Question: questions 28,29-30 QUESTION 28 After acing FIN 301 and continuing on through a highly successful academic journey to a LeBow Bachelors of Science in Finance,

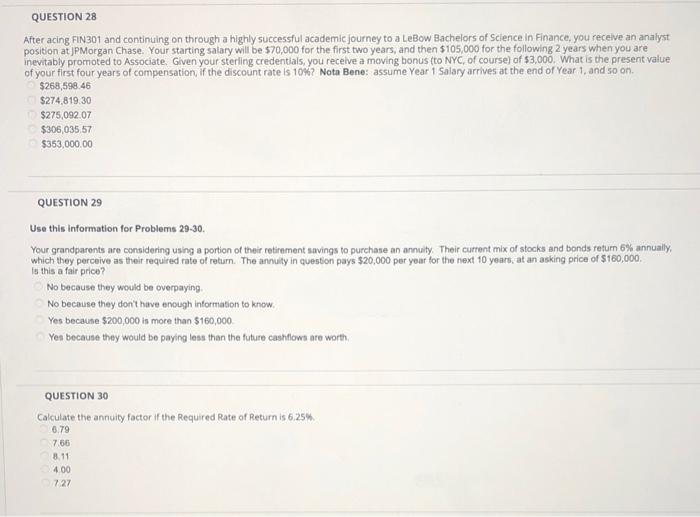

QUESTION 28 After acing FIN 301 and continuing on through a highly successful academic journey to a LeBow Bachelors of Science in Finance, you receive an analyst position at JPMorgan Chase. Your starting salary will be $70,000 for the first two years, and then $105,000 for the following 2 years when you are inevitably promoted to Associate. Given your sterling credentials, you receive a moving bonus (to NYC, of course) of $3,000. What is the present value of your first four years of compensation, if the discount rate is 10%? Nota Bene: assume Year 1 Salary arrives at the end of Year 1, and so on. $268,598.46 $274,819.30 $275,092.07 $306,035,57 $353,000.00 QUESTION 29 Use this information for Problems 29-30. Your grandparents are considering using a portion of their retirement savings to purchase an annuity. Their current mix of stocks and bonds return 6% annually, which they perceive as their required rate of return. The annuity in question pays $20,000 per year for the next 10 years, at an asking price of $180,000 Is this a fair price? No because they would be overpaying. No because they don't have enough information to know Yes because $200,000 is more than $160,000 Yen because they would be paying less than the future cashflows are worth QUESTION 30 Calculate the annuity factor if the Required Rate of Return is 6.25% 6.79 7.66 8.11 4.00 727

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts