Question: Questions Construct a loss matrix. All matrices must be constructed with the Risk Management Alternatives as the rows and the States of the World as

Questions

- Construct a loss matrix. All matrices must be constructed with the Risk Management Alternatives as the rows and the States of the World as the columns, as we did in the video. Ignore tax considerations for this assignment.

- Suppose Acmes risk manager wants to minimize expected loss as her decision rule. Which of the three risk management alternatives does she choose? Show all expected loss calculations and explain why the risk manager chooses a particular option.

- Assume that Acmes risk manager has a worry value (WV) equal to $1,500 for retention and a WV of $1,000 for deductible insurance. If the risk manager decides to minimize TOTAL COST, which of the three risk management alternatives does she choose? Show all total cost calculations and explain why the risk manager selects a particular option.

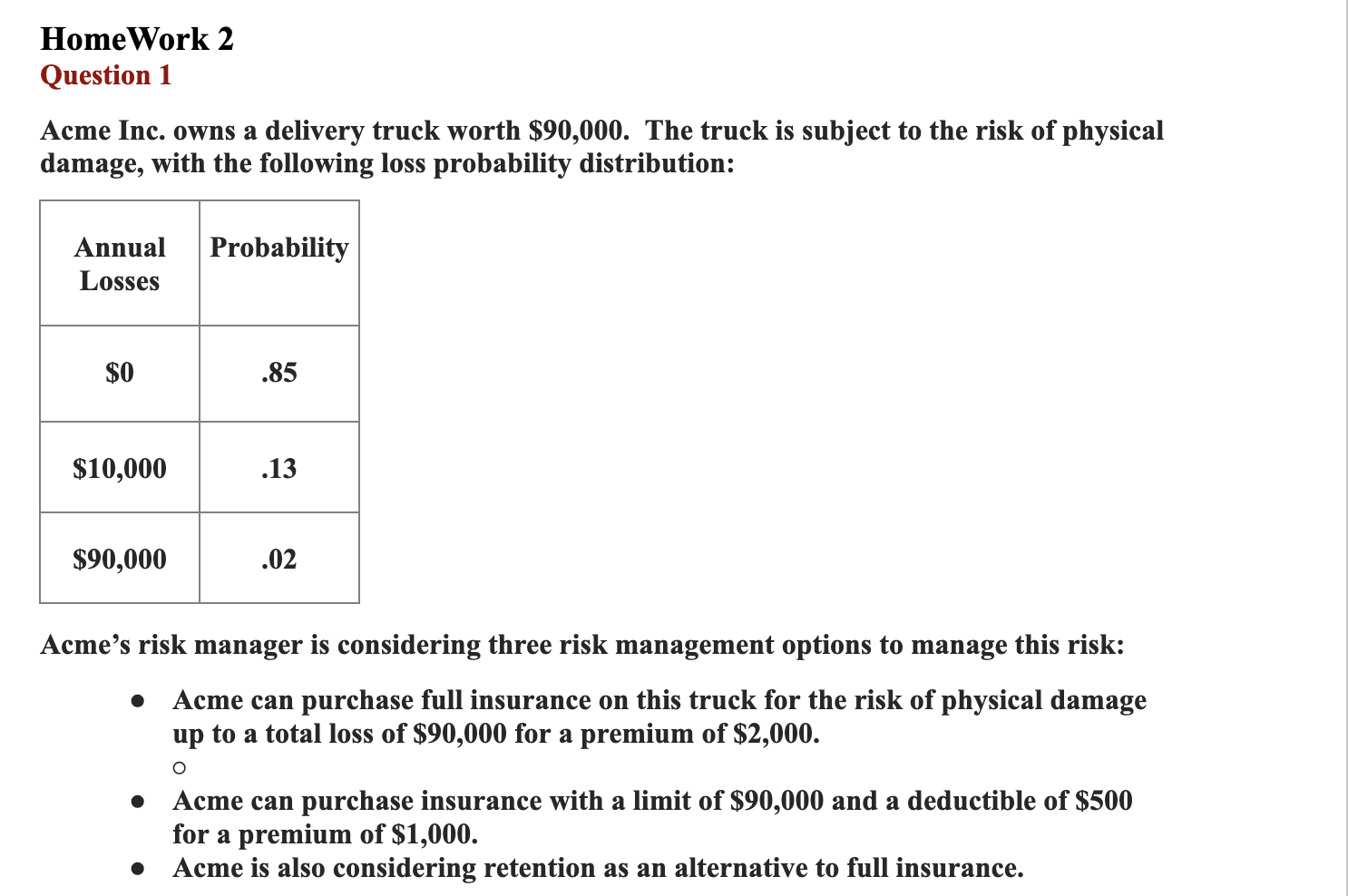

Acme Inc. owns a delivery truck worth $$90,000. The truck is subject to the risk of physical damage, with the following loss probability distribution: Acme's risk manager is considering three risk management options to manage this risk: - Acme can purchase full insurance on this truck for the risk of physical damage up to a total loss of $90,000 for a premium of $2,000. - Acme can purchase insurance with a limit of $90,000 and a deductible of $500 for a premium of $1,000. - Acme is also considering retention as an alternative to full insurance. Acme Inc. owns a delivery truck worth $$90,000. The truck is subject to the risk of physical damage, with the following loss probability distribution: Acme's risk manager is considering three risk management options to manage this risk: - Acme can purchase full insurance on this truck for the risk of physical damage up to a total loss of $90,000 for a premium of $2,000. - Acme can purchase insurance with a limit of $90,000 and a deductible of $500 for a premium of $1,000. - Acme is also considering retention as an alternative to full insurance

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts