 600,000 & 292,000 & 4,500 \\ Thompson & September 2019 & 600,000 & 276,000 & 2,500 \\ \hline \end{tabular} Source: Delta 9 Cannabis Inc., "Investor Presentation Q2 2020," March 2020, accessed September 24, 2020, https://cdn.shopify.com/s/files/1/0067/7596/3703/files/Delta_9_Investor_Presentation_Q2_2020.pdf?v=1589997898. EXHIBIT 4: DELTA 9 SHARE PRICE (CA\$) Source: "Delta 9 Cannabis Inc. (DN.TO) Historical Data," Yahoo Finance, March 31, 2020, accessed September 24, 2020, https://ca.finance.yahoo.com/quote/DN.TO/chart?p=DN.TO. EXHIBIT 5: COST OF PRODUCTION PER GRAM \begin{tabular}{lc} \hline Company & Cost per Gram (CAS) \\ \hline Organigram Holdings Inc. & 0.75 \\ Aurora Cannabis Inc. & 0.85 \\ Delta 9 Cannabis Inc. & 0.98 \\ Aphria Inc. & 1.43 \\ Canopy Growth Corp. & 2.12 \\ Cronos Group Inc. & 3.01 \\ Tilray Inc. & 3.97 \\ \hline \end{tabular} Note: * Estimated. Source: Organigram Holdings Inc., "Management's Discussion and Analysis of Financial Condition and Results of Operations ("MD\&A") for the Three and Six months Ended February 29, 2020 and February 28, 2019," February 29, 2020, accessed September 24, 2020, https://investors.organigram.ca/sites/defaultfiles/documents/mda-q2-2020-final.pdf; Mark Prvulovic, "Is Aphria the Best Large-Cap Cannabis Stock Right Now?," Motley Fool, November 25, 2019, accessed September 24, 2020, https://www.fool.com/investing/2019/11/25/is-aphria-the-best-large-cap-cannabis-stock-right.aspx; Delta 9 Cannabis Inc., "Management's Discussion and Analysis (for the Three-Month Period Ending March 31,2020)," March 31, 2020, accessed September 24, 2020, https://cdn.shopify.com/s/files/1/0067/7596/3703/files/2020_1ST_QTR_MD_A.pdf?v=1589913748; Debra Ray, "Cronos Group (TSX:CRON) May Beat This \#1 Pot Stock!," Motley Fool, September 29, 2019, accessed September 24, 2020, https://www.fool.ca/2019/09/29/cronos-group-tsxcron-may-beat-this-1-pot-stock; Tilray Inc., "Tilray, Inc. Reports 2020 Second Quarter Results," press release, August 10, 2020, accessed September 24, 2020, https://ir.tilray.comode/8351/pdf. EXHIBIT 6: PRICE AND COST PER GRAM FOR DELTA 9 (CA\$) Source: Delta 9 Cannabis Inc., "Investor Presentation Q2 2020," March 2020, accessed September 24, 2020, https://cdn.shopify.com/s/files/1/0067/7596/3703/files/Delta_9_Investor_Presentation_Q2_2020.pdf?v=1589997898. EXHIBIT 7: BREAKDOWN OF COST PER GRAM FOR DELTA 9 (CA\$) Source: Jim Lawson (chief financial officer, Delta 9 Cannabis Inc.), interview by author, August 26, 2020. EXHIBIT 8: RELEVANT COSTS, PRICES, PROJECTIONS, AND NOTES FOR WHOLESALE PRODUCTION Source: Jim Lawson (chief financial officer, Delta 9 Cannabis Inc.), interview by author, August 26, 2020; Delta 9 Cannabis Inc., "Investor Presentation Q2 2020," March 2020, accessed September 20, https:/lodn.shopify.com/s/files/1/0067/7596/3703/files/Delta_9_Investor_Presentation_Q2_2020.pdf?v=1589997898; Delta 9 Cannabis Inc., "Consolidated Interim Financial Statements (Unaudited)," June 30, 2020, accessed September 24, 2020, https://cdn.shopify.com/s/files/1/0067/7596/3703/files/2020_Delta_9_Financial_Statements_and_Notes_Q2.pdf?v=1600283043. EXHIBIT 9: CANNABIS RETAIL SATURATION INDICATORS (MARCH 2020) Note: "A slow rollout of stores in Ontario stemmed from major changes in legislation regarding private retail of cannabis. Source: Statistics Canada, "The Retail Cannabis Market in Canada: A Portrait of the First Year," December 12, 2019, accessed September 24, 2020, https://www150.statcan.gc.ca1/pub/11-621-m/11-621-m2019005-eng.htm

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts