Question: Questions to be discussed before class 1. What is your assessment of HPC's capital budgeting process curently in place? Would you recoummend any improvements? What

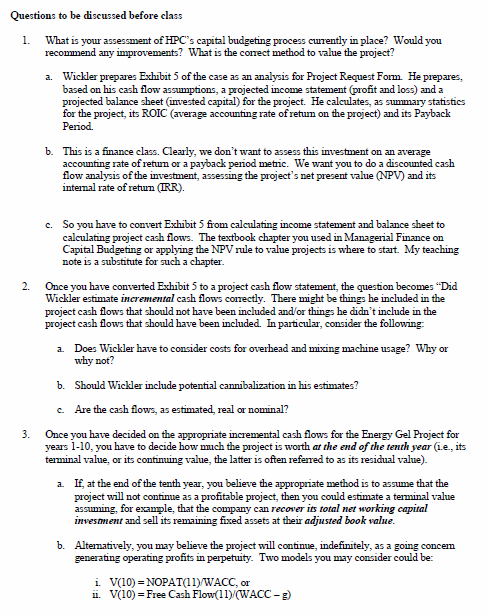

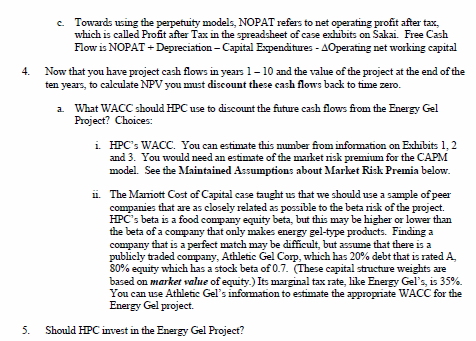

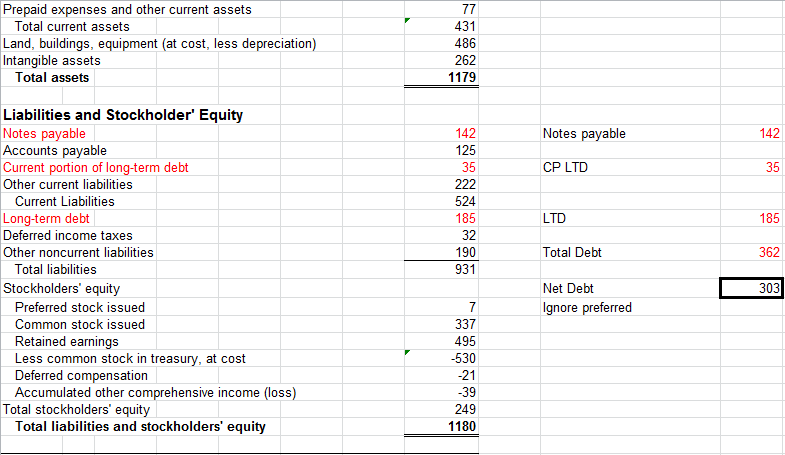

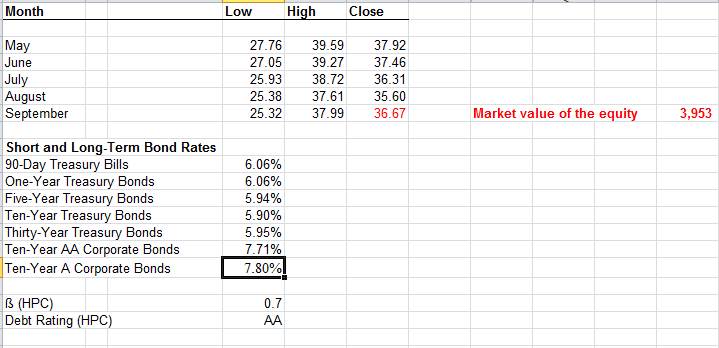

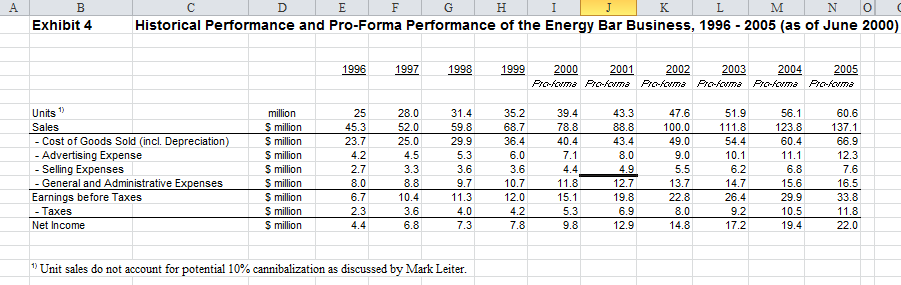

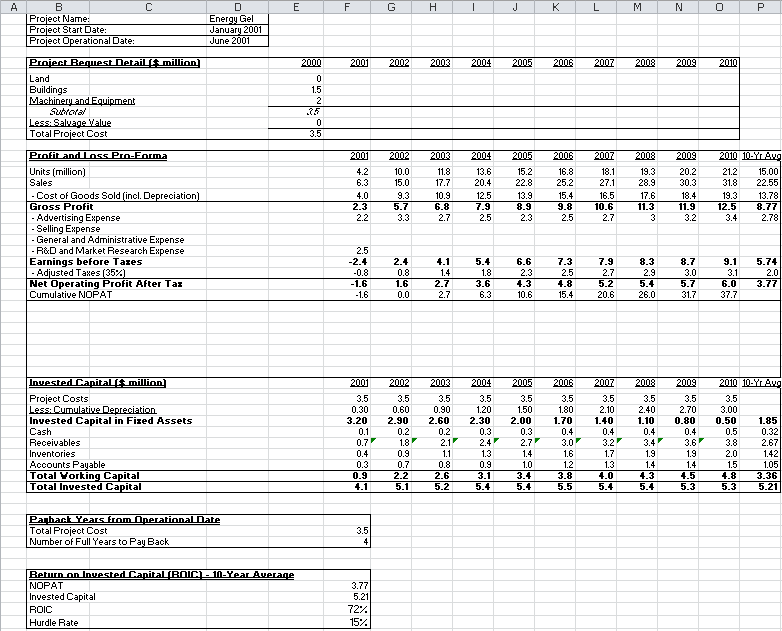

Questions to be discussed before class 1. What is your assessment of HPC's capital budgeting process curently in place? Would you recoummend any improvements? What is the cormect method to value the project? a. Wickler prepares Exhibit 5 of the case as an analysis for Project Request Form He prepares, based on his cash flow assuumptions, a projected income statement (profit and loss) and a projected balance sheet invested capital) for the project. He calculates, as sunmmary statistics for the project, its ROIC (average accounting rate ofretum on the project) and its Payback Period. b. This is a finance class. Clearly, we don't want to assess this investment on an average accounting rate of retun or a payback period metic. We want you to do a discounted cash flow analysis of the investment, assessing the project's net present value (NPV) and its internal rate of retuun (IRR). So you have to convert Exhibit 5 from calculating income statement and balance sheet to calculating project cash flows. The textbook chapter you used in Managerial Finance on Capital Budgeting or applying the NPV rle to value projects is where to staat. My teaching note is a substitute for such a chapter c. 2. Once you have converted Exhibit 5 to a project cash flow statement, the question becomes "Did Wickler estimate incremental cash flows cornectly. There might be things he included in the project cash flows that should not have been included and/or things he didn't include in the project cash flows that should have been included. In particular, consider the following a. Does Wickler have to consider costs for overhead and mixing machine usage? Why or why not? Should Wickler include potential cannibalization in his estimates? Are the cash flows, as estimated, real or nominal? b. c. 3. Once you have decided on the appropriate incremental cash flows for the Energy Gel Project for yers 1-10, you have to decide how umch the project is worth at the end of the tenth year (ie, its terminal value, or its continuing value, the latter is often referred to as its residual value). If, at the end of the tenth year, you believe the appropriate method is to assume that the project will not continue as a profitable project, then you could estimate a terminal value assuming, for exanple, that the company can recover its total net working capital invesanent and sell its remaining fixed assets at their adjusted book value a. b. Alteatively, you may believe the project will continue, indefinitely, as a going concerm generating operating profits in perpetuity. Two models you may consider could be: i. V(10)-NOPAT(1)/WACC, or ii. V(10)- Free Cash Flow(11)(WACC-g) c. Towards using the perpetuity models, NOPAT refers to net operating profit after ta which is called Profit after Tax in the spreadsheet of case exhibits on Sakai. Free Cash Flow is NOPAT+Depreciation- Capital Expenditures AOperating net working capital 4. Now that you have project cash flows in years 1-10 and the value of the project at the end of the ten years to calculate NPV you must discount these cash flows back to time zero. a. What WACC should HPC use to discount the future cash flows firom the Energy Gel Project? Choices: i. HPCs WACC. You can estimate this number firom information on Exhibits 1.'2 and 3. You would need an estimate of the market risk premiuum for the CAPM model. See the Maintained Assumptions about Market Risk Premia below ii- The Mamott Cost of Capital case taught us that we should use a sample ofpeer companies that are as closely related as possible to the beta risk of the project. HPC's beta is a food company equity beta, but this may be higher or lower than the beta ofa company that only makes energy gel-type products. Finding a company that is a perfect match may be difficult, but assume that there is a publicly traded company, Athletic Gel Corp, which has 20% debt that is rated A, 80% equity which has a stock beta of 0.7-These capital structure weights are based on market value of equity.) Its marginal tax rate, like Energy Gel's is 35%. You can use Athletic Gel's Energy Gel project. to estimate the appropriate WACC for the 5. Should HPC invest in the Energy Gel Project? Prepaid expenses and other current assets 431 486 262 1179 Total current assets Land, buildings, equipment (at cost, less depreciation) Intangible assets Total assets Liabilities and Stockholder' Equity Notes payable Accounts pavable Current portion of long-term debt Other current liabilities 142 125 35 Notes payable 142 CP LTD 35 Current Liabilities Long-term debt Deferred income taxes Other noncurrent liabilities 524 185 32 190 931 LTD Total Debt Net Debt 185 362 303 Total liabilities Stockholders' equity Preferred stock issued Common stock issued Retained earnings Less common stock in treasury, at cost Deferred compensation Accumulated other comprehensive income (loss) Ignore preferred 337 495 -530 21 39 249 1180 Total stockholders' equity Total liabilities and stockholders' equity Month Low High Close May une July August September 27.76 39.59 37.92 27.0539.27 37.46 25.93 38.72 36.31 25.383735.60 25.3237.9936.67 Market value of the equity 3,953 Short and Lonq-Term Bond Rates 6,06% 6.06% 5.94% 5.90% 5.95% 7.71% 90-Day Treasury Bills O Bonds ne-Year Treasury Five-Year Treasury Bonds Ten-Year Treasury Bonds Thirty-Year Treasury Bonds Ten-Year AA Corporate Bonds Ten-Year A Corporate Bonds & (HPC) Debt Rating (HPC) 0.7 Questions to be discussed before class 1. What is your assessment of HPC's capital budgeting process curently in place? Would you recoummend any improvements? What is the cormect method to value the project? a. Wickler prepares Exhibit 5 of the case as an analysis for Project Request Form He prepares, based on his cash flow assuumptions, a projected income statement (profit and loss) and a projected balance sheet invested capital) for the project. He calculates, as sunmmary statistics for the project, its ROIC (average accounting rate ofretum on the project) and its Payback Period. b. This is a finance class. Clearly, we don't want to assess this investment on an average accounting rate of retun or a payback period metic. We want you to do a discounted cash flow analysis of the investment, assessing the project's net present value (NPV) and its internal rate of retuun (IRR). So you have to convert Exhibit 5 from calculating income statement and balance sheet to calculating project cash flows. The textbook chapter you used in Managerial Finance on Capital Budgeting or applying the NPV rle to value projects is where to staat. My teaching note is a substitute for such a chapter c. 2. Once you have converted Exhibit 5 to a project cash flow statement, the question becomes "Did Wickler estimate incremental cash flows cornectly. There might be things he included in the project cash flows that should not have been included and/or things he didn't include in the project cash flows that should have been included. In particular, consider the following a. Does Wickler have to consider costs for overhead and mixing machine usage? Why or why not? Should Wickler include potential cannibalization in his estimates? Are the cash flows, as estimated, real or nominal? b. c. 3. Once you have decided on the appropriate incremental cash flows for the Energy Gel Project for yers 1-10, you have to decide how umch the project is worth at the end of the tenth year (ie, its terminal value, or its continuing value, the latter is often referred to as its residual value). If, at the end of the tenth year, you believe the appropriate method is to assume that the project will not continue as a profitable project, then you could estimate a terminal value assuming, for exanple, that the company can recover its total net working capital invesanent and sell its remaining fixed assets at their adjusted book value a. b. Alteatively, you may believe the project will continue, indefinitely, as a going concerm generating operating profits in perpetuity. Two models you may consider could be: i. V(10)-NOPAT(1)/WACC, or ii. V(10)- Free Cash Flow(11)(WACC-g) c. Towards using the perpetuity models, NOPAT refers to net operating profit after ta which is called Profit after Tax in the spreadsheet of case exhibits on Sakai. Free Cash Flow is NOPAT+Depreciation- Capital Expenditures AOperating net working capital 4. Now that you have project cash flows in years 1-10 and the value of the project at the end of the ten years to calculate NPV you must discount these cash flows back to time zero. a. What WACC should HPC use to discount the future cash flows firom the Energy Gel Project? Choices: i. HPCs WACC. You can estimate this number firom information on Exhibits 1.'2 and 3. You would need an estimate of the market risk premiuum for the CAPM model. See the Maintained Assumptions about Market Risk Premia below ii- The Mamott Cost of Capital case taught us that we should use a sample ofpeer companies that are as closely related as possible to the beta risk of the project. HPC's beta is a food company equity beta, but this may be higher or lower than the beta ofa company that only makes energy gel-type products. Finding a company that is a perfect match may be difficult, but assume that there is a publicly traded company, Athletic Gel Corp, which has 20% debt that is rated A, 80% equity which has a stock beta of 0.7-These capital structure weights are based on market value of equity.) Its marginal tax rate, like Energy Gel's is 35%. You can use Athletic Gel's Energy Gel project. to estimate the appropriate WACC for the 5. Should HPC invest in the Energy Gel Project? Prepaid expenses and other current assets 431 486 262 1179 Total current assets Land, buildings, equipment (at cost, less depreciation) Intangible assets Total assets Liabilities and Stockholder' Equity Notes payable Accounts pavable Current portion of long-term debt Other current liabilities 142 125 35 Notes payable 142 CP LTD 35 Current Liabilities Long-term debt Deferred income taxes Other noncurrent liabilities 524 185 32 190 931 LTD Total Debt Net Debt 185 362 303 Total liabilities Stockholders' equity Preferred stock issued Common stock issued Retained earnings Less common stock in treasury, at cost Deferred compensation Accumulated other comprehensive income (loss) Ignore preferred 337 495 -530 21 39 249 1180 Total stockholders' equity Total liabilities and stockholders' equity Month Low High Close May une July August September 27.76 39.59 37.92 27.0539.27 37.46 25.93 38.72 36.31 25.383735.60 25.3237.9936.67 Market value of the equity 3,953 Short and Lonq-Term Bond Rates 6,06% 6.06% 5.94% 5.90% 5.95% 7.71% 90-Day Treasury Bills O Bonds ne-Year Treasury Five-Year Treasury Bonds Ten-Year Treasury Bonds Thirty-Year Treasury Bonds Ten-Year AA Corporate Bonds Ten-Year A Corporate Bonds & (HPC) Debt Rating (HPC) 0.7

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts