Question: Questions in real exam will be selected from this list. Questions will have different numbers/different currencies. a. 1. Spot rate USD/ARS 65.93. Annual inflation estimate

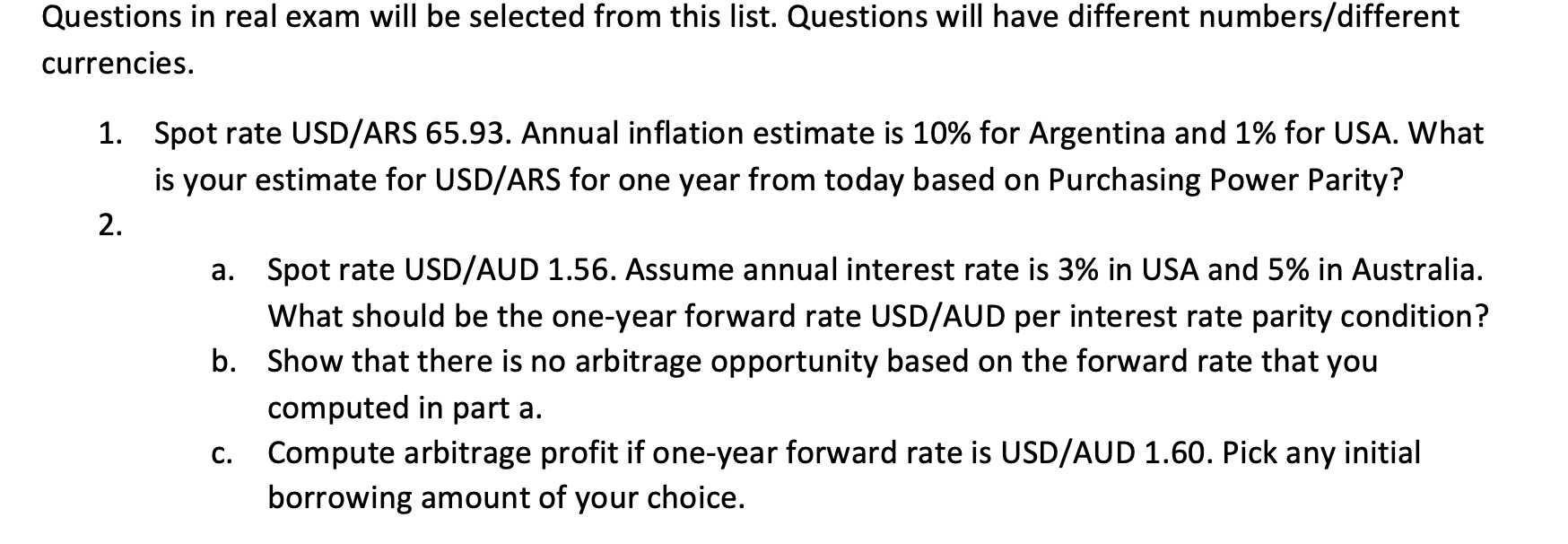

Questions in real exam will be selected from this list. Questions will have different numbers/different currencies. a. 1. Spot rate USD/ARS 65.93. Annual inflation estimate is 10% for Argentina and 1% for USA. What is your estimate for USD/ARS for one year from today based on Purchasing Power Parity? 2. Spot rate USD/AUD 1.56. Assume annual interest rate is 3% in USA and 5% in Australia. What should be the one-year forward rate USD/AUD per interest rate parity condition? b. Show that there is no arbitrage opportunity based on the forward rate that you computed in part a. Compute arbitrage profit if one-year forward rate is USD/AUD 1.60. Pick any initial borrowing amount of your choice. C

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts