Question: questions module 4 - Microsoft Word (Error de activacin de productos) Correspondencia Revisar Vista E. 2 . A Normal 1. Sin espa... Titulo 1 Titulo

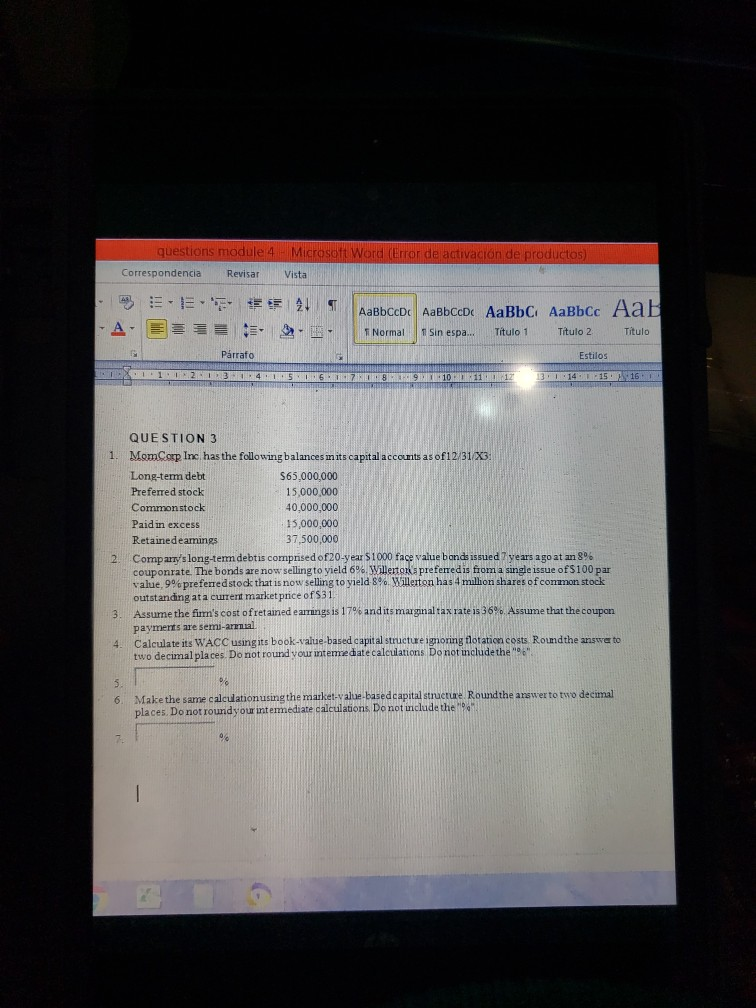

questions module 4 - Microsoft Word (Error de activacin de productos) Correspondencia Revisar Vista E. 2 . A Normal 1. Sin espa... Titulo 1 Titulo 2 Titulo Prrafo Estilos INTEL 1234567891012 131 14 15 16 QUESTION 3 1. MomCorp Inc has the following balances in its capital accounts as of12/31X3. Long-term debt $65,000,000 Preferred stock 15,000,000 Commonstock 40,000,000 Paid in excess 15,000,000 Retainedeamings 37.500.000 2 Comparty's long-tem debtis comprised of 20-year 51000 face value bonds issued 7 years ago at an 8% couponrate. The bonds are now selling to yield 6% Willetons preferredis from a single issue of $100 par value, 9%preferred stock that is now selling to yield 8% Willerton has 4 million shares of conmon stock outstanding ata current market price of 531 3. Assume the firm's cost ofretained earnings is 17% and its marginal tax rate is 36%. Assume that the coupon payments are semi-annual 4 Calculate its WACC using its book-value-based capital structure ignoring flotation costs Roundthe answer to two decimal places. Do not round your intemediate calculations Do not include the 5 6 8 Make the same calculation using the market-value-based capital structure Round the answer to two decimal places. Do not round your intermediate calculations. Do not include the 7 06 1

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts