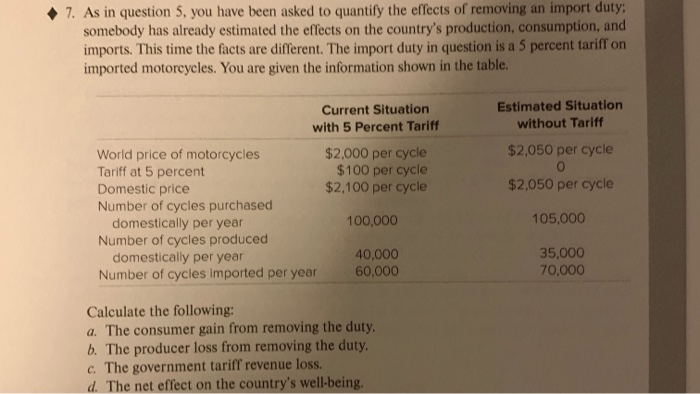

Question: 7. As in question 5, you have been asked to quantify the effects of removing an import duty; somebody has already estimated the effects

7. As in question 5, you have been asked to quantify the effects of removing an import duty; somebody has already estimated the effects on the country's production, consumption, and imports. This time the facts are different. The import duty in question is a 5 percent tariff on imported motorcycles. You are given the information shown in the table. World price of motorcycles Tariff at 5 percent Domestic price Number of cycles purchased domestically per year Number of cycles produced Current Situation with 5 Percent Tariff domestically per year Number of cycles imported per year $2,000 per cycle $100 per cycle $2,100 per cycle 100,000 40,000 60,000 Calculate the following: a. The consumer gain from removing the duty. b. The producer loss from removing the duty. c. The government tariff revenue loss. d. The net effect on the country's well-being. Estimated Situation without Tariff $2,050 per cycle 0 $2,050 per cycle 105,000 35,000 70,000

Step by Step Solution

3.48 Rating (155 Votes )

There are 3 Steps involved in it

a The consumer gain from removing the duty is 5250000 b ... View full answer

Get step-by-step solutions from verified subject matter experts