Question: questions 1-4 1. Select a company. - You CANNOT use the instructor's example company, Target. - The company you select must be a merchandising or

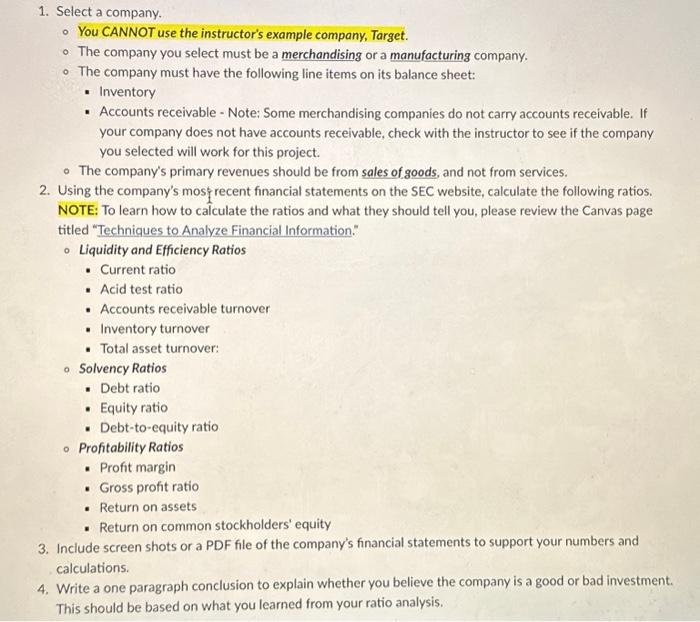

1. Select a company. - You CANNOT use the instructor's example company, Target. - The company you select must be a merchandising or a manufacturing company. - The company must have the following line items on its balance sheet: - Inventory - Accounts receivable - Note: Some merchandising companies do not carry accounts receivable. If your company does not have accounts receivable, check with the instructor to see if the company you selected will work for this project. - The company's primary revenues should be from sales of goods, and not from services. 2. Using the company's mosfrecent financial statements on the SEC website, calculate the following ratios. NOTE: To learn how to calculate the ratios and what they should tell you, please review the Canvas page titled "Techniques to Analyze Financial Information." - Liquidity and Efficiency Ratios - Current ratio - Acid test ratio - Accounts receivable turnover - Inventory turnover - Total asset turnover: - Solvency Ratios - Debt ratio - Equity ratio - Debt-to-equity ratio - Profitability Ratios - Profit margin - Gross profit ratio - Return on assets - Return on common stockholders' equity 3. Include screen shots or a PDF file of the company's financial statements to support your numbers and calculations. 4. Write a one paragraph conclusion to explain whether you believe the company is a good or bad investment. This should be based on what you learned from your ratio analysis

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts