Question: Questions: Please answer ALL three questions in paragraph format. 1) Problems 1 and 2 above identified instances of ineffective operation of key controls in the

Questions: Please answer ALL three questions in paragraph format.

1) Problems 1 and 2 above identified instances of ineffective operation of key controls in the revenue cycle.

How would these identified control deficiencies affect the nature, timing, and extent of substantive procedures for the revenue cycle?

2) Based on results from Questions 1 and 2 above:

What role does materiality play in classifying the type of control deficiencies identified in Problems 1 and 2 above?

3) Revenue is recognized when shipped. Based on shipping dates in the shipping file, total revenue for 2018 is $1,372,637. The audit team has set overall materiality at 1% of revenue.

Would you classify the authorization control deficiency identified in Problem 2 above as a control deficiency, a significant deficiency, or a material weakness?

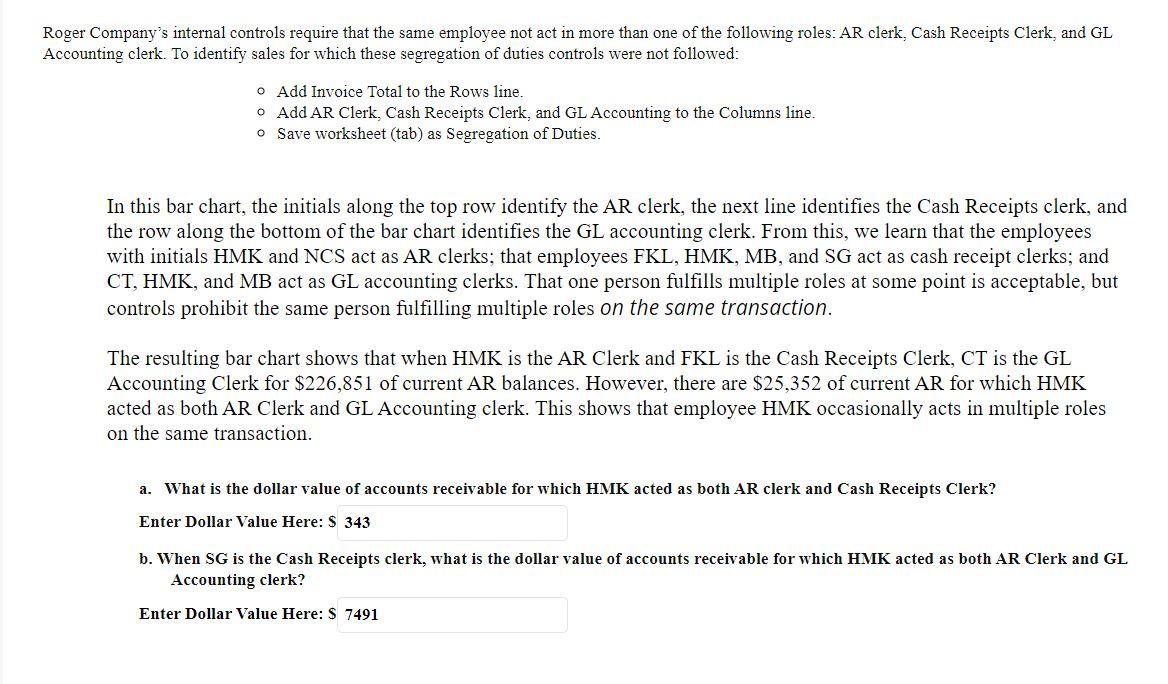

Roger Company's internal controls require that the same employee not act in more than one of the following roles: AR clerk, Cash Receipts Clerk, and GL Accounting clerk. To identify sales for which these segregation of duties controls were not followed: O Add Invoice Total to the Rows line. O Add AR Clerk, Cash Receipts Clerk, and GL Accounting to the Columns line. o Save worksheet (tab) as Segregation of Duties. In this bar chart, the initials along the top row identify the AR clerk, the next line identifies the Cash Receipts clerk, and the row along the bottom of the bar chart identifies the GL accounting clerk. From this, we learn that the employees with initials HMK and NCS act as AR clerks; that employees FKL, HMK, MB, and SG act as cash receipt clerks, and CT, HMK, and MB act as GL accounting clerks. That one person fulfills multiple roles at some point is acceptable, but controls prohibit the same person fulfilling multiple roles on the same transaction. The resulting bar chart shows that when HMK is the AR Clerk and FKL is the Cash Receipts Clerk, CT is the GL Accounting Clerk for $226,851 of current AR balances. However, there are $25,352 of current AR for which HMK acted as both AR Clerk and GL Accounting clerk. This shows that employee HMK occasionally acts in multiple roles on the same transaction. a. What is the dollar value of accounts receivable for which HMK acted as both AR clerk and Cash Receipts Clerk? Enter Dollar Value Here: S 343 b. When SG is the Cash Receipts clerk, what is the dollar value of accounts receivable for which HMK acted as both AR Clerk and GL Accounting clerk? Enter Dollar Value Here: S 7491 Roger Company also requires all sales to be authorized Using the transactions in the accounts receivable file, identify the total dollar volume of AR that was not approved (hint, use the Filter pane). Save your worksheet (tab) as Not Approved AR. 13726 Roger Company's internal controls require that the same employee not act in more than one of the following roles: AR clerk, Cash Receipts Clerk, and GL Accounting clerk. To identify sales for which these segregation of duties controls were not followed: O Add Invoice Total to the Rows line. O Add AR Clerk, Cash Receipts Clerk, and GL Accounting to the Columns line. o Save worksheet (tab) as Segregation of Duties. In this bar chart, the initials along the top row identify the AR clerk, the next line identifies the Cash Receipts clerk, and the row along the bottom of the bar chart identifies the GL accounting clerk. From this, we learn that the employees with initials HMK and NCS act as AR clerks; that employees FKL, HMK, MB, and SG act as cash receipt clerks, and CT, HMK, and MB act as GL accounting clerks. That one person fulfills multiple roles at some point is acceptable, but controls prohibit the same person fulfilling multiple roles on the same transaction. The resulting bar chart shows that when HMK is the AR Clerk and FKL is the Cash Receipts Clerk, CT is the GL Accounting Clerk for $226,851 of current AR balances. However, there are $25,352 of current AR for which HMK acted as both AR Clerk and GL Accounting clerk. This shows that employee HMK occasionally acts in multiple roles on the same transaction. a. What is the dollar value of accounts receivable for which HMK acted as both AR clerk and Cash Receipts Clerk? Enter Dollar Value Here: S 343 b. When SG is the Cash Receipts clerk, what is the dollar value of accounts receivable for which HMK acted as both AR Clerk and GL Accounting clerk? Enter Dollar Value Here: S 7491 Roger Company also requires all sales to be authorized Using the transactions in the accounts receivable file, identify the total dollar volume of AR that was not approved (hint, use the Filter pane). Save your worksheet (tab) as Not Approved AR. 13726

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts