Question: questions 2&3 Section B: Answer Three questions from 4. All questions carry equal marks Question 2 Part A Cherry Co has two independent divisions, A

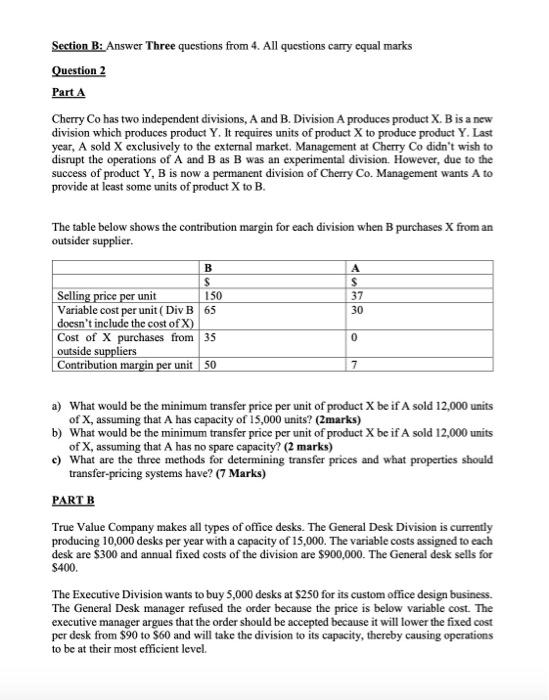

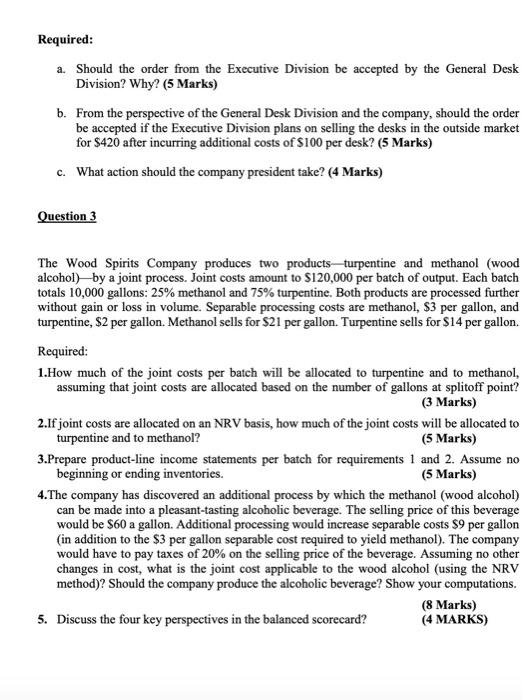

Section B: Answer Three questions from 4. All questions carry equal marks Question 2 Part A Cherry Co has two independent divisions, A and B. Division A produces product X. B is a new division which produces product Y. It requires units of product X to produce product Y. Last year, A sold X exclusively to the external market. Management at Cherry Co didn't wish to disrupt the operations of A and B as B was an experimental division. However, due to the success of product Y, B is now a permanent division of Cherry Co. Management wants A to provide at least some units of product X to B. The table below shows the contribution margin for each division when B purchases X from an outsider supplier. B $ S Selling price per unit 150 37 Variable cost per unit (Div B 65 30 doesn't include the cost of X) Cost of X purchases from 35 outside suppliers Contribution margin per unit 50 7 0 a) What would be the minimum transfer price per unit of product X be if A sold 12,000 units of X, assuming that A has capacity of 15,000 units? (Zmarks) b) What would be the minimum transfer price per unit of product X be if A sold 12,000 units of X, assuming that A has no spare capacity? (2 marks) c) What are the three methods for determining transfer prices and what properties should transfer pricing systems have? (7 Marks) PART B True Value Company makes all types of office desks. The General Desk Division is currently producing 10,000 desks per year with a capacity of 15,000. The variable costs assigned to each desk are $300 and annual fixed costs of the division are $900,000. The General desk sells for $400 The Executive Division wants to buy 5,000 desks at $250 for its custom office design business. The General Desk manager refused the order because the price is below variable cost. The executive manager argues that the order should be accepted because it will lower the fixed cost per desk from $90 to S60 and will take the division to its capacity, thereby causing operations to be at their most efficient level Required: a. Should the order from the Executive Division be accepted by the General Desk Division? Why? (5 Marks) b. From the perspective of the General Desk Division and the company, should the order be accepted if the Executive Division plans on selling the desks in the outside market for $420 after incurring additional costs of $100 per desk? (5 Marks) c. What action should the company president take? (4 Marks) Question 3 The Wood Spirits Company produces two products turpentine and methanol (wood alcohol)by a joint process. Joint costs amount to $120,000 per batch of output. Each batch totals 10,000 gallons: 25% methanol and 75% turpentine. Both products are processed further without gain or loss in volume. Separable processing costs are methanol, S3 per gallon, and turpentine, $2 per gallon. Methanol sells for $21 per gallon. Turpentine sells for $14 per gallon. Required: 1.How much of the joint costs per batch will be allocated to turpentine and to methanol, assuming that joint costs are allocated based on the number of gallons at splitoff point? (3 Marks) 2.If joint costs are allocated on an NRV basis, how much of the joint costs will be allocated to turpentine and to methanol? (5 Marks) 3.Prepare product-line income statements per batch for requirements 1 and 2. Assume no beginning or ending inventories. (5 Marks) 4. The company has discovered an additional process by which the methanol (wood alcohol) can be made into a pleasant-tasting alcoholic beverage. The selling price of this beverage would be $60 a gallon. Additional processing would increase separable costs $9 per gallon (in addition to the $3 per gallon separable cost required to yield methanol). The company would have to pay taxes of 20% on the selling price of the beverage. Assuming no other changes in cost, what is the joint cost applicable to the wood alcohol (using the NRV method)? Should the company produce the alcoholic beverage? Show your computations. (8 Marks) 5. Discuss the four key perspectives in the balanced Scorecard? (4 MARKS)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts