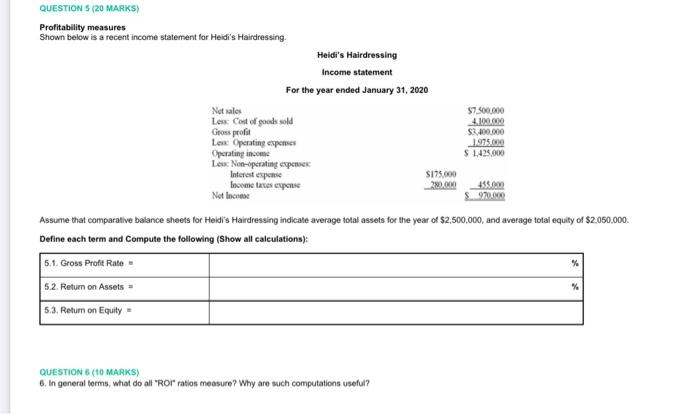

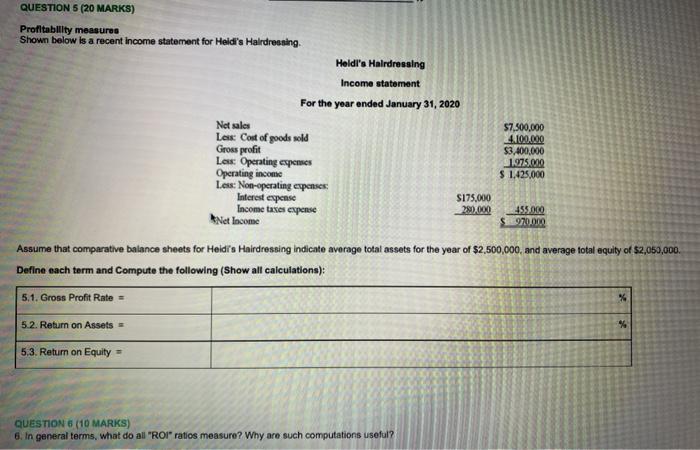

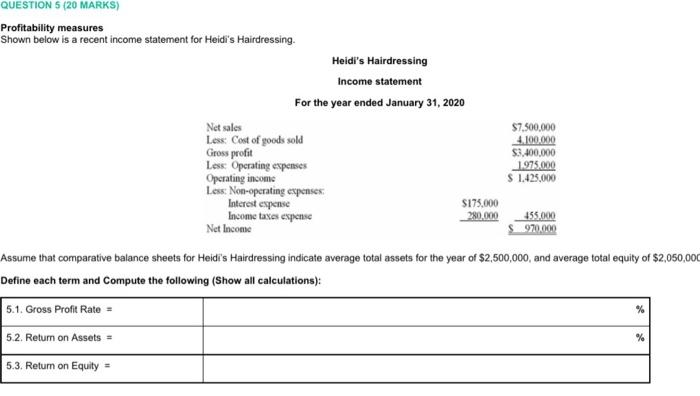

Question: QUESTIONS (20 MARKS) Profitability measures Shown below is a recent income statement for Heidi's Hairdressing Heidi's Hairdressing Income statement For the year ended January 31,

QUESTIONS (20 MARKS) Profitability measures Shown below is a recent income statement for Heidi's Hairdressing Heidi's Hairdressing Income statement For the year ended January 31, 2020 Notales $7.500.000 Less Cost of goods sold 4.100.000 Gross profit $3,400.000 Les Operating esperes 1975. Operating income $ 1,425.000 Low No-operating expenser S175.000 Income taxes espouse 455.0 Net Income 970.000 Assume that comparative balance sheets for Heidi's Hairdressing indicate average total assets for the year of $2,500,000, and average total equilty of $2,050,000 Define each term and Compute the following (Show all calculations): 5.1. Gross Proft Rate % 5.2. Return on Assets 5.3. Retum on Equity QUESTION 6 (10 MARKS) 6. In general terms, what do all "ror ratios measure? Why are such computations useful? QUESTION 5 (20 MARKS) Profitability measures Shown below is a recent income statement for Hold's Halrdressing Heldi's Hairdressing Income statement For the year ended January 31, 2020 Net sales Les Cost of goods sold Gross profit Las Operating penes Operating income Less: Non-operating expenses Interest expense Income tases e pense Net Income $7,500,000 4.100.000 $3,400,000 1975.000 $ 1.425.000 $175,000 280.000 455.000 970.000 Assume that comparative balance sheets for Heidi's Hairdressing indicate average total assets for the year of $2,500,000, and average total equity of $2,050,000. Define each term and Compute the following (Show all calculations): 5.1. Gross Profit Rate = % 5.2. Return on Assets % 5.3. Return on Equity - QUESTION 5 (10 MARKS) 6. In general terms, what do al "Roi" ratios measure? Why are such computations useful? QUESTION 5 (20 MARKS) Profitability measures Shown below is a recent income statement for Heidi's Hairdressing. Heidi's Hairdressing Income statement For the year ended January 31, 2020 Net sales $7.500.000 Les Cost of goods sold 4.100.000 Gross profit $3,400.000 Less Operating expenses 1.975.000 Operating income $ 1.425.000 Less: Non-operating expenses. Interest expense $175,000 Income taxes expense 280.000 155.000 Net Income 970.000 Assume that comparative balance sheets for Heidi's Hairdressing indicate average total assets for the year of $2,500,000, and average total equity of $2,050,000 Define each term and Compute the following (Show all calculations): 5.1. Gross Profit Rate = 5.2. Return on Assets 5.3. Return on Equity % % QUESTION (10 MARKS) 6. In general terms, what do all "ROT" ratios measure? Why are such computations useful

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts