Question: Questions for Slide Deck 2: Learn Your Calculator 1. A lender offers you a $100,000 30-year, fully amortizing, fixed rate mortgage with monthly payments at

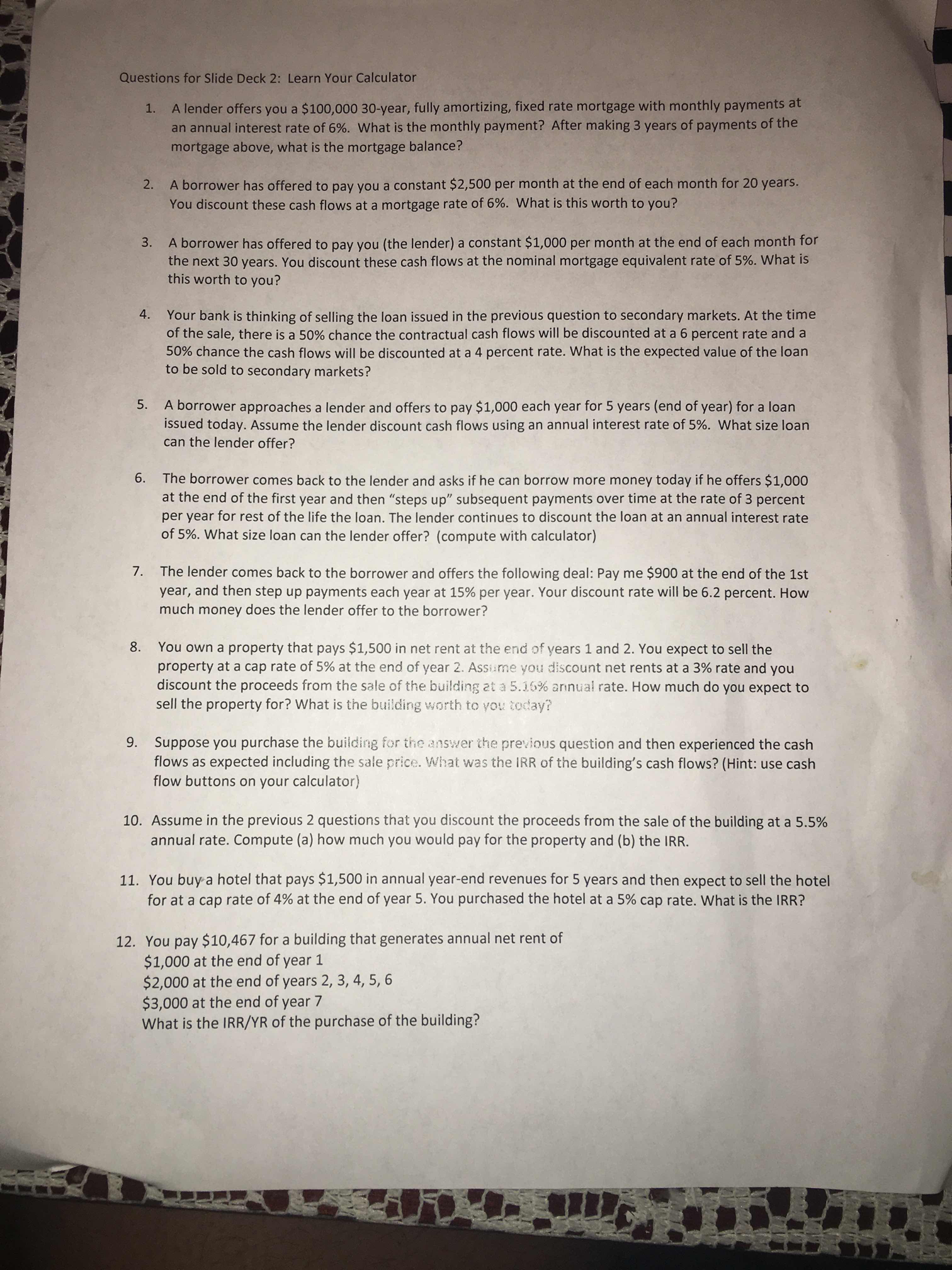

Questions for Slide Deck 2: Learn Your Calculator 1. A lender offers you a $100,000 30-year, fully amortizing, fixed rate mortgage with monthly payments at an annual interest rate of 6%. What is the monthly payment? After making 3 years of payments of the mortgage above, what is the mortgage balance? 2. A borrower has offered to pay you a constant $2,500 per month at the end of each month for 20 years. You discount these cash flows at a mortgage rate of 6%. What is this worth to you? 3. A borrower has offered to pay you (the lender) a constant $1,000 per month at the end of each month for the next 30 years. You discount these cash flows at the nominal mortgage equivalent rate of 5%. What is this worth to you? 4 . Your bank is thinking of selling the loan issued in the previous question to secondary markets. At the time of the sale, there is a 50% chance the contractual cash flows will be discounted at a 6 percent rate and a 50% chance the cash flows will be discounted at a 4 percent rate. What is the expected value of the loan to be sold to secondary markets? 5 . A borrower approaches a lender and offers to pay $1,000 each year for 5 years (end of year) for a loan issued today. Assume the lender discount cash flows using an annual interest rate of 5%. What size loan can the lender offer? 5. The borrower comes back to the lender and asks if he can borrow more money today if he offers $1,000 at the end of the first year and then "steps up" subsequent payments over time at the rate of 3 percent per year for rest of the life the loan. The lender continues to discount the loan at an annual interest rate of 5%. What size loan can the lender offer? (compute with calculator) 7. The lender comes back to the borrower and offers the following deal: Pay me $900 at the end of the 1st year, and then step up payments each year at 15% per year. Your discount rate will be 6.2 percent. How much money does the lender offer to the borrower? 8. You own a property that pays $1,500 in net rent at the end of years 1 and 2. You expect to sell the property at a cap rate of 5% at the end of year 2. Assume you discount net rents at a 3% rate and you discount the proceeds from the sale of the building at a 5.16% annual rate. How much do you expect to sell the property for? What is the building worth to you today? 9 . Suppose you purchase the building for the answer the previous question and then experienced the cash flows as expected including the sale price. What was the IRR of the building's cash flows? (Hint: use cash flow buttons on your calculator) 10. Assume in the previous 2 questions that you discount the proceeds from the sale of the building at a 5.5% annual rate. Compute (a) how much you would pay for the property and (b) the IRR. 11. You buy a hotel that pays $1,500 in annual year-end revenues for 5 years and then expect to sell the hotel for at a cap rate of 4% at the end of year 5. You purchased the hotel at a 5% cap rate. What is the IRR? 12. You pay $10,467 for a building that generates annual net rent of $1,000 at the end of year 1 $2,000 at the end of years 2, 3, 4, 5, 6 $3,000 at the end of year 7 What is the IRR/YR of the purchase of the building