Question: Questions: a. What is the net present value (at the discount rate of 10%) of this project? b. Perot?s engineers have determined that spending $10

Questions:

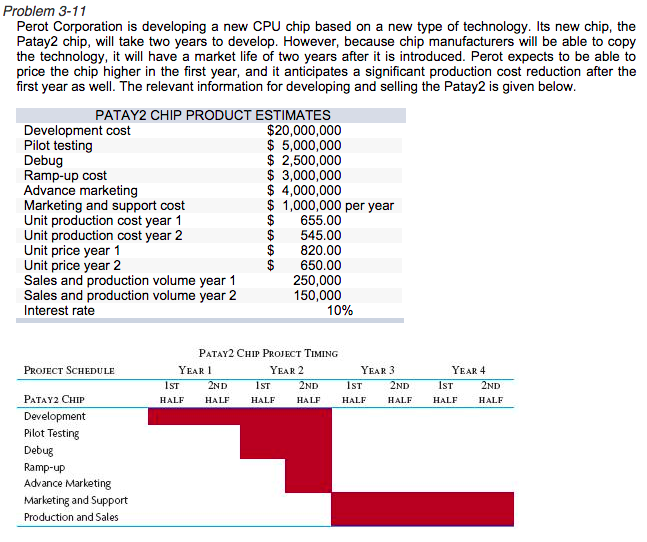

a. What is the net present value (at the discount rate of 10%) of this project?

b. Perot?s engineers have determined that spending $10 million more on development will allow them to add even more advanced features. Having a more advanced chip will allow them to price the chip $50 higher in both years ($870 for year 1 and $700 for year 2). What is the NPV of the project if this option is implemented?

c. If sales are only 200,000 the first year and 100,000 the second year, what would the NPV of the project be? Assume the development costs and sales price are as originally estimated.

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts