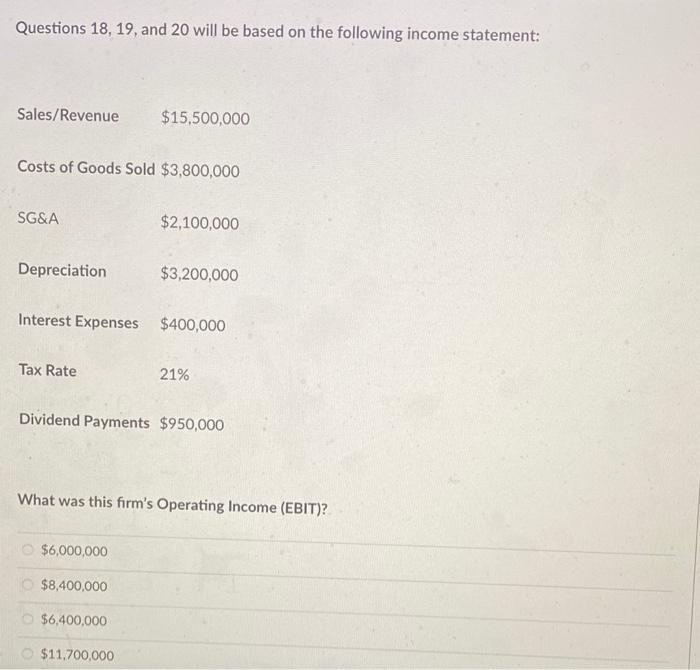

Question: Questions 18, 19, and 20 will be based on the following income statement: Sales/Revenue $15,500,000 Costs of Goods Sold $3,800,000 SG&A $2,100,000 Depreciation $3,200,000 Interest

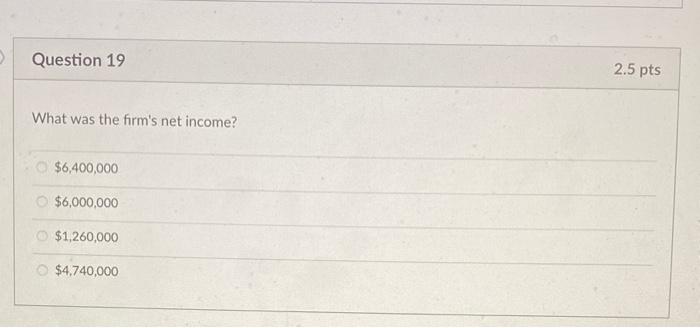

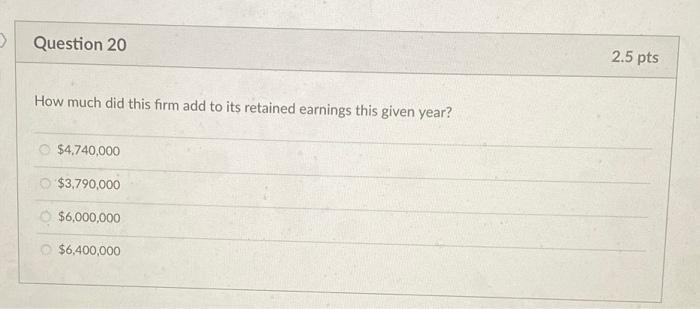

Questions 18, 19, and 20 will be based on the following income statement: Sales/Revenue $15,500,000 Costs of Goods Sold $3,800,000 SG&A $2,100,000 Depreciation $3,200,000 Interest Expenses $400,000 Tax Rate 21% Dividend Payments $950,000 What was this firm's Operating Income (EBIT)? $6,000,000 $8,400,000 $6,400,000 $11.700,000 Question 19 2.5 pts What was the firm's net income? $6,400,000 $6,000,000 $1,260,000 $4,740,000 Question 20 2.5 pts How much did this firm add to its retained earnings this given year? $4,740,000 $3,790,000 $6,000,000 $6,400,000

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock