Question: Questions 9 - 1 7 . DIRECTIONS: Questions 9 through 1 7 are to be answered on the basis of the following information. You are

Questions

DIRECTIONS: Questions through are to be answered on the basis of the following

information.

You are conducting an audit of the PAP Company, which has a contract to supply the

municipal hospitals with specialty refrigerators on a costplus basis. The following information

available:

Inventories, March

The NET INCOME for the period is

A $

B $

C $

D $

The number of units manufactured is

A

B

C

D

The unit cost of refrigerators manufactured is MOST NEARLY

A $

B $

C $

D $

The TOTAL variable costs are

A $

B $

C $

D $

The TOTAL fixed costs are

A $

B $

C $

D $

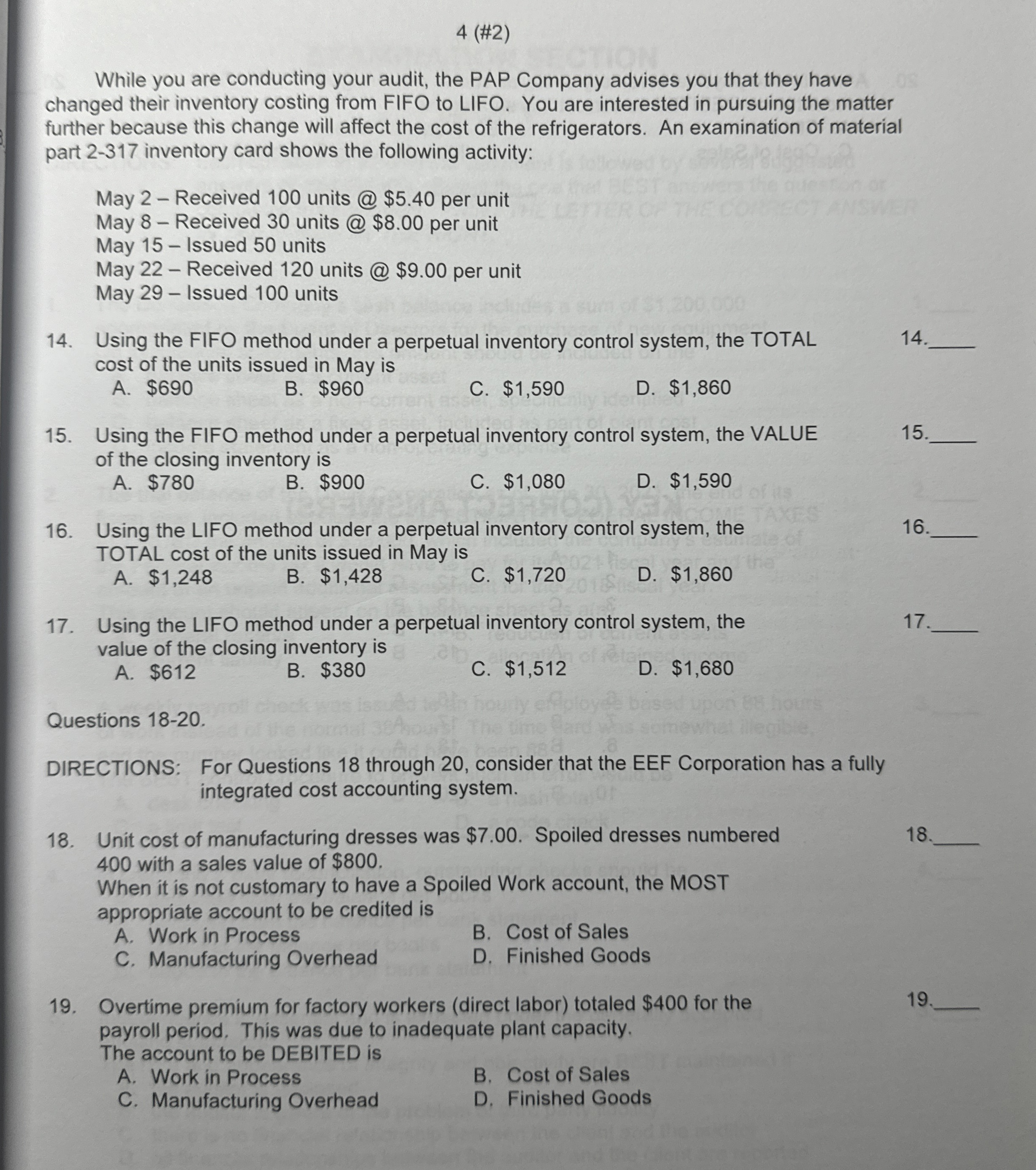

While you are conducting your audit, the PAP Company advises you that they have

changed their inventory costing from FIFO to LIFO. You are interested in pursuing the matter

further because this change will affect the cost of the refrigerators. An examination of material

part inventory card shows the following activity:

May Received units @ $ per unit

May Received units @ $ per unit

May Issued units

May Received units @ $ per unit

May Issued units

Using the FIFO method under a perpetual inventory control system, the TOTAL

cost of the units issued in May is

A $

B $

C $

D $

Using the FIFO method under a perpetual inventory control system, the VALUE

of the closing inventory is

A $

B $

C $

D $

Using the LIFO method under a perpetual inventory control system, the

TOTAL cost of the units issued in May is

A $

B $

C $

D $

Using the LIFO method under a perpetual inventory control system, the

value of the closing inventory is

A $

B $

C $

D $

Questions

DIRECTIONS: For Questions through consider that the EEF Corporation has a fully

integrated cost accounting system.

Unit cost of manufacturing dresses was $ Spoiled dresses numbered

with a sales value of $

When it is not customary to have a Spoiled Work account, the MOST

appropriate account to be credited is

A Work in Process

B Cost of Sales

C Manufacturing Overhead

D Finished Goods

Overtime premium for factory workers direct labor totaled $ for the

payroll period. This was due to inadequate plant capacity.

The account to be DEBITED is

A Work in Process

B Cost of Sales

C Manufacturing Overhead

D Finished Goods

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock