Question: (questions are on second page. first page is info needed to answer) 17.6. Examine the peer group average ratios given in problems 17.4 and 17.5.

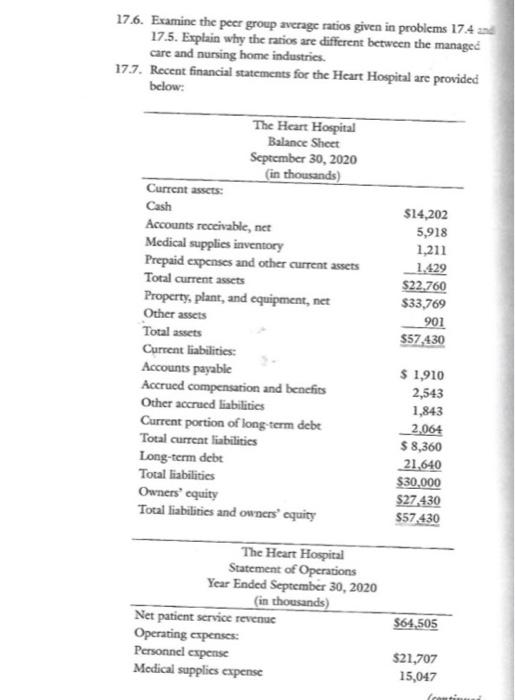

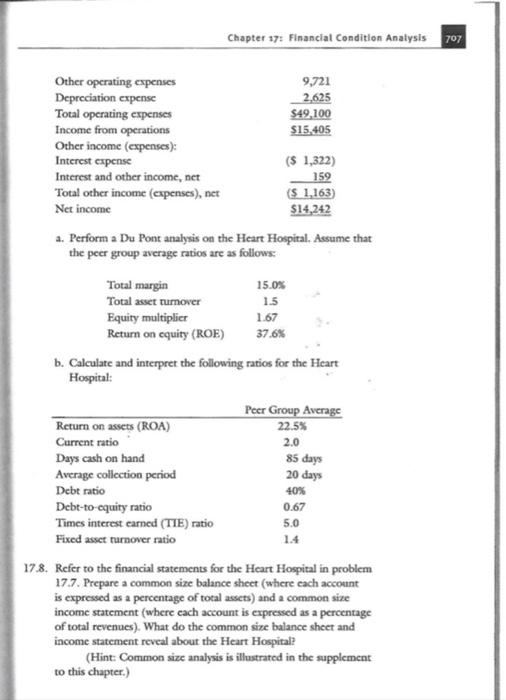

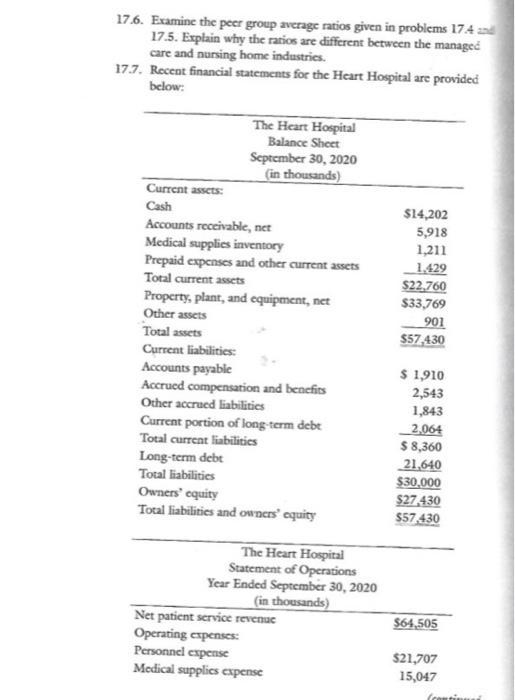

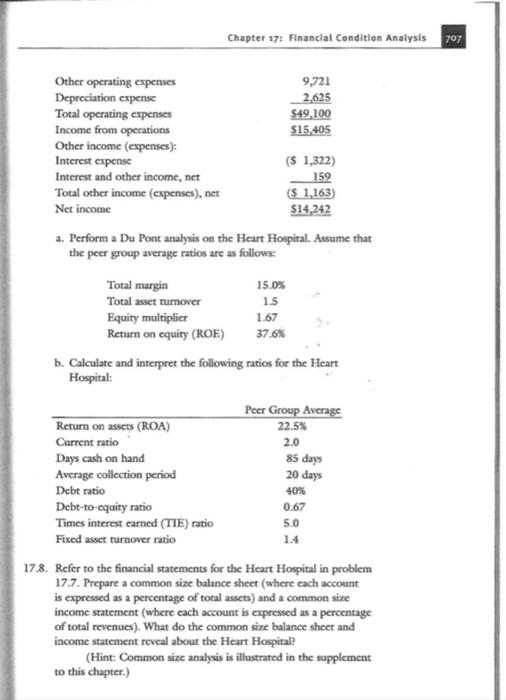

17.6. Examine the peer group average ratios given in problems 17.4 and 17.5. Explain why the ratios are different between the managed care and nursing home industries. 17.7. Recent financial statements for the Heart Hospital are provided below: The Heart Hospital Balance Sheet September 30, 2020 (in thousands) Current assets: Cash $14,202 Accounts receivable, net 5,918 Medical supplies inventory 1,211 Prepaid expenses and other current assets 1,429 Total current assets $22,760 Property, plant, and equipment, net $33,769 Other assets 901 Total assets $57,430 Current liabilities: Accounts payable $ 1,910 Accrued compensation and benefits 2,543 Other accrued liabilities 1,843 Current portion of long-term debe 2,064 Total current liabilities $ 8,360 Long-term debt 21,640 Total liabilities $30,000 Owners' equity $27,430 Total liabilities and owners' equity $57,430 Net patient service revenue $64,505 Operating expenses: Personnel expense $21,707 Medical supplies expense 15,047 The Heart Hospital Statement of Operations Year Ended September 30, 2020 (in thousands) (continui Chapter 17: Financial Condition Analysis 707 9,721 Other operating expenses Depreciation expense Total operating expenses 2,625 $49,100 $15,405 Income from operations Other income (expenses): Interest expense ($ 1,322) 159 Interest and other income, net Total other income (expenses), net ($ 1,163) Net income $14,242 a. Perform a Du Pont analysis on the Heart Hospital. Assume that the peer group average ratios are as follows: Total margin 15.0% Total asset turnover 1.5 Equity multiplier 1.67 Return on equity (ROE) 37.6% b. Calculate and interpret the following ratios for the Heart Hospital: Peer Group Average Return on assets (ROA) 22.5% Current ratio 2.0 Days cash on hand 85 days 20 days Average collection period Debt ratio 40% Debt-to-equity ratio 0.67 5.0 Times interest earned (TIE) ratio Fixed asset turnover ratio 1.4 17.8. Refer to the financial statements for the Heart Hospital in problem 17.7. Prepare a common size balance sheet (where each account is expressed as a percentage of total assets) and a common size income statement (where each account is expressed as a percentage of total revenues). What do the common size balance sheet and income statement reveal about the Heart Hospital? (Hint: Common size analysis is illustrated in the supplement to this chapter.) 17.6. Examine the peer group average ratios given in problems 17.4 and 17.5. Explain why the ratios are different between the managed care and nursing home industries. 17.7. Recent financial statements for the Heart Hospital are provided below: The Heart Hospital Balance Sheet September 30, 2020 (in thousands) Current assets: Cash $14,202 Accounts receivable, net 5,918 Medical supplies inventory 1,211 Prepaid expenses and other current assets 1,429 Total current assets $22,760 Property, plant, and equipment, net $33,769 Other assets 901 Total assets $57,430 Current liabilities: Accounts payable $ 1,910 Accrued compensation and benefits 2,543 Other accrued liabilities 1,843 Current portion of long-term debe 2,064 Total current liabilities $ 8,360 Long-term debt 21,640 Total liabilities $30,000 Owners' equity $27,430 Total liabilities and owners' equity $57,430 Net patient service revenue $64,505 Operating expenses: Personnel expense $21,707 Medical supplies expense 15,047 The Heart Hospital Statement of Operations Year Ended September 30, 2020 (in thousands) (continu Chapter 17: Financial Condition Analysis 707 9,721 Other operating expenses Depreciation expense Total operating expenses 2,625 $49,100 $15,405 Income from operations Other income (expenses): Interest expense ($ 1,322) 159 Interest and other income, net Total other income (expenses), net ($ 1,163) Net income $14,242 a. Perform a Du Pont analysis on the Heart Hospital. Assume that the peer group average ratios are as follows: Total margin 15.0% Total asset turnover 1.5 Equity multiplier 1.67 Return on equity (ROE) 37.6% b. Calculate and interpret the following ratios for the Heart Hospital: Peer Group Average Return on assets (ROA) 22.5% Current ratio 2.0 Days cash on hand 85 days 20 days Average collection period Debt ratio 40% Debt-to-equity ratio 0.67 5.0 Times interest earned (TIE) ratio Fixed asset turnover ratio 1.4 17.8. Refer to the financial statements for the Heart Hospital in problem 17.7. Prepare a common size balance sheet (where each account is expressed as a percentage of total assets) and a common size income statement (where each account is expressed as a percentage of total revenues). What do the common size balance sheet and income statement reveal about the Heart Hospital? (Hint: Common size analysis is illustrated in the supplement to this chapter.)

Step by Step Solution

There are 3 Steps involved in it

To address these questions and tasks we need to follow a systematic approach to calculate and interpret ratios as well as prepare common size financial statements Lets break down each part 176 Examine ... View full answer

Get step-by-step solutions from verified subject matter experts