Question: Questions: How to determine which product is labour or machine intensive, or even expensive to make? (especially which Table) Difference between Plantwide rate and Departmental

Questions:

- How to determine which product is labour or machine intensive, or even expensive to make? (especially which Table)

- Difference between Plantwide rate and Departmental rate? Why Departmental rate better than Plantwide rate?

- What is ABC and How does ABC system works? How can we use ABC system in a manufacturing firm to reduce cost distortion? (backed by at least one research paper)

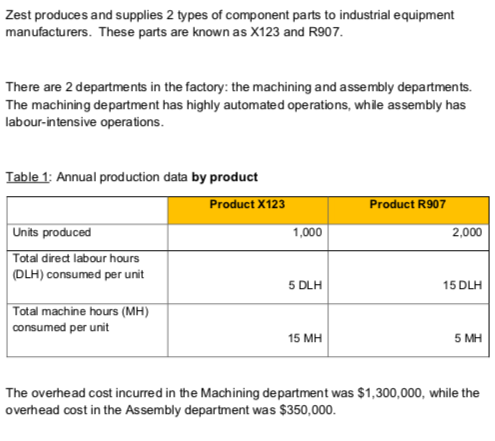

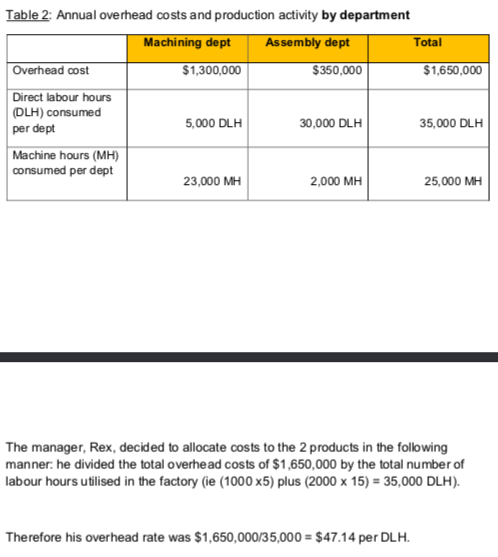

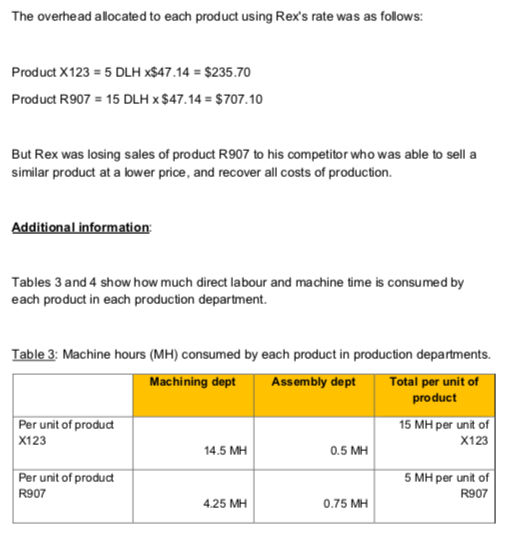

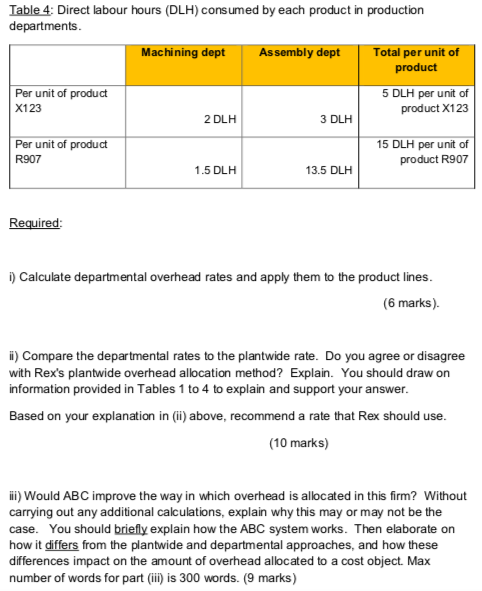

Zest produces and supplies 2 types of component parts to industrial equipment manufacturers. These parts are known as X123 and R907. There are 2 departments in the factory: the machining and assembly departments. The machining department has highly automated operations, while assembly has labour-intensive operations. Table 1: Annual production data by product Units produced Product X123 Product R907 1,000 2,000 Total direct labour hours (DLH) consumed per unit 5 DLH 15 DLH Total machine hours (MH) consumed per unit 15 MH 5 MH The overhead cost incurred in the Machining department was $1,300,000, while the overhead cost in the Assembly department was $350,000.

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts