Question: . Questions 13 - 18 are all based on the following information. Steward Princeville, the CEO of St. Charles Elevators, Inc. believes that the firm

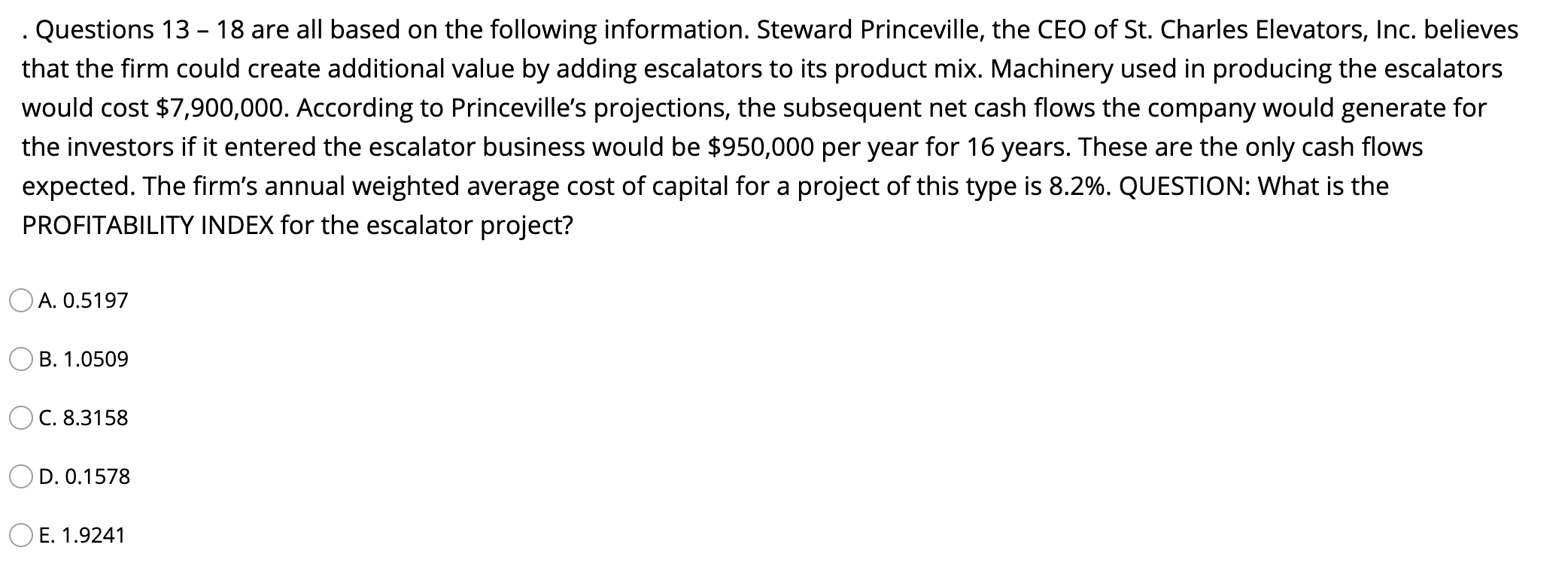

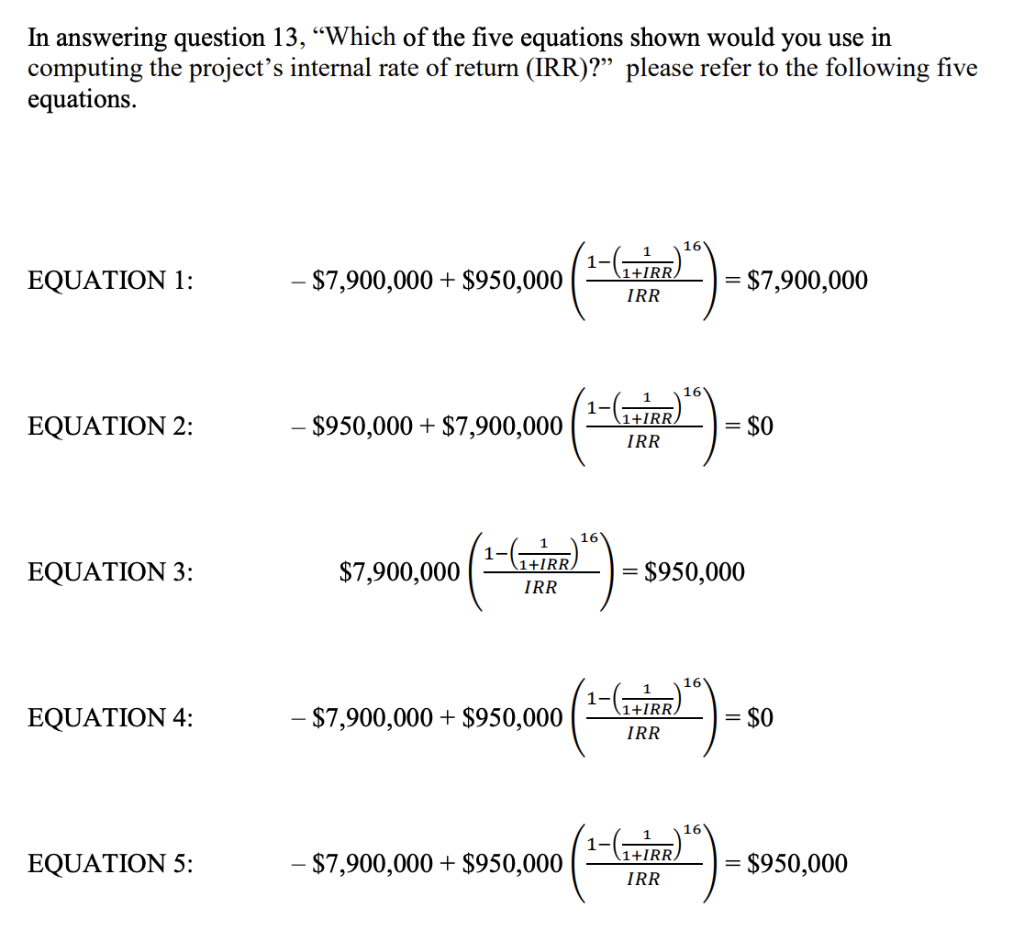

. Questions 13 - 18 are all based on the following information. Steward Princeville, the CEO of St. Charles Elevators, Inc. believes that the firm could create additional value by adding escalators to its product mix. Machinery used in producing the escalators would cost $7,900,000. According to Princeville's projections, the subsequent net cash flows the company would generate for the investors if it entered the escalator business would be $950,000 per year for 16 years. These are the only cash flows expected. The firm's annual weighted average cost of capital for a project of this type is 8.2%. QUESTION: What is the PROFITABILITY INDEX for the escalator project? OA. 0.5197 OB. 1.0509 OC. 8.3158 OD. 0.1578 O E. 1.9241 In answering question 13, Which of the five equations shown would you use in computing the project's internal rate of return (IRR)? please refer to the following five equations. EQUATION 1: - $7,900,000 + $950,000 ("Cemi ) - ,900,000 - $7,900,000 + $950,000 1+IRR IRR J=$7,900,000 EQUATION 2: EQUATION 3: 1+IRR $7,900 0,00 - ] = $950,000 IRR - $950,000 + 87,900,000 (P) - so 90.0 ('- ") - soooo - 5790,00 + 950.000 (5 puta") aso - 57.900,00 + 850.0 (957 ") - sos0,00 EQUATION 4: EQUATION 5

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts