Question: Questions 25 - 28 Now consider Securities A & B with the following information: RA= 1.22%, 2A= 15.34%%, RB= 2.95%, 2B= 14.42%%, AB= 0.15 Solve

Questions 25 - 28 Now consider Securities A & B with the following information: RA= 1.22%, 2A= 15.34%%, RB= 2.95%, 2B= 14.42%%, AB= 0.15 Solve for the minimum variance portfolio assuming that short sales are allowed: 25. What is the fraction invested in Security A? (2 decimal places if required) 26. What is the fraction invested in Security B? (2 decimal places if required) 27. What is the expected return of the portfolio? (in %, 2 decimal places if required) 28. What is the standard deviation of the portfolio? (in %, 2 decimal places if required)

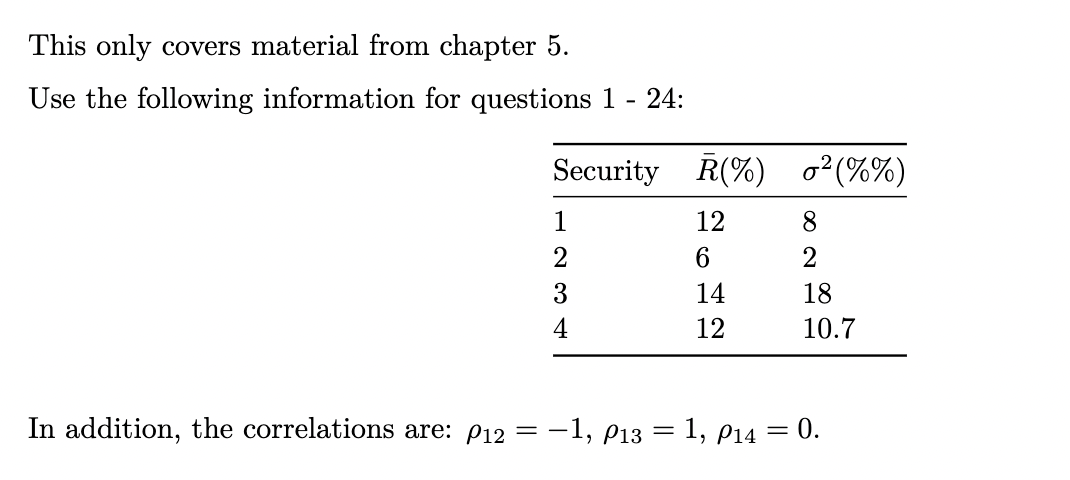

This only covers material from chapter 5. Use the following information for questions 1 24: Security R(%) 1 12 2 6 3 14 4 12 In addition, the correlations are: P12 = - -1, P13 = 1, P14 = 0. 0 (%%) 8 2 18 10.7 This only covers material from chapter 5. Use the following information for questions 1 24: Security R(%) 1 12 2 6 3 14 4 12 In addition, the correlations are: P12 = - -1, P13 = 1, P14 = 0. 0 (%%) 8 2 18 10.7

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts