Question: questions (5-7) QUESTION 5 Which bond would most likely possess the highest degree of Interest rate risk? A 8% coupon rate, 10 years to maturity

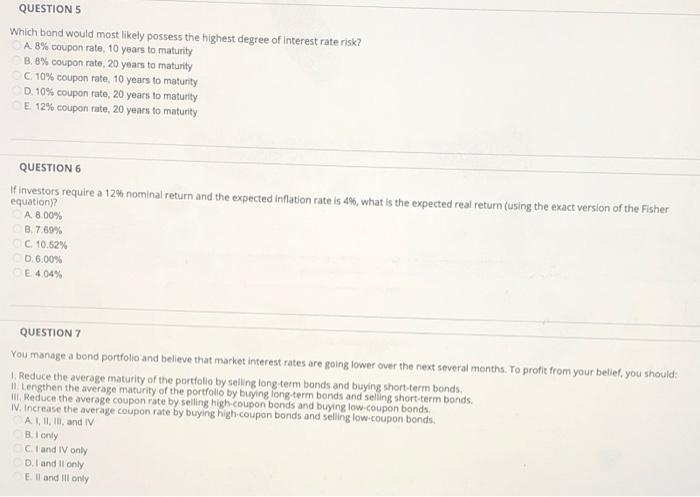

QUESTION 5 Which bond would most likely possess the highest degree of Interest rate risk? A 8% coupon rate, 10 years to maturity B. 8% coupon rate, 20 years to maturity C 10% coupon rate, 10 years to maturity D. 10% coupon rate, 20 years to maturity E. 12% coupon rate, 20 years to maturity QUESTION 6 If investors require a 12% nominal return and the expected inflation rate is 4%, what is the expected real return (using the exact version of the Fisher equation)? A 8.00% B. 7.69% C10.52% 0.6.00% E 4.04% QUESTION 7 You manage a bond portfolio and believe that market interest rates are going tower over the next several months. To profit from your belief, you should 1. Reduce the average maturity of the portfolio by selling long term bonds and buying short-term bonds Il Lengthen the average maturity of the portfolio by buying long-term bonds and selling short-term bonds. II Reduce the average coupon rate by selling high-coupon bonds and buying low.coupon bonds W. Increase the average coupon rate by buying high coupon bonds and selling low-coupon bonds. A I, II, III and IV Bl only CI and IV only D. I and It only E il and ill only

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts