Question: Questions and spreadsheet are in the attached document below. Please help and thank you. AutoSave O off) H REIT valuation template (3) - Excel File

Questions and spreadsheet are in the attached document below. Please help and thank you.

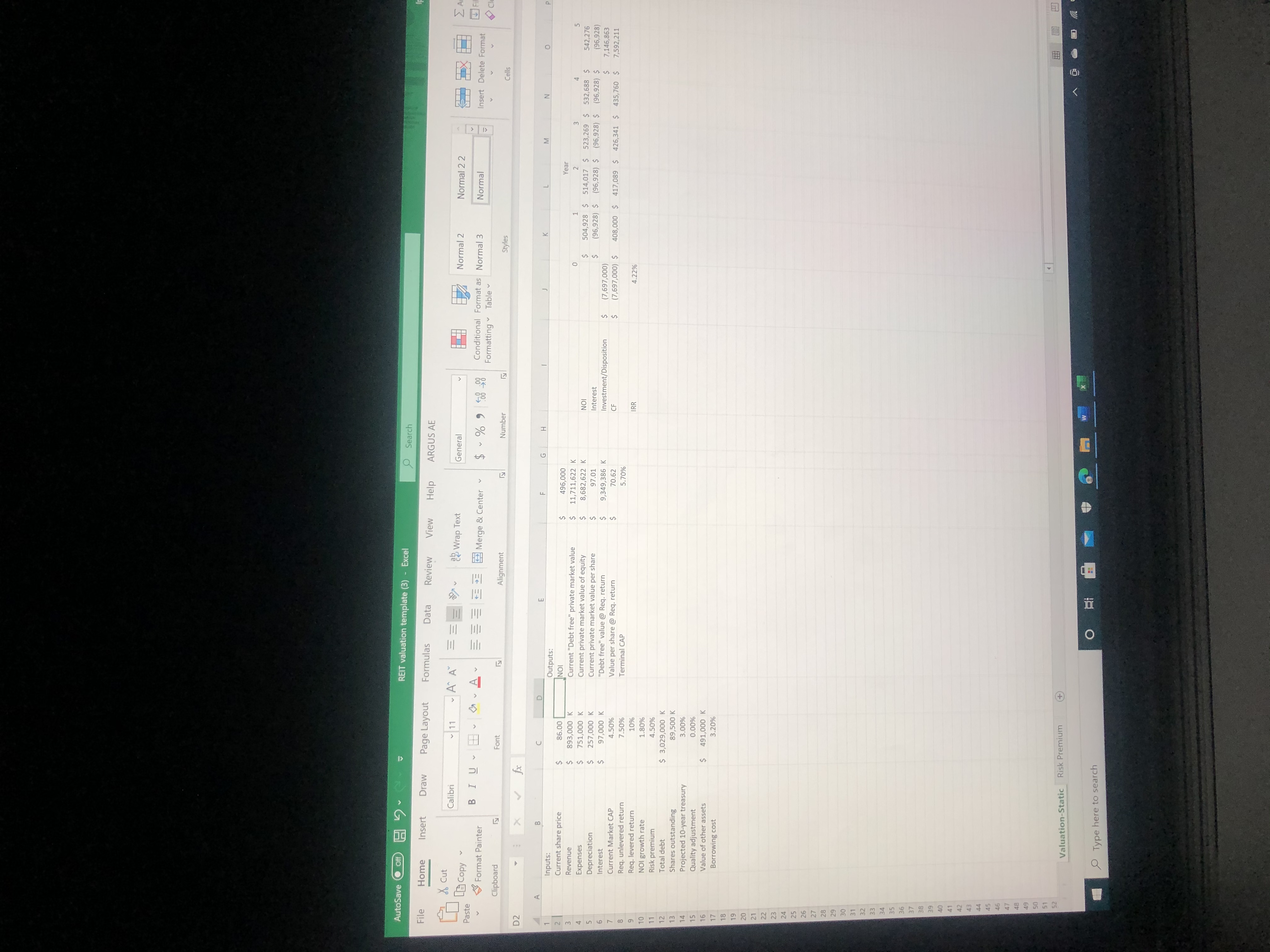

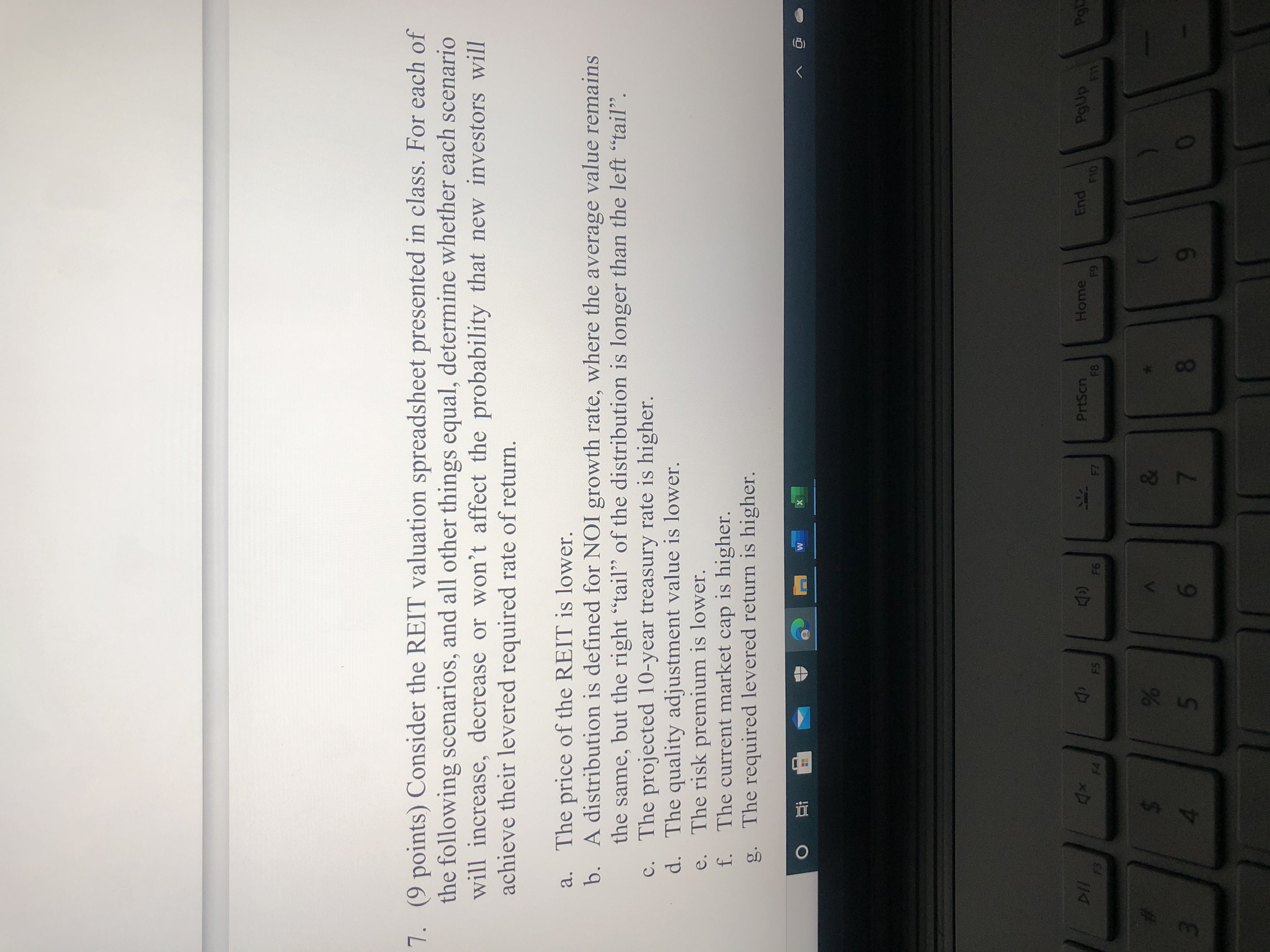

AutoSave O off) H REIT valuation template (3) - Excel File Home Insert Draw Page Layout Formulas Data Review View Help ARGUS AE & Cut Calibri 11 ~ A" A " 29 Wrap Text Normal 2 Normal 2 2 [) Copy General Paste BIUGAV BEEBE Merge & Center $ ~ % 9 08 98 Conditional Format as Normal 3 Normal sert Delete Format Format Painter Formatting " Table Clipboard Font Alignment Number Styles Cells D2 X V fix G H N Inputs: Outputs: Current share price 86.00 NOL Year Revenue 893,000 Current "Debt free" private market value 11,711,622 K 751,000 K Current private market value of equity 8,682,622 K NOI 504,928 $ 514,017 $ 523,269 5 532,688 $ 542,276 Expenses Depreciation 257,000 K Current private market value per share 97.01 Interest (96,928) $ (96,928) $ (96,928) $ (96,928) $ Interest 97,000 K "Debt free" value @ Req. return 9,349,386 K Investment/Disposition (7,697,000) 7,146,863 Current Market CAP 4.50% Value per share @ Req. return 70.62 CF (7,697,000) $ 408,000 $ 417,089 $ 426,341 $ 435,760 $ 7,592 ,211 Req. unlevered return 7.50% Terminal CAP 5.70% IRR 4.22% Req. levered return NOI growth rate Risk premium N - 8 6 O J OV E W N = 6 6 O VO MI A WN Total debt $ 3,029,000 K Shares outstanding 89,500 K Projected 10-year treasury 3.00% Quality adjustment 0.00% Value of other assets $ 191,000 K Borrowing cost 3.20% Valuation-Static Risk Premium + Type here to search7. (9 points) Consider the REIT valuation spreadsheet presented in class. For each of the following scenarios, and all other things equal, determine whether each scenario will increase, decrease or won't affect the probability that new investors will achieve their levered required rate of return. a. The price of the REIT is lower. b. A distribution is defined for NOI growth rate, where the average value remains the same, but the right "tail" of the distribution is longer than the left "tail". c. The projected 10-year treasury rate is higher. d. The quality adjustment value is lower. e. The risk premium is lower. f. The current market cap is higher. g. The required levered return is higher. w X PrtSon Home End PgUp PO F3 ES F6 F7 F8 F9 F10 & 5 6