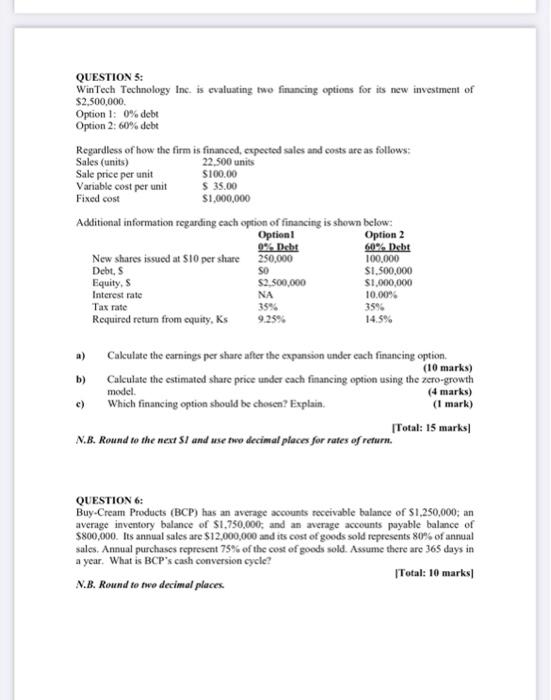

Question: QUESTIONS: WinTech Technology Inc. is evaluating two financing options for its new investment of $2,500,000 Option : 0% debt Option 2: 60% debt Regardless of

QUESTIONS: WinTech Technology Inc. is evaluating two financing options for its new investment of $2,500,000 Option : 0% debt Option 2: 60% debt Regardless of how the firm is financed, expected sales and costs are as follows: Sales (units) 22.500 units Sale price per unit $100,00 Variable cost per unit $ 35.00 Fixed cost $1,000,000 Additional information regarding each option of financing is shown below: Option1 Option 2 0% Deht 60% Debt New shares issued at $10 per share 250,000 100.000 Debt, s So $1.500.000 Equity, s $2.500,000 $1,000,000 Interest rate NA 10.00% Tax rate Required return from cquity, Ks 9.25% 14.5% 35% 35% a) b) e) Calculate the earnings per share after the expansion under each financing option (10 marks) Calculate the estimated share price under cach financing option using the zero-growth model (4 marks) Which financing option should be chosen? Explain (1 mark) [Total: 15 marks N.B. Round to the next Sl and use two decimal places for rates of return. QUESTION 6: Buy-Cream Products (BCP) has an average accounts receivable balance of S1,250,000; an average inventory balance of $1.750.000 and an average accounts payable balance of $800,000. Its annual sales are $12,000,000 and its cost of goods sold represents 80% of annual sales. Annual purchases represent 75% of the cost of goods sold. Assume there arc 365 days in a year. What is BCP's cash conversion cycle? Total: 10 marks! N.B. Round to two decimal places

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts