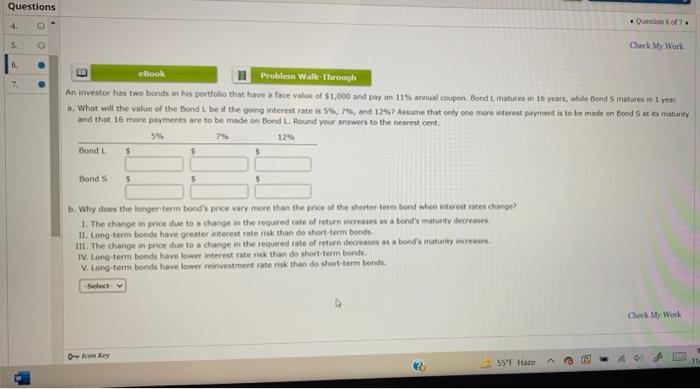

Question: Questions 4. Question S Check My Work 6. B 17. ebook Problem Walk Through An investor has two bonds in his portfolio that he face

Questions 4. Question S Check My Work 6. B 17. ebook Problem Walk Through An investor has two bonds in his portfolio that he face value of $1,000 and pay on 11's annual coupon Bond L matures in 16 years, while Bond Smatutes in your a. What will the value of the Bond Leif the going interest rates and 1247 Assume that only one more interest payment is to be made on bonds at its matunty and that 16 more payments are to be made on Bond L. Round your answers to the nearest cent. 55 7 125 Bond $ $ Bonds 5 5 b. Why does the longer term bond's price vary more than the price of the shorter term bond when interest rates change 1. The change in price due to change in the required rate of return increases as a bond's maturity decreases II. Long-term bonds have greater interest rate nk than do short-term bonds III. The change in price due to a change in the required rate of return decreases as a bond maturity increases IV. Long-term bonds have lower interest rate risk than do short-term bonds V. Long-term bonds have lower reinvestment rate risk than do short-term bonds Check Sty Work Olenke SST Haze

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts