Question: Questions 3 - 1 0 : Note: If not stated, the applicable items are assumed to have been paid / received in cash. On 3

Questions :

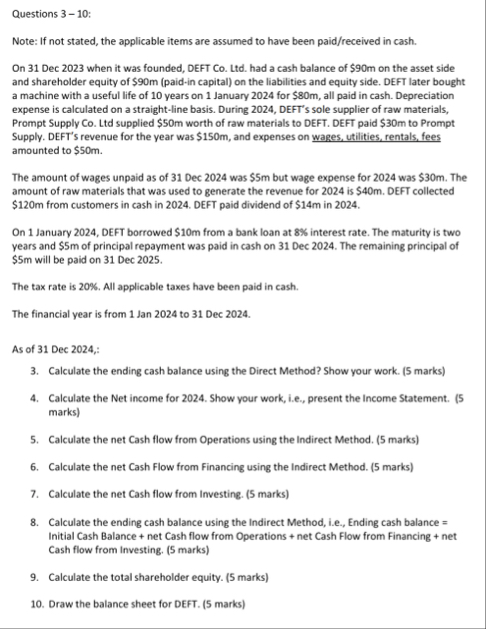

Note: If not stated, the applicable items are assumed to have been paidreceived in cash.

On Dec when it was founded, DEFT Co Ltd had a cash balance of $ on the asset side and shareholder equity of $paidin capital on the liabilities and equity side. DEFT later bought a machine with a useful life of years on January for $ all paid in cash. Depreciation expense is calculated on a straightline basis. During DEFT's sole supplier of raw materials, Prompt Supply Co Ltd supplied $ worth of raw materials to DEFT. DEFT paid $ to Prompt Supply. DEFT's revenue for the year was $ and expenses on wages, utilities, rentals, fees amounted to $

The amount of wages unpaid as of Dec was $ but wage expense for was $ The amount of raw materials that was used to generate the revenue for is $ DEFT collected $ from customers in cash in DEFT paid dividend of $ in

On January DEFT borrowed $ from a bank loan at interest rate. The maturity is two years and $ of principal repayment was paid in cash on Dec The remaining principal of $ will be paid on Dec

The tax rate is All applicable taxes have been paid in cash.

The financial year is from Jan to Dec

As of Dec :

Calculate the ending cash balance using the Direct Method? Show your work. marks

Calculate the Net income for Show your work, ie present the Income Statement. marks

Calculate the net Cash flow from Operations using the Indirect Method. marks

Calculate the net Cash Flow from Financing using the Indirect Method. marks

Calculate the net Cash flow from Investing. marks

Calculate the ending cash balance using the Indirect Method, ie Ending cash balance Initial Cash Balance net Cash flow from Operations net Cash Flow from Financing net Cash flow from Investing. marks

Calculate the total shareholder equity. marks

Draw the balance sheet for DEFT. marks

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock