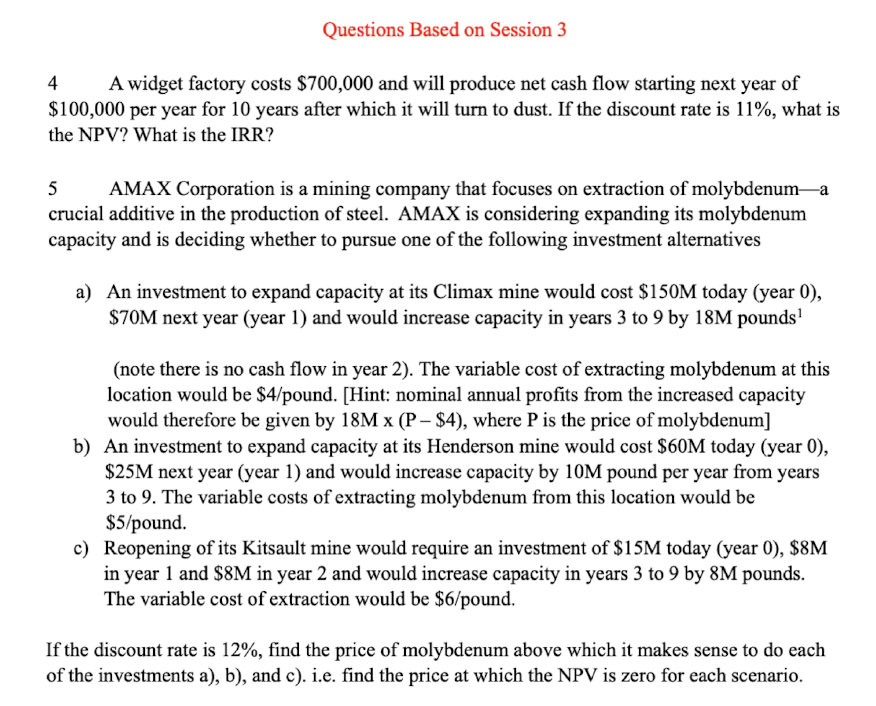

Question: Questions Based on Session 3 4 A widget factory costs $ 7 0 0 , 0 0 0 and will produce net cash flow starting

Questions Based on Session

A widget factory costs $ and will produce net cash flow starting next year of

$ per year for years after which it will turn to dust. If the discount rate is what is

the NPV What is the IRR?

AMAX Corporation is a mining company that focuses on extraction of molybdenuma

crucial additive in the production of steel. AMAX is considering expanding its molybdenum

capacity and is deciding whether to pursue one of the following investment alternatives

a An investment to expand capacity at its Climax mine would cost $ today year

$ next year year and would increase capacity in years to by M pounds

note there is no cash flow in year The variable cost of extracting molybdenum at this

location would be $poundHint: nominal annual profits from the increased capacity

would therefore be given by $ where P is the price of molybdenum

b An investment to expand capacity at its Henderson mine would cost $ today year

$ next year year and would increase capacity by M pound per year from years

to The variable costs of extracting molybdenum from this location would be

$pound

c Reopening of its Kitsault mine would require an investment of $ today year $

in year and $ in year and would increase capacity in years to by M pounds.

The variable cost of extraction would be $ pound.

If the discount rate is find the price of molybdenum above which it makes sense to do each

of the investments a b and c ie find the price at which the NPV is zero for each scenario.

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock