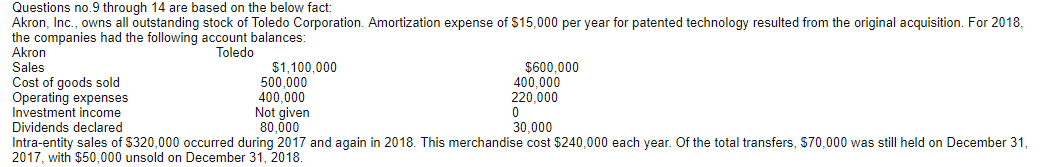

Question: Questions no.9 through 14 are based on the below fact: Akron, Inc., owns all outstanding stock of Toledo Corporation. Amortization expense of $15,000 per year

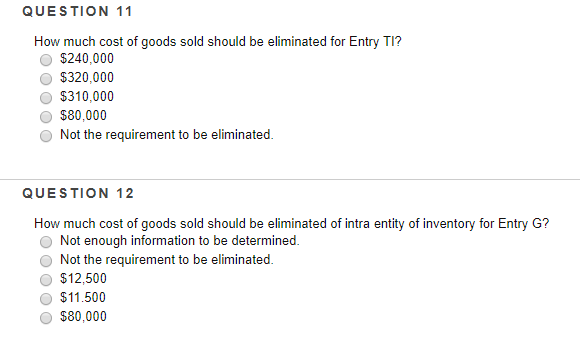

Questions no.9 through 14 are based on the below fact: Akron, Inc., owns all outstanding stock of Toledo Corporation. Amortization expense of $15,000 per year for patented technology resulted from the original acquisition. For 2018, the companies had the following account balances: Akron Toledo Sales $1,100,000 $600,000 Cost of goods sold 500,000 400,000 Operating expenses 400,000 220,000 Investment income Not given Dividends declared 80,000 30,000 Intra-entity sales of $320,000 occurred during 2017 and again in 2018. This merchandise cost $240,000 each year. Of the total transfers, $70,000 was still held on December 31, 2017, with $50,000 unsold on December 31, 2018. QUESTION 11 How much cost of goods sold should be eliminated for Entry TI? $240,000 $320,000 $310.000 $80,000 Not the requirement to be eliminated. QUESTION 12 How much cost of goods sold should be eliminated of intra entity of inventory for Entry G? Not enough information to be determined. Not the requirement to be eliminated. $12.500 $11.500 $80,000

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts