Question: Questions: Sinking Funds (20 marks) An annuity is any sequence of equal periodic payments. If payments are made at the end of each time interval,

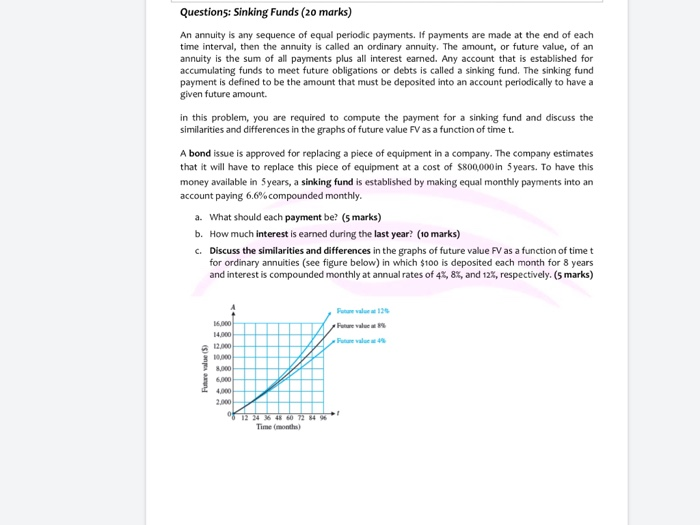

Questions: Sinking Funds (20 marks) An annuity is any sequence of equal periodic payments. If payments are made at the end of each time interval, then the annuity is called an ordinary annuity. The amount, or future value, of an annuity is the sum of all payments plus all interest earned. Any account that is established for accumulating funds to meet future obligations or debts is called a sinking fund. The sinking fund payment is defined to be the amount that must be deposited into an account periodically to have a given future amount. in this problem, you are required to compute the payment for a sinking fund and discuss the similarities and differences in the graphs of future value FV as a function of time t. A bond issue is approved for replacing a piece of equipment in a company. The company estimates that it will have to replace this piece of equipment at a cost of $800,000 in 5 years. To have this money available in 5 years, a sinking fund is established by making equal monthly payments into an account paying 6.6% compounded monthly. a. What should each payment be? (5 marks) b. How much interest is earned during the last year? (10 marks) c. Discuss the similarities and differences in the graphs of future value FV as a function of timet for ordinary annuities (see figure below) in which $100 is deposited each month for 8 years and interest is compounded monthly at annual rates of 4%, 8%, and 12%, respectively. (5 marks) Future value (5) Time (months) Questions: Sinking Funds (20 marks) An annuity is any sequence of equal periodic payments. If payments are made at the end of each time interval, then the annuity is called an ordinary annuity. The amount, or future value, of an annuity is the sum of all payments plus all interest earned. Any account that is established for accumulating funds to meet future obligations or debts is called a sinking fund. The sinking fund payment is defined to be the amount that must be deposited into an account periodically to have a given future amount. in this problem, you are required to compute the payment for a sinking fund and discuss the similarities and differences in the graphs of future value FV as a function of time t. A bond issue is approved for replacing a piece of equipment in a company. The company estimates that it will have to replace this piece of equipment at a cost of $800,000 in 5 years. To have this money available in 5 years, a sinking fund is established by making equal monthly payments into an account paying 6.6% compounded monthly. a. What should each payment be? (5 marks) b. How much interest is earned during the last year? (10 marks) c. Discuss the similarities and differences in the graphs of future value FV as a function of timet for ordinary annuities (see figure below) in which $100 is deposited each month for 8 years and interest is compounded monthly at annual rates of 4%, 8%, and 12%, respectively. (5 marks) Future value (5) Time (months)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts