Question: Questions 3 & 4: Comprehensive questions (42 marks) Q3: Prepare consolidated income statement for the year ended June 30, 2018 under the entity theory

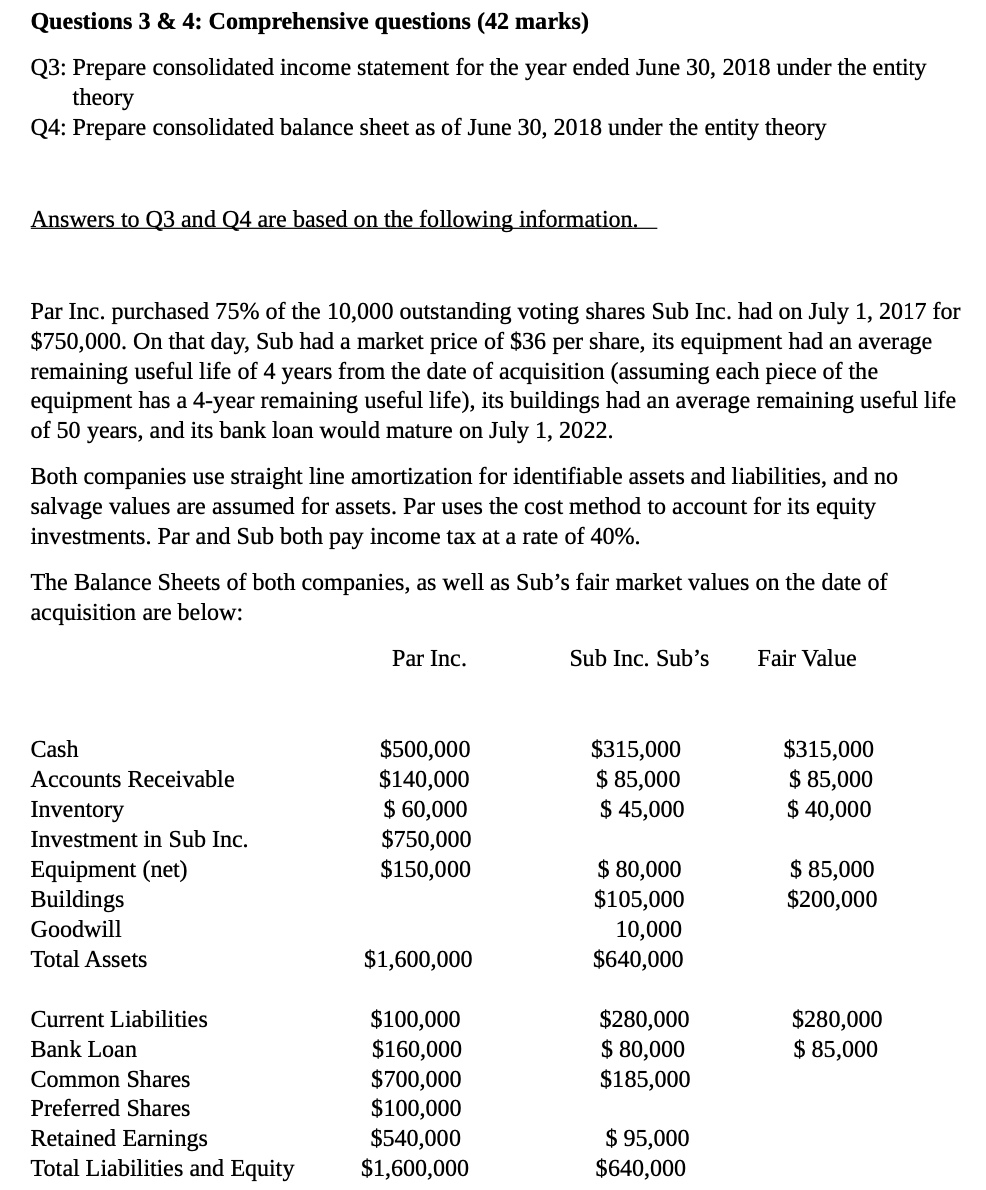

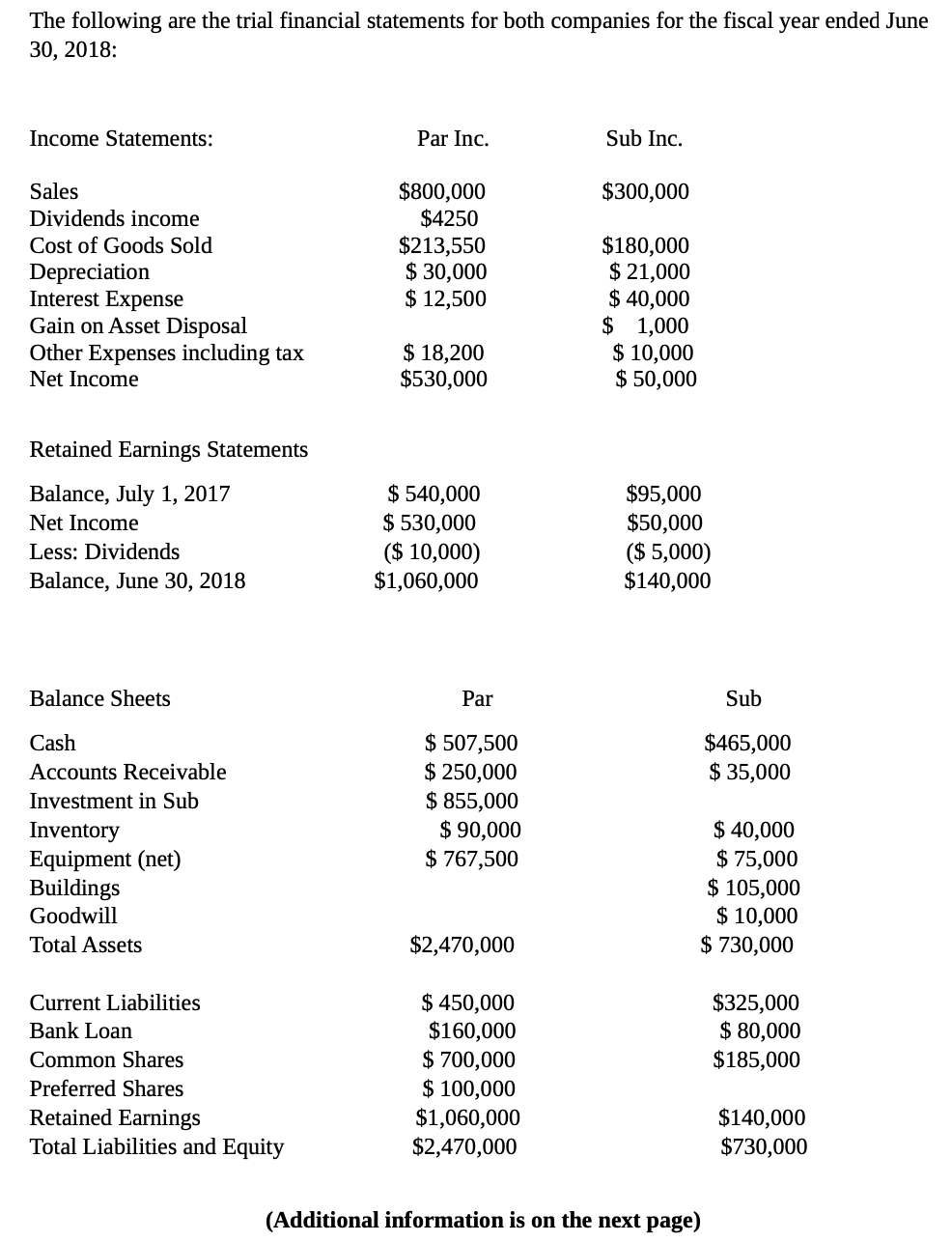

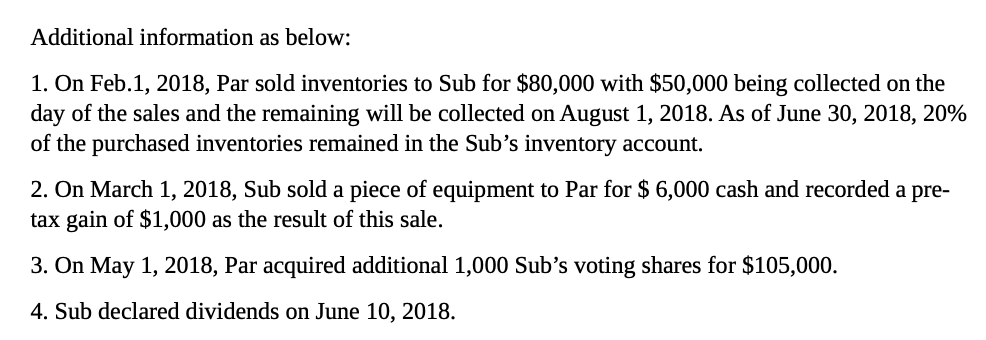

Questions 3 & 4: Comprehensive questions (42 marks) Q3: Prepare consolidated income statement for the year ended June 30, 2018 under the entity theory Q4: Prepare consolidated balance sheet as of June 30, 2018 under the entity theory Answers to Q3 and Q4 are based on the following information. Par Inc. purchased 75% of the 10,000 outstanding voting shares Sub Inc. had on July 1, 2017 for $750,000. On that day, Sub had a market price of $36 per share, its equipment had an average remaining useful life of 4 years from the date of acquisition (assuming each piece of the equipment has a 4-year remaining useful life), its buildings had an average remaining useful life of 50 years, and its bank loan would mature on July 1, 2022. Both companies use straight line amortization for identifiable assets and liabilities, and no salvage values are assumed for assets. Par uses the cost method to account for its equity investments. Par and Sub both pay income tax at a rate of 40%. The Balance Sheets of both companies, as well as Sub's fair market values on the date of acquisition are below: Par Inc. Sub Inc. Sub's Fair Value Cash $500,000 $315,000 Accounts Receivable $140,000 $ 85,000 Inventory $ 60,000 $ 45,000 $315,000 $ 85,000 $ 40,000 Investment in Sub Inc. $750,000 Equipment (net) $150,000 $ 80,000 Buildings $105,000 $ 85,000 $200,000 Goodwill 10,000 Total Assets $1,600,000 $640,000 Current Liabilities $100,000 $280,000 Bank Loan $160,000 Common Shares $700,000 $ 80,000 $185,000 $280,000 $ 85,000 Preferred Shares $100,000 Retained Earnings $540,000 $ 95,000 Total Liabilities and Equity $1,600,000 $640,000

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts