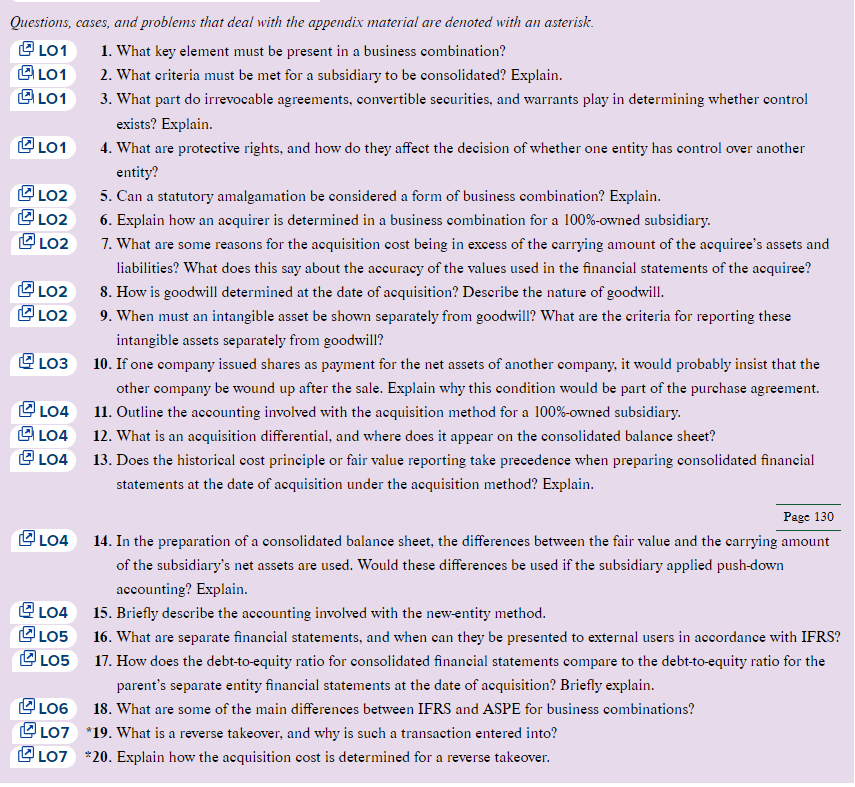

Question: Questions, cases, and problems that deal with the appendix material are denoted with an asterisk. LO 1 LO 1 LO 1 LO 1 LO 2

Questions, cases, and problems that deal with the appendix material are denoted with an asterisk.

LO

LO

LO

LO

LO

LO

LO

LO

LO

LO

LO

LO

LO

What key element must be present in a business combination?

What criteria must be met for a subsidiary to be consolidated? Explain.

What part do irrevocable agreements, convertible securities and warrants play in determining whether control

exists? Explain.

What are protective rights, and how do they affect the decision of whether one entity has control over another

entity?

Can a statutory amalgamation be considered a form of business combination? Explain.

Explain how an acquirer is determined in a business combination for a owned subsidiary.

What are some reasons for the acquisition cost being in excess of the carrying amount of the acquiree's assets and

liabilities? What does this say about the accuracy of the values used in the financial statements of the acquiree?

How is goodwill determined at the date of acquisition? Describe the nature of goodwill.

When must an intangible asset be shown separately from goodwill? What are the criteria for reporting these

intangible assets separately from goodwill?

If one company issued shares as payment for the net assets of another company, it would probably insist that the

other company be wound up after the sale. Explain why this condition would be part of the purchase agreement.

Outline the accounting involved with the acquisition method for a owned subsidiary.

What is an acquisition differential, and where does it appear on the consolidated balance sheet?

Does the historical cost principle or fair value reporting take precedence when preparing consolidated financial

statements at the date of acquisition under the acquisition method? Explain.

Page

In the preparation of a consolidated balance sheet, the differences between the fair value and the carrying amount

of the subsidiary's net assets are used. Would these differences be used if the subsidiary applied pushdown

accounting? Explain.

Briefly describe the accounting involved with the newentity method.

What are separate financial statements, and when can they be presented to external users in accordance with IFRS?

How does the debttoequity ratio for consolidated financial statements compare to the debttoequity ratio for the

parent's separate entity financial statements at the date of acquisition? Briefly explain.

What are some of the main differences between IFRS and ASPE for business combinations?

What is a reverse takeover, and why is such a transaction entered into?

Explain how the acquisition cost is determined for a reverse takeover.

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock