Question: QUESTIONS Bonds issued by Multi Media have a par value of $1000, were priced at $860 1 year ago, and are priced at $840 today.

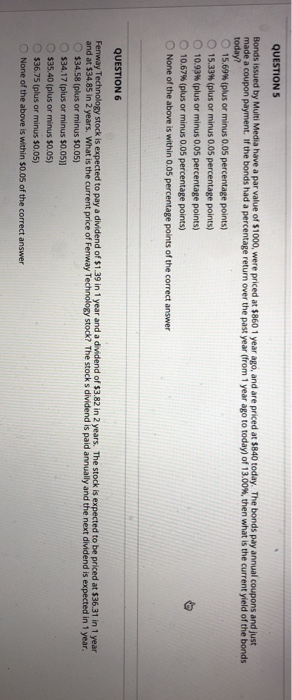

QUESTIONS Bonds issued by Multi Media have a par value of $1000, were priced at $860 1 year ago, and are priced at $840 today. The bonds pay annual coupons and just made a coupon payment. If the bonds had a percentage return over the past year from 1 year ago to today) of 13.00%, then what is the current yield of the bonds today? 15.69% (plus or minus 0.05 percentage points) 15.33% (plus or minus 0.05 percentage points) 10.93% (plus or minus 0.05 percentage points) 10.67% (plus or minus 0.05 percentage points) None of the above is within 0.05 percentage points of the correct answer QUESTION 6 Fenway Technology stock is expected to pay a dividend of $1.39 in 1 year and a dividend of $3.82 in 2 years. The stock is expected to be priced at $36.31 in 1 year and at $34.85 in 2 years. What is the current price of Fenway Technology stock? The stocks dividend is paid annually and the next dividend is expected in 1 year. $34.58 (plus or minus $0.05) $34.17 (plus or minus $0.05)) $35.40 (plus or minus $0.05) $36.75 (plus or minus $0.05) None of the above is within $0.05 of the correct

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts