Question: Questions about SWAP: multiple question - 3 pts each. 20. [5 pts) Consider a Plain Vanilla Interest Rate Swap agreement that AAA pays a fixed

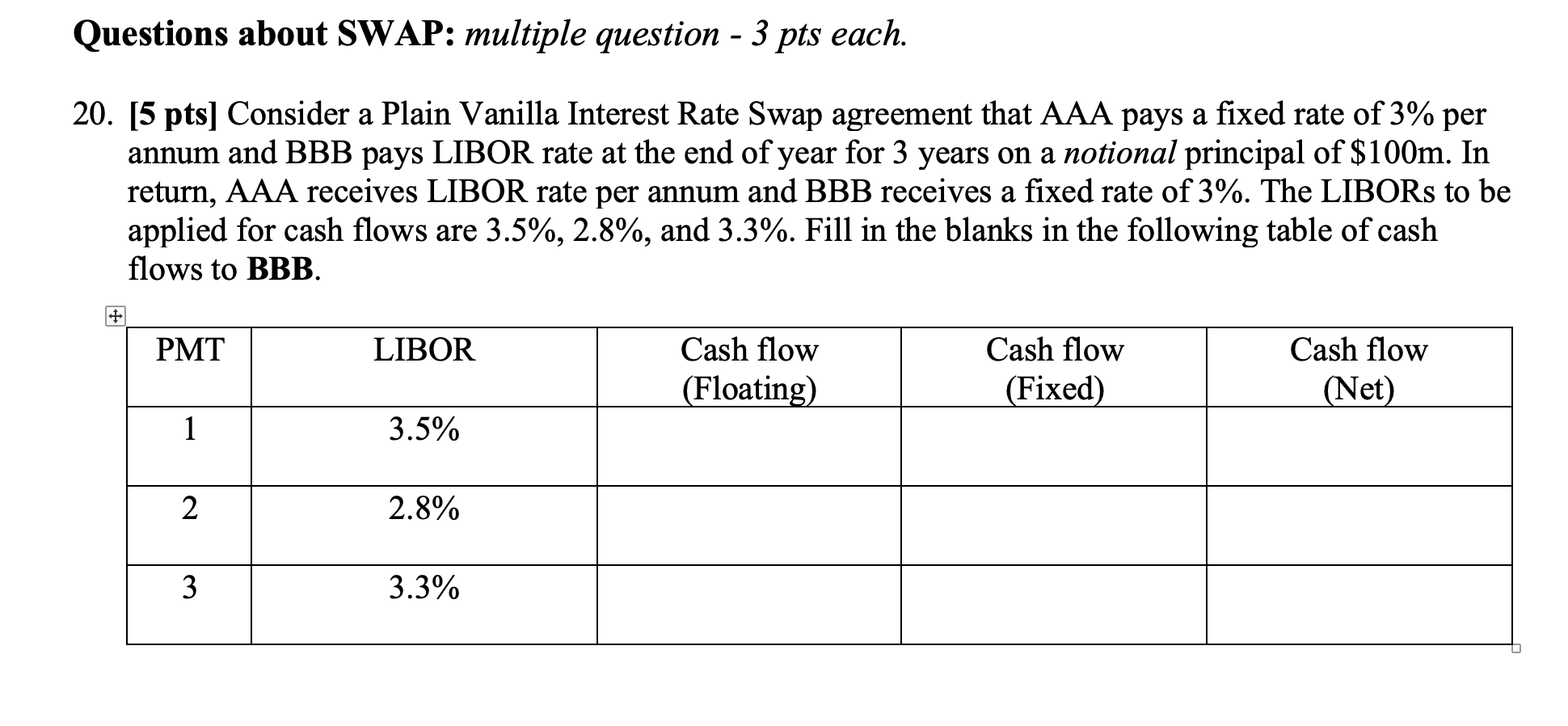

Questions about SWAP: multiple question - 3 pts each. 20. [5 pts) Consider a Plain Vanilla Interest Rate Swap agreement that AAA pays a fixed rate of 3% per annum and BBB pays LIBOR rate at the end of year for 3 years on a notional principal of $100m. In return, AAA receives LIBOR rate per annum and BBB receives a fixed rate of 3%. The LIBORs to be applied for cash flows are 3.5%, 2.8%, and 3.3%. Fill in the blanks in the following table of cash flows to BBB. PMT LIBOR Cash flow (Floating) Cash flow (Fixed) Cash flow (Net) 3.5% 2.8% 3.3%

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts