Question: Questions 3,4,5,6,7 You start saving today for a down payment on a house which you wish to purchase in 7 years. If you start today

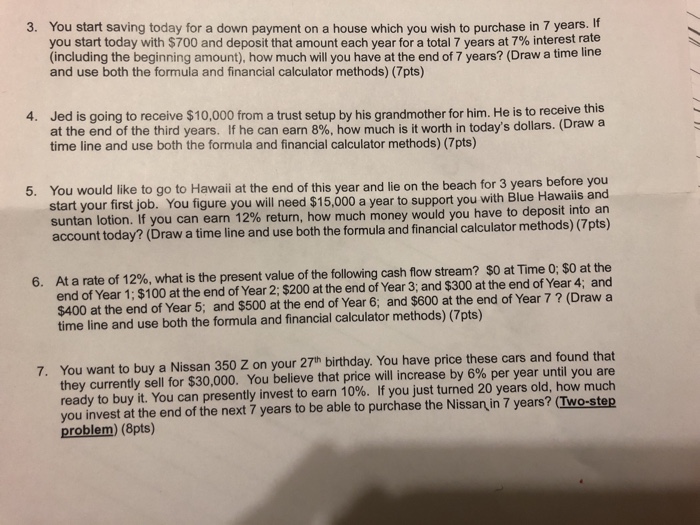

You start saving today for a down payment on a house which you wish to purchase in 7 years. If you start today with $700 and deposit that amount each year for a total 7 years at 7% interest rate (including the beginning amount), how much will you have at the end of 7 years? (Draw a time line and use both the formula and financial calculator methods) (7pts) 3. Jed is going to receive $10,000 from a trust setup by his grandmother for him. He is to receive this at the end of the third years. If he can earn 8%, how much is it worth in today's dollars. (Draw a time line and use both the formula and financial calculator methods) (7pts) 4. You would like to go to Hawaii at the end of this year and lie on the beach for 3 years before you start your first job. You figure you will need $15,000 a year to support you with Blue Ha suntan lotion. If you can earn 12% return, how m account today? (Draw a time line and use both the formula and financial calculator methods) (7pts) 5. waiis and uch money would you have to deposit into an 6. At a rate of 12%, what is the present value of the following cash flow stream? $0atTime0; $0 at the end of Year 1;$100 at the end of Year 2:$200 at the end of Year3; and $300 at the end of Year 4; and $400 at the end of Year 5; and $500 at the end of Year 6; and $600 at the end of Year 7? (Draw a time line and use both the formula and financial calculator methods) (7pts) 7. You want to buy a Nissan 350 Z on your 27h birthday. You have price these cars and found that they currently sell for $30,000. You believe that price will increase by 6% per year until you are ready to buy it. You can presently invest to earn 10%. If you ust turned 20 years old, how much you invest at the end of the next 7 years to be able to purchase the Nissan in 7 years? (Two-step problem) (8pts)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts