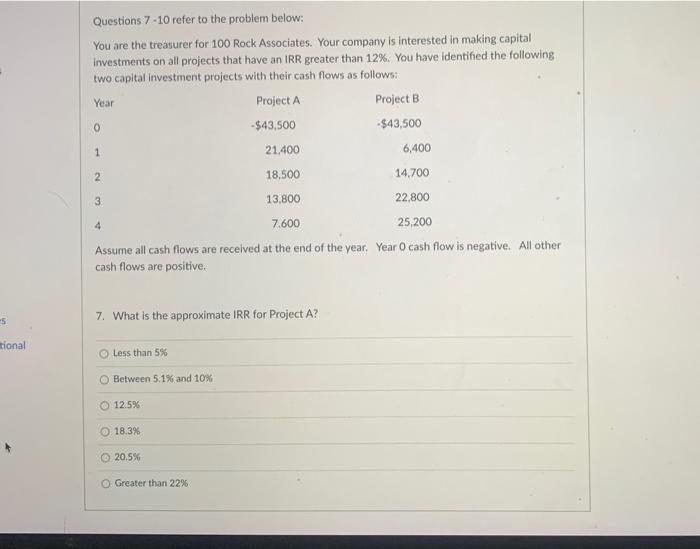

Question: Questions 7-10 refer to the problem below: You are the treasurer for 100 Rock Associates. Your company is interested in making capital Investments on all

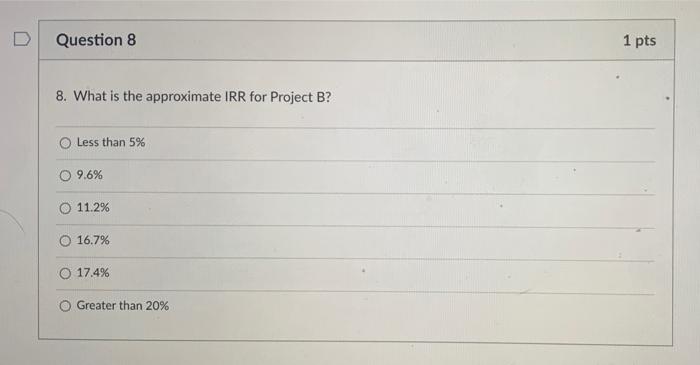

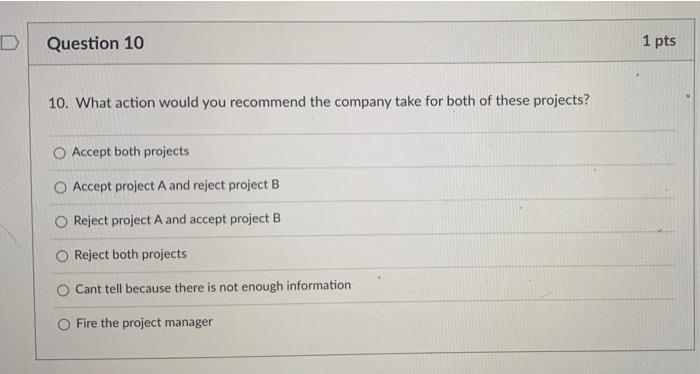

Questions 7-10 refer to the problem below: You are the treasurer for 100 Rock Associates. Your company is interested in making capital Investments on all projects that have an IRR greater than 12%. You have identified the following two capital investment projects with their cash flows as follows: Year Project A Project B -$43,500 -$43,500 1 21.400 6,400 2 18,500 14,700 0 3 13,800 22,800 4 7.600 25,200 Assume all cash flows are received at the end of the year. Year O cash flow is negative. All other cash flows are positive. 7. What is the approximate IRR for Project A? -5 tional Less than 5% Between 5.1% and 10% 12.5% 18.3% 20.5% O Greater than 22% Question 8 1 pts 8. What is the approximate IRR for Project B? O Less than 5% O 9.6% 11.2% 16.7% 17.4% O Greater than 20% D Question 10 1 pts 10. What action would you recommend the company take for both of these projects? O Accept both projects Accept project A and reject project B Reject project A and accept project B Reject both projects O Cant tell because there is not enough information Fire the project manager

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts