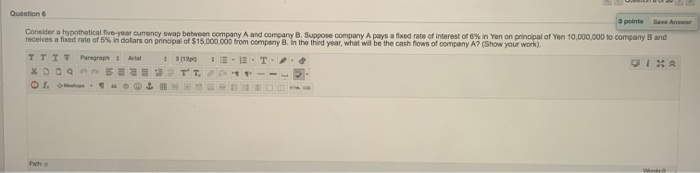

Question: Questions 5 point Save Answer Consider a hypothetical five-year currency swap between company A and company B. Suppose company A pays a fixed rate of

Questions 5 point Save Answer Consider a hypothetical five-year currency swap between company A and company B. Suppose company A pays a fixed rate of interest of 8% in Yan on principal of Yon 10,000,000 to company B and receives a fixed rate of 5% in dollars on principal of $15.000.000 from company B. In the third year, what will be the cash flows of company A? (Show your work) TTTT Paragraph + Arial 512 : - - T 9 XD O s .. 1 w

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts