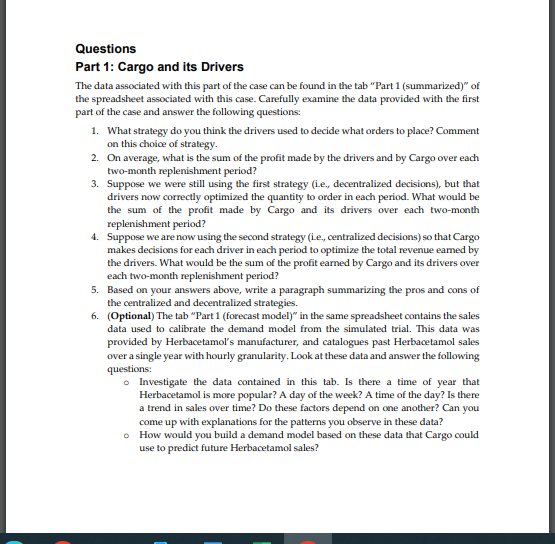

Question: Questions Part 1 : Cargo and its Drivers The data associated with this part of the case can be found in the tab Part 1

Questions

Part : Cargo and its Drivers

The data associated with this part of the case can be found in the tab "Part summarized of

the spreadsheet associated with this case. Carefully examine the data provided with the first

part of the case and answer the following questions:

What strategy do you think the drivers used to decide what orders to place? Comment

on this choice of strategy.

On average, what is the sum of the profit made by the drivers and by Cargo over each

twomonth replenishment period?

Suppose we were still using the first strategy ie decentralized decisions but that

drivers now correctly optimized the quantity to order in each period. What would be

the sum of the profit made by Cargo and its drivers over each twomonth

replenishment period?

Suppose we are now using the second strategy ie centralized decisions so that Cargo

makes decisions for each driver in each period to optimize the total revenue eamed by

the drivers. What would be the sum of the profit earned by Cargo and its drivers over

each twomonth replenishment period?

Based on your answers above, write a paragraph summarizing the pros and cons of

the centralized and decentralized strategies.

Optional The tab "Part forecast model in the same spreadsheet contains the sales

data used to calibrate the demand model from the simulated trial. This data was

provided by Herbacetamol's manufacturer, and catalogues past Herbacetamol sales

over a single year with hourly granularity. Look at these data and answer the following

questions:

Investigate the data contained in this tab. Is there a time of year that

Herbacetamol is more popular? A day of the week? A time of the day? Is there

a trend in sales over time? Do these factors depend on one another? Can you

come up with explanations for the patterns you observe in these data?

How would you build a demand model based on these data that Cargo could

use to predict future Herbacetamol sales?

Part : Cargo and its Suppliers

The data associated with this part of the case can be found in two tabs "Part wholesale

and "Part revenue sharing of the spreadsheet associated with this case. It refers to the

simulations carried out on the phone charger described in the case, which costs $ to

produce and retails for $both prices are included in the spreadsheet The file also contains

simulated demand realizations for months. First, assume that there is no salvage value for

the phone chargers at the end of each month.

We consider and simulate the supply chain under a wholesale price contract. As

mentioned, we use a retail price of $ a unit production cost of $ and a monthly

demand that is normally distributed with mean and standard deviation The

demand realizations are given in the spreadsheet.

a Under a wholesale price of $ what is the retailer's optimal order quantity?

b Under a wholesale price of $ compute the expected profit of the retailer and

of the supplier.

c Vary the value of the wholesale price between $ and $ and find the value

that yields the highest possible profit for the supplier. What is this wholesale

price value?

d For the wholesale price value obtained in Part c what is the total expected

profit of the supply chain ie the sum of the retailer's profit and the supplier's

profit

The supply chain's FirstBest profit is defined as the profit under the ideal situation

where the entire supply chain is owned by one party, ie the centralized supply chain.

a What is the supply chain's optimal order quantity?

b What is the FirstBest expected profit?

c How does the retailer's order quantity from Part a compare to the FirstBest's

optimal order quantity from Part a Why is it the case? Carefully justify your

answer.

d How does the total expected profit from Part d compare to the FirstBest

expected profit from Part b What is the relative difference between these

two values?

Optional Resolve questions and using a salvage value of $ How does it affect

the results? Please elaborate.

We now consider using a revenue sharing contract. We start with a wholesale price

of $ and a revenue share percentage of

a What is the retailer's optimal order quantity? What can you say on this value?

b Compute the retailer's expected profit and the supplier's expected profit under

the above revenue sharing contract. What can you conclude?

c When comparing the wholesale price contract to the revenue sharing contract,

who benefits? Justify your answer. T'III IIII

: mm m

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock