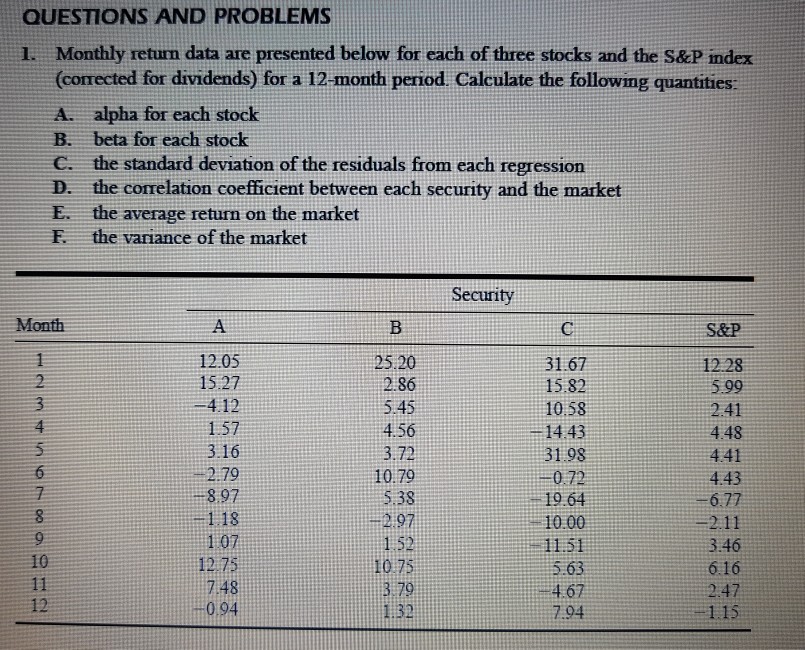

Question: QUESTIONS AND PROBLEMS Monthly return data are presented below for each of three stocks and the S&P index (corrected for dividends) for a 12-month period.

QUESTIONS AND PROBLEMS Monthly return data are presented below for each of three stocks and the S&P index (corrected for dividends) for a 12-month period. Calculate the following quantities: A. alpha for each stock B. beta for each stock C. the standard deviation of the residuals from each regression D. the corelation coefficient between each security and the market E. the average return on the market F the variance of the market L Security Month S&P 12.05 15.27 4.12 1.57 3.16 2.79 8.97 1.18 1 07 25.20 2.86 5.45 456 3.72 10.79 5.38 2:97 31.67 15.82 10.58 1443 31.98 0.72 19.64 10.00 11.51 5.63 4.67 7.94 12 28 5.99 2.41 4.48 4.41 4.43 6.77 2.11 3:46 6 16 247 1:15 4 10 7.48 0.94 3:79 1.32 12

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts