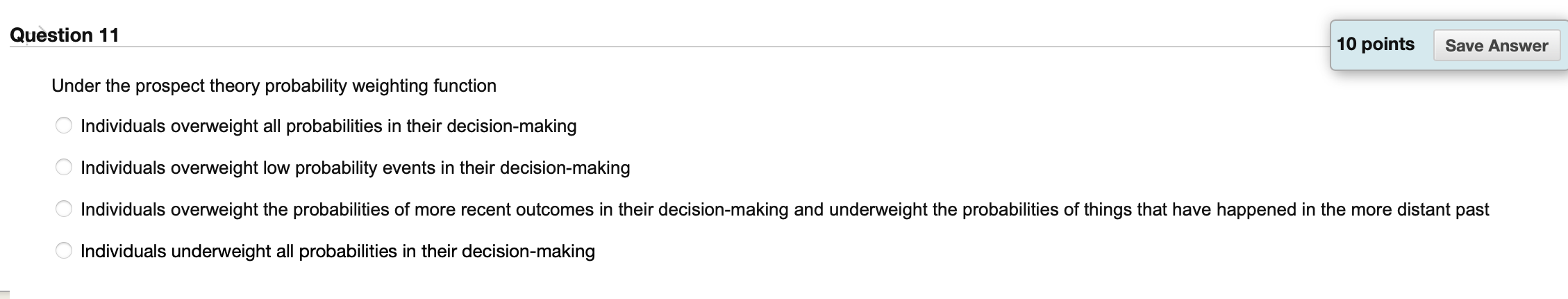

Question: Questlon 1 1 ' 10 points Save Answer Under the prospect theory probability weighting function R Individuals overweight all probabilities in their decision-making Individuals

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts