Question: QUESTIONS 1. What is a value-weighted average? Why does such sis on such firms as Microsoft and ExxonMobil than 2. How does the computation of

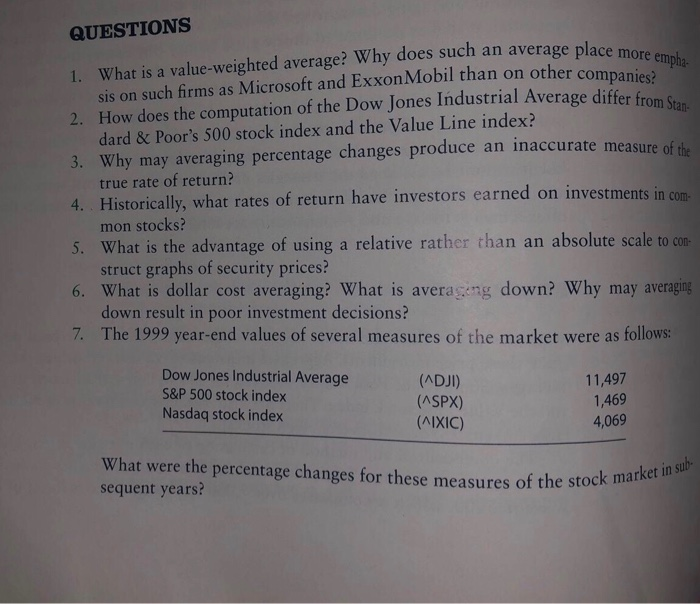

QUESTIONS 1. What is a value-weighted average? Why does such sis on such firms as Microsoft and ExxonMobil than 2. How does the computation of the Dow Jones Industrial Average differ from Stan- an average place more empha other companies? on dard & Poor's 500 stock index and the Value Line index? 3. Why may averaging percentage changes produce true rate of return? 4. Historically, what rates of return have investors earned on investments in com- an inaccurate measure of the stocks? mon 5. What is the advantage of using a relative rather than an absolute scale to con struct graphs of security prices? 6. What is dollar cost averaging? What is averageng down? Why may averaging down result in poor investment decisions? 7. The 1999 year-end values of several measures of the market were as follows: CO: Dow Jones Industrial Average S&P 500 stock index 11,497 1,469 4,069 (ADJI) (ASPX) (AIXIC) Nasdaq stock index What were the percentage changes for these measures of the stock market in sub- sequent years

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts