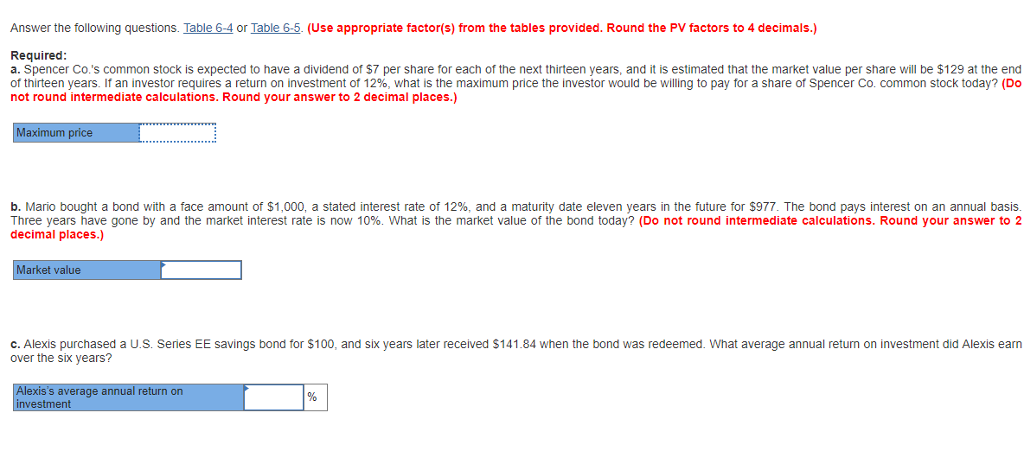

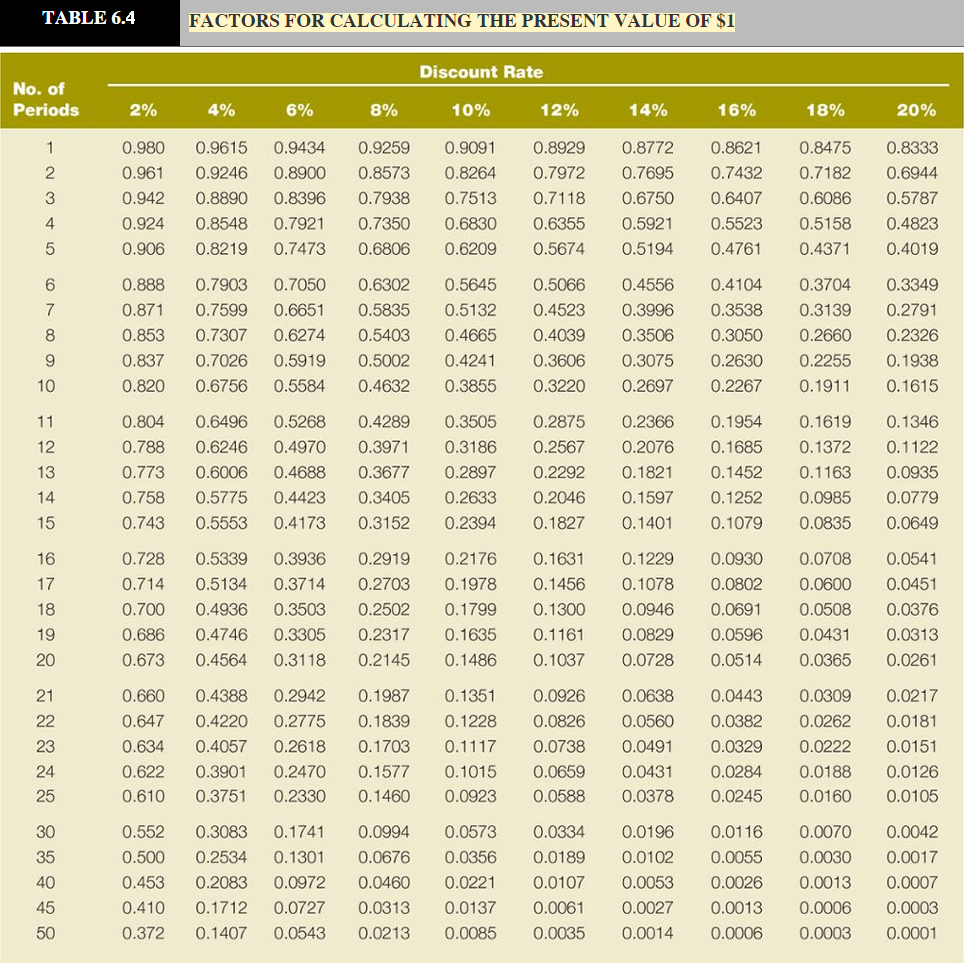

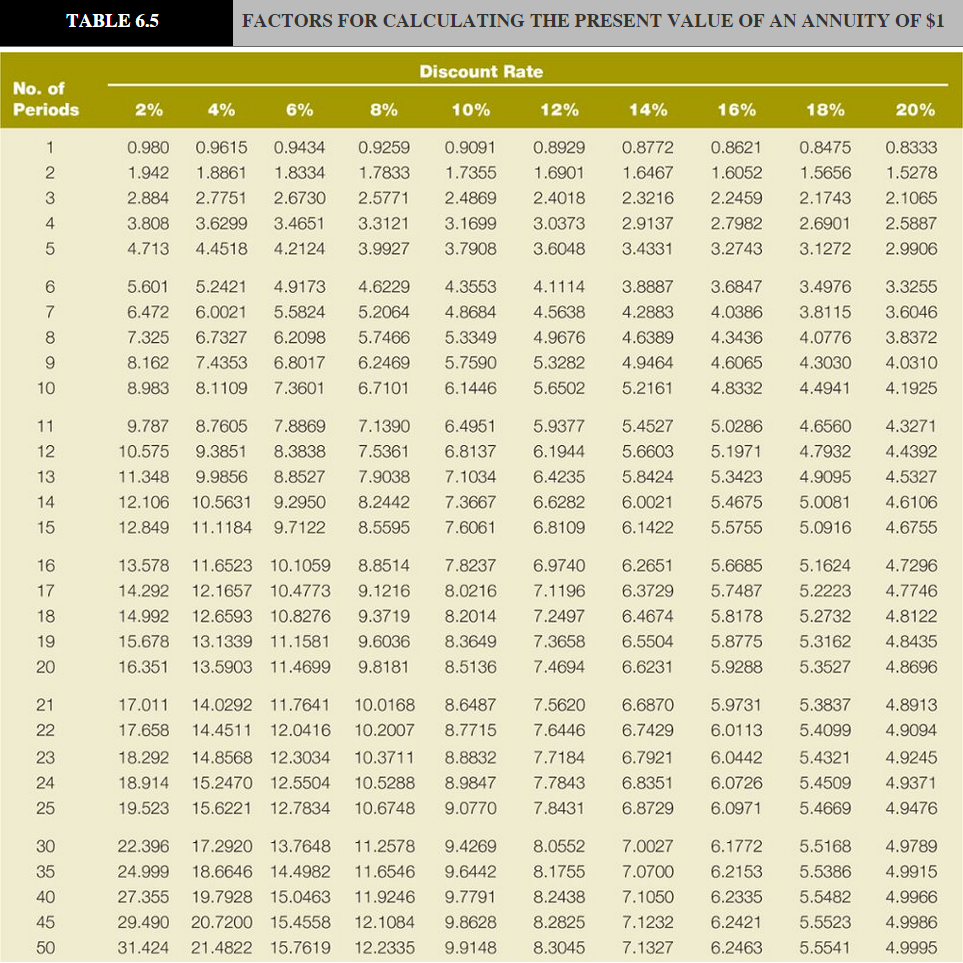

Question: Questions: Tables: Answer the following questions. Table 6-4 or Table 6-5 Use appropriate factor(s) from the tables provided. Round the PV factors to 4 decimals.)

Questions:

Tables:

Answer the following questions. Table 6-4 or Table 6-5 Use appropriate factor(s) from the tables provided. Round the PV factors to 4 decimals.) Required a. Spencer Co.'s common stock is expected to have a dividend of S7 per share for each of the next thirteen years, and it is estimated that the market value per share will be $129 at the end of thirteen years. 1 an investor requires a return on investment of 1 % what is he maximum price he investor would be il ng ) a or a share ot encer o. common stoc not round intermediate calculations. Round your answer to 2 decimal places.) Maximum price b. Mario bought a bond with a face amount of $1,000, a stated interest rate of 12%, and a maturity date eleven years in the future for $977. The bond pays interest on an annual basis Three years have gone by and the market interest rate is now 10%, what is he market value of the bond today? Do no round termediate a ciation Round ouran wer? decimal places.) arket value c.Alexis purchased a U.S. Series EE savings bond for $100, and six years later received $141.84 when the bond was redeemed. What average annual return on investment did Alexis earn over the six years? exis's average annual return on

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts