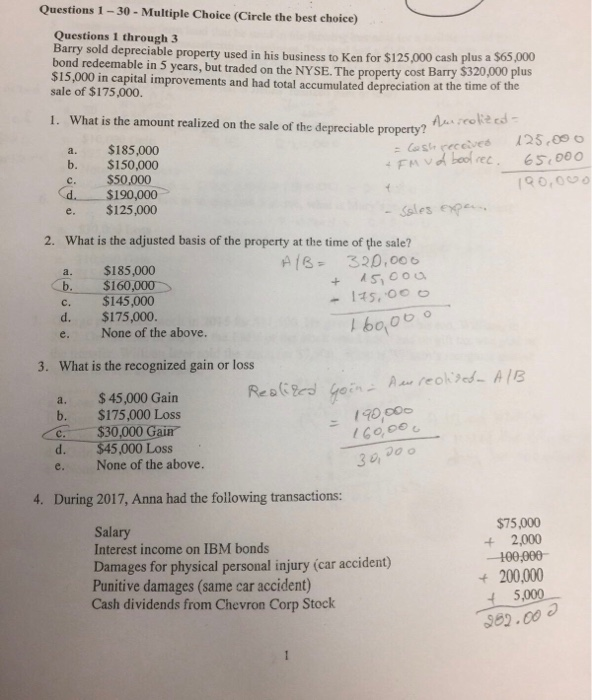

Question: Questions 1-30 - Multiple Choice (Circle the best choice) Questions 1 through 3 Barry sold depreciable property used in his business to Ken for $125,000

Questions 1-30 - Multiple Choice (Circle the best choice) Questions 1 through 3 Barry sold depreciable property used in his business to Ken for $125,000 cash plus a $65,00o bond redeemable in 5 ycars, but traded on the NYSE. The property cost Barry $15,000 sale of $175,000. in capital improvements and had total accumulated depreciation at the time of the $320,000 plus 1. What is the amount realized on the sale of the depreciable property? 12s.co o Cust, receives a. $185,000 b. $150,000 c. $50,000 $190,000 e. $125,000 sles expe 2. What is the adjusted basis of the property at the time of the sale? $185,000 $160,000 c. $145,000 d. $175,000. e. None of the above. 3. What is the recognized gain or loss a $-4500 Gain Ree gein h b. $175,000 Loss C.$30,000 Gair d.345,000)Loss e. None of the above. 3090 4. During 2017, Anna had the following transactions: Salary Interest income on IBM bonds Damages for physical personal injury (car accident) Punitive damages (same car accident) Cash dividends from Chevron Corp Stock $75,000 4 2,000 -100,000 200,000 5,000- 38.00

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts