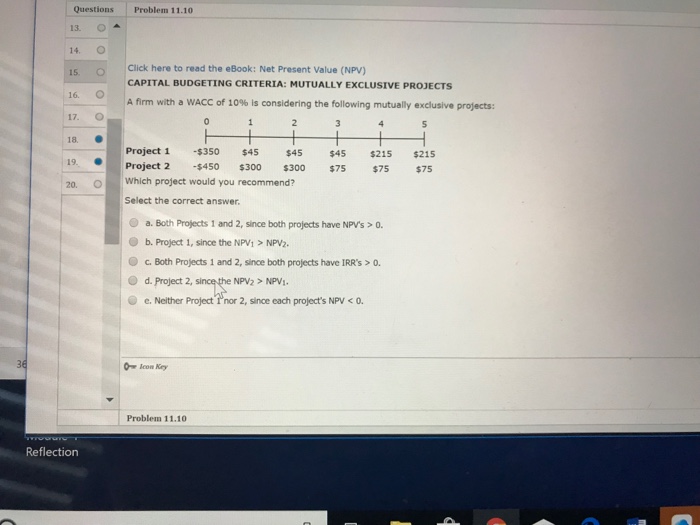

Question: Questions Problem 11.10 13. O 14. O 15 Click here to read the eBook: Net Present Value (NPV) 16. o CAPITAL BUDGETING CRITERIA: MUTUALLY EXCLUSIVE

Questions Problem 11.10 13. O 14. O 15 Click here to read the eBook: Net Present Value (NPV) 16. o CAPITAL BUDGETING CRITERIA: MUTUALLY EXCLUSIVE PROJECTS A firm with a WACC of 10% is considering the following mutually exclusive projects: 18. : 19, 20. Project 1 $350 $45 $45 $4 $215 $215 Project 2 $450$300 300 $75 $75 $75 2 O Which project would you recommend? Select the correct answer. O a. Both Projects 1 and 2, since both projects have NPV's>0 b. Project 1, since the NPV1 NPV2 c.Both Projects 1 and 2, since both projects have IRR's> O. O d. Project 2, since the NPV2 > NPV e. Neither Project I nor 2, since each project's NPVs0. Problem 11.10 Reflection

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts