Question: Questlon 1 7 ( 9 points ) On January 1 . Year 1 . Lacrosse Corp granted Corky, its president, 1 0 , 0 0

Questlon points

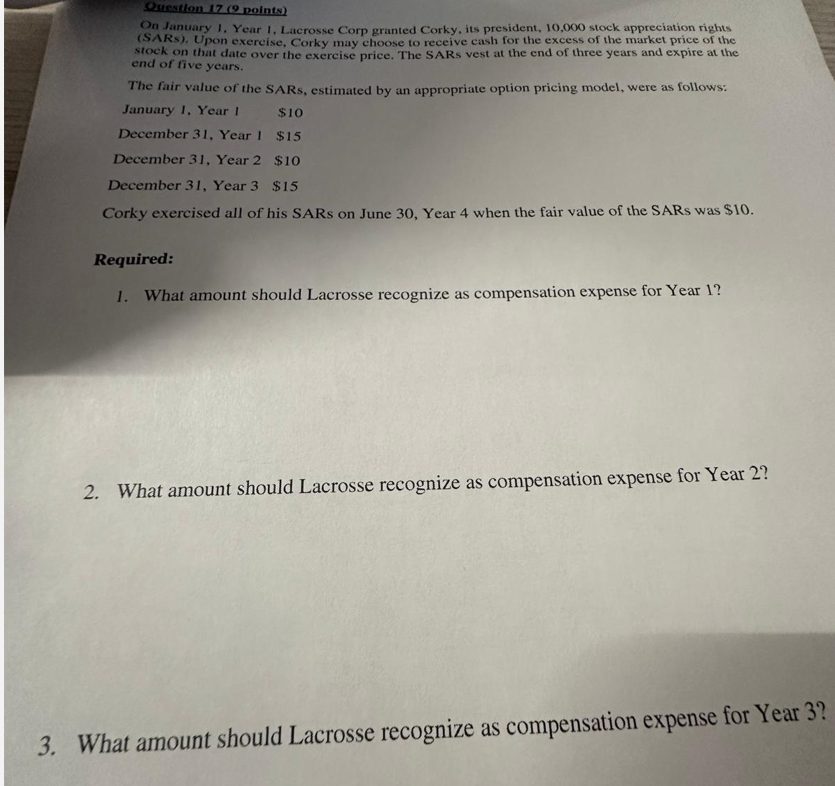

On January Year Lacrosse Corp granted Corky, its president, stock appreciation rights SARs Upon exercise, Corky may choose to receive cash for the excess of the market price of the stock on that date over the exercise price. The SARs vest at the end of three years and expire at the end of five years.

The fair vatue of the SARs, estimated by an appropriate option pricing model, were as follows:

January Year I $

December Year $

December Year $

December Year $

Corky exercised all of his SARs on June Year when the fair value of the SARs was $

Required:

What amount should Lacrosse recognize as compensation expense for Year

What amount should Lacrosse recognize as compensation expense for Year

What amount should Lacrosse recognize as compensation expense for Year

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock