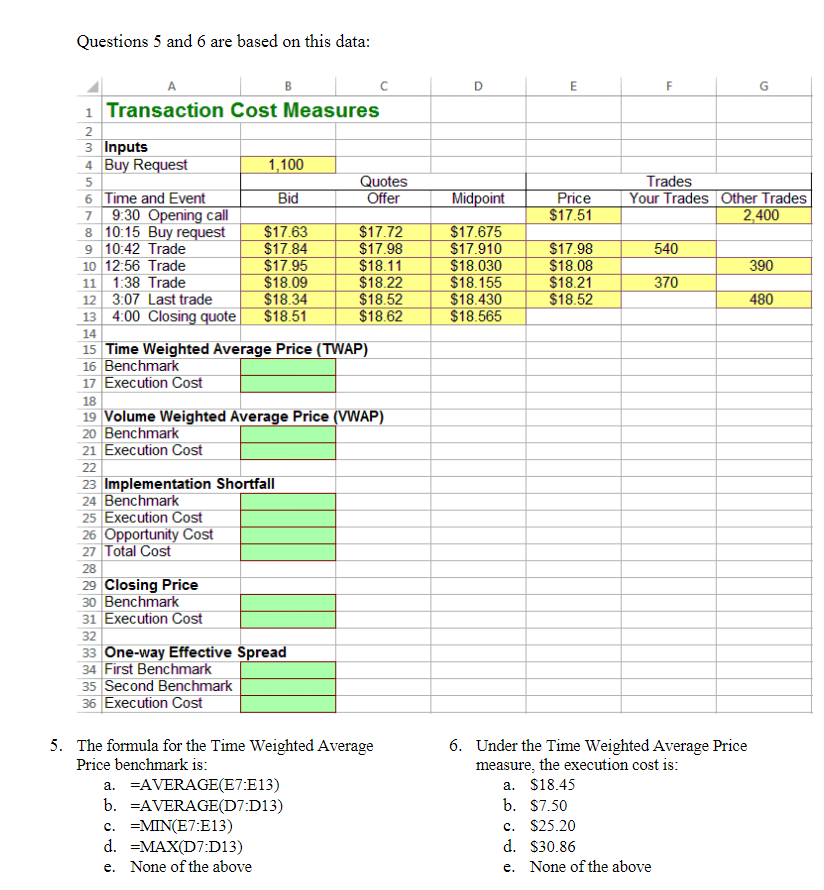

Question: Questions 5 and 6 are based on this data: D m E F Midpoint Price $17.51 Trades Your Trades Other Trades 2,400 540 390 $17.675

Questions 5 and 6 are based on this data: D m E F Midpoint Price $17.51 Trades Your Trades Other Trades 2,400 540 390 $17.675 $17.910 $18.030 $18.155 $18.430 $18.565 $17.98 $18.08 $18.21 $18.52 370 480 B 1 Transaction Cost Measures 2. 3 Inputs 4 Buy Request 1,100 5 Quotes 6 Time and Event Bid Offer 7 9.30 Opening call 8 10:15 Buy request $17.63 $17.72 9 10:42 Trade $17.84 $17.98 10 12:56 Trade $17.95 $18.11 11 1:38 Trade $18.09 $18.22 12 3:07 Last trade $18.34 $18.52 13 4:00 Closing quote $18.51 $18.62 14 15 Time Weighted Average Price (TWAP) 16 Benchmark 17 Execution Cost 18 19 Volume Weighted Average Price (VWAP) 20 Benchmark 21 Execution Cost 22 23 Implementation Shortfall 24 Benchmark 25 Execution Cost 26 Opportunity Cost 27 Total Cost 29 Closing Price 30 Benchmark 31 Execution Cost 32 33 One-way Effective Spread 34 First Benchmark 35 Second Benchmark 36 Execution Cost 28 5. The formula for the Time Weighted Average Price benchmark is: a. =AVERAGE(E7:E13) b. =AVERAGE(D7:013) c. =MIN(E7:E13) d. =MAX(D7:013) e. None of the above 6. Under the Time Weighted Average Price measure, the execution cost is: a. $18.45 b. $7.50 c. $25.20 d. $30.86 e. None of the above Questions 5 and 6 are based on this data: D m E F Midpoint Price $17.51 Trades Your Trades Other Trades 2,400 540 390 $17.675 $17.910 $18.030 $18.155 $18.430 $18.565 $17.98 $18.08 $18.21 $18.52 370 480 B 1 Transaction Cost Measures 2. 3 Inputs 4 Buy Request 1,100 5 Quotes 6 Time and Event Bid Offer 7 9.30 Opening call 8 10:15 Buy request $17.63 $17.72 9 10:42 Trade $17.84 $17.98 10 12:56 Trade $17.95 $18.11 11 1:38 Trade $18.09 $18.22 12 3:07 Last trade $18.34 $18.52 13 4:00 Closing quote $18.51 $18.62 14 15 Time Weighted Average Price (TWAP) 16 Benchmark 17 Execution Cost 18 19 Volume Weighted Average Price (VWAP) 20 Benchmark 21 Execution Cost 22 23 Implementation Shortfall 24 Benchmark 25 Execution Cost 26 Opportunity Cost 27 Total Cost 29 Closing Price 30 Benchmark 31 Execution Cost 32 33 One-way Effective Spread 34 First Benchmark 35 Second Benchmark 36 Execution Cost 28 5. The formula for the Time Weighted Average Price benchmark is: a. =AVERAGE(E7:E13) b. =AVERAGE(D7:013) c. =MIN(E7:E13) d. =MAX(D7:013) e. None of the above 6. Under the Time Weighted Average Price measure, the execution cost is: a. $18.45 b. $7.50 c. $25.20 d. $30.86 e. None of the above

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts