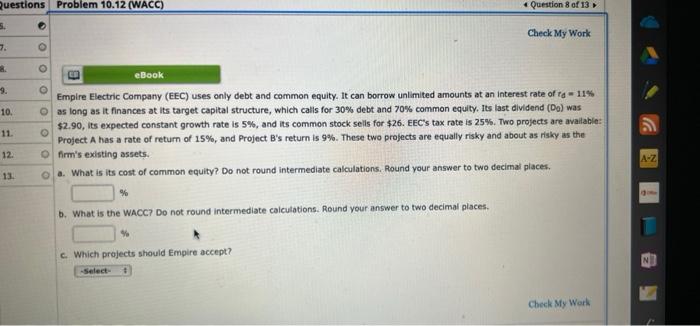

Question: Questions Problem 10.12 (WACC) 5. 7. 8. 9. 10. 11. 12. 13. O O eBook O Empire Electric Company (EEC) uses only debt and common

Questions Problem 10.12 (WACC) 5. 7. 8. 9. 10. 11. 12. 13. O O eBook O Empire Electric Company (EEC) uses only debt and common equity. It can borrow unlimited amounts at an interest rate of rg - 11% O as long as it finances at its target capital structure, which calls for 30% debt and 70 % common equity. Its last dividend (Do) was $2.90, its expected constant growth rate is 5%, and its common stock sells for $26. EEC's tax rate is 25%. Two projects are available: Project A has a rate of return of 15%, and Project B's return is 9%. These two projects are equally risky and about as risky as the O firm's existing assets. oa. What is its cost of common equity? Do not round intermediate calculations, Round your answer to two decimal places. % 9 Question 8 of 13 b. What is the WACC? Do not round intermediate calculations. Round your answer to two decimal places. % c. Which projects should Empire accept? -Select- Check My Work Check My Work A-Z

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts