Question: questions 4-8 only please other questions given for context 8. Continuing from question 7, as of February 1, what is the seasonal forecast for February?

questions 4-8 only please

other questions given for context

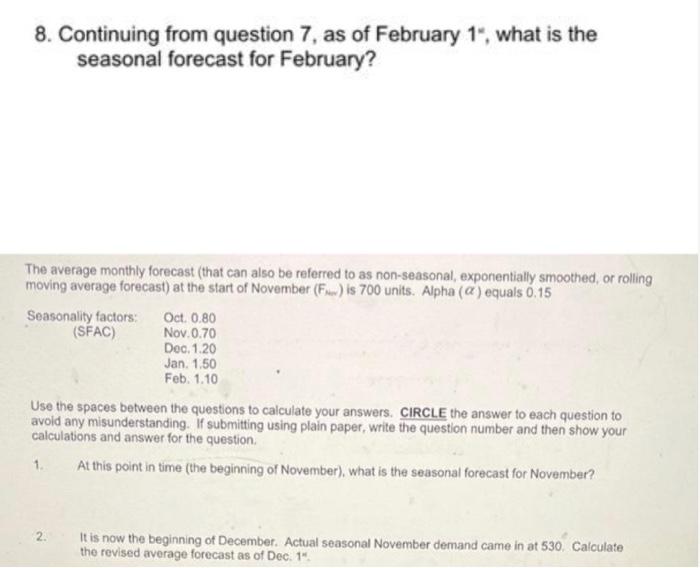

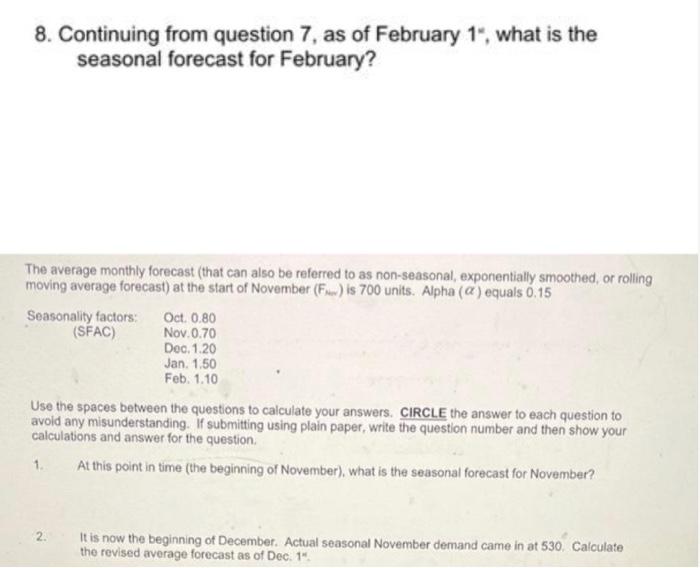

8. Continuing from question 7, as of February 1", what is the seasonal forecast for February? The average monthly forecast (that can also be referred to as non-seasonal, exponentially smoothed, or rolling moving average forecast) at the start of November (F...) is 700 units. Alpha (@) equals 0.15 Seasonality factors: Oct, 0.80 (SFAC) Nov.0.70 Doc. 1.20 Jan. 1.50 Feb. 1.10 Use the spaces between the questions to calculate your answers. CIRCLE the answer to each question to avoid any misunderstanding. If submitting using plain paper, write the question number and then show your calculations and answer for the question 1 At this point in time (the beginning of November), what is the seasonal forecast for November? 2. It is now the beginning of December. Actual seasonal November demand came in at 530. Calculate the revised average forecast as of Dec. 1" I liverage monthly forecast that can also be referred to as non-seasonal exponentially smoothed or rolling moving average forecast) at the start of November (...) is 700 units. Alpha (a) equals 0.15 Seasonality factors Oct. 0.80 Nov.0.70 Dec. 5.20 Jan 150 Feb. 1.10 (SFAC) 3. Continuing from question 2: a. what is the forecast error (FE) from November? b. If the running sum of algebraic forecast errors at the end of October was: = -105, what is this sum as of the end of November? 4. Continuing from question 2 as of December 15, what is the seasonal forecast for January? 5. Continuing from question 2, it is now the beginning of January. Actual seasonal December demand came in at 770. Calculate the revised average forecast as of Jan. 1. 6. Continuing from question 5, as of January 16, what is the seasonal forecast for January? 7. Continuing from question 5, it is now the beginning of February. Actual seasonal January demand came in at 1020. Calculate the revised average forecast as of Feb. 1. 8. Continuing from question 7, as of February 1", what is the seasonal forecast for February? The average monthly forecast (that can also be referred to as non-seasonal, exponentially smoothed, or rolling moving average forecast) at the start of November (F...) is 700 units. Alpha (@) equals 0.15 Seasonality factors: Oct, 0.80 (SFAC) Nov.0.70 Doc. 1.20 Jan. 1.50 Feb. 1.10 Use the spaces between the questions to calculate your answers. CIRCLE the answer to each question to avoid any misunderstanding. If submitting using plain paper, write the question number and then show your calculations and answer for the question 1 At this point in time (the beginning of November), what is the seasonal forecast for November? 2. It is now the beginning of December. Actual seasonal November demand came in at 530. Calculate the revised average forecast as of Dec. 1" I liverage monthly forecast that can also be referred to as non-seasonal exponentially smoothed or rolling moving average forecast) at the start of November (...) is 700 units. Alpha (a) equals 0.15 Seasonality factors Oct. 0.80 Nov.0.70 Dec. 5.20 Jan 150 Feb. 1.10 (SFAC) 3. Continuing from question 2: a. what is the forecast error (FE) from November? b. If the running sum of algebraic forecast errors at the end of October was: = -105, what is this sum as of the end of November? 4. Continuing from question 2 as of December 15, what is the seasonal forecast for January? 5. Continuing from question 2, it is now the beginning of January. Actual seasonal December demand came in at 770. Calculate the revised average forecast as of Jan. 1. 6. Continuing from question 5, as of January 16, what is the seasonal forecast for January? 7. Continuing from question 5, it is now the beginning of February. Actual seasonal January demand came in at 1020. Calculate the revised average forecast as of Feb. 1

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock